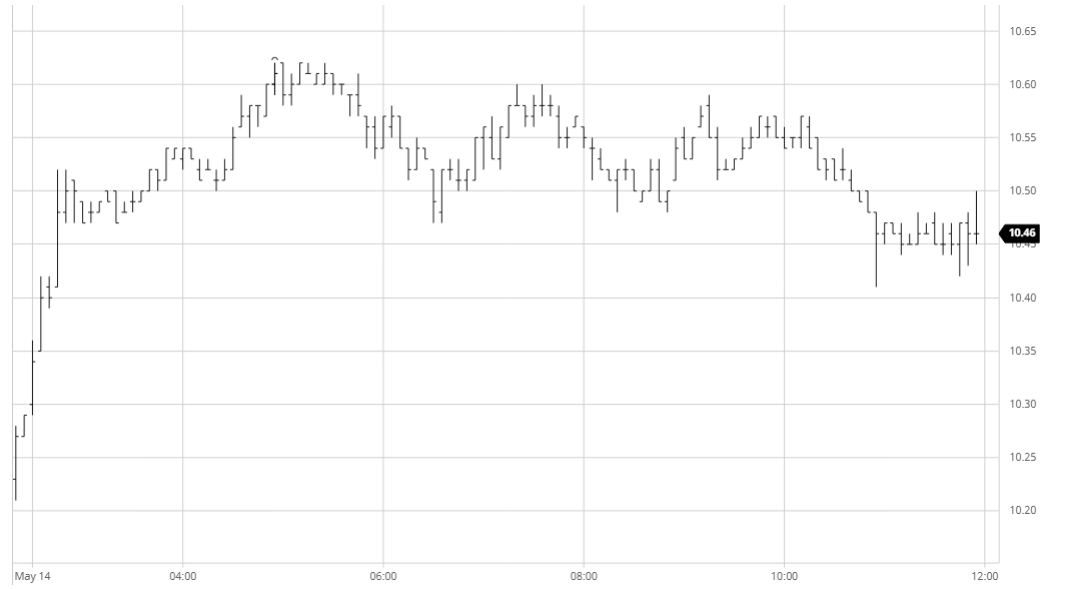

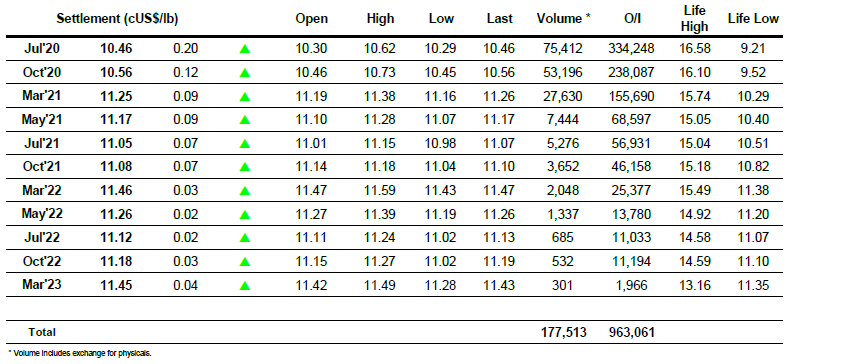

The market shot out of the traps this morning to somewhat unexpectedly be trading more than 25 points higher within the first 20 minutes. This placed No.11 briefly at the top of the CRB and with only crude keeping pace it appears that we are continuing to see algo’s tying themselves to crude in how they act within the sugar world. This bold start was then followed up with some remarkably strong whites buying that led premiums to stretch to new contract highs during the day, led by the Aug/Jul’20 which reached $125 by late afternoon. To emphasise the hold that crude has over the spec/algo activity we completely disregarded early weakness for USDBRL as the rate recorded a new low of 5.9714, remaining within the upper half of the morning range throughout a rather mundane afternoon period. Though outright values were away from the highs late on we did see nearby spreads remain firm with Jul/Oct’20 ending at -0.10 and Jul/Mar at -0.79, while Jul’20 settlement at 10.46 was sufficient to provide a positive technical leaning to a another day within the broader recent range.

No. 11 Futures

ICE Futures U.S. Sugar No.11 Contract

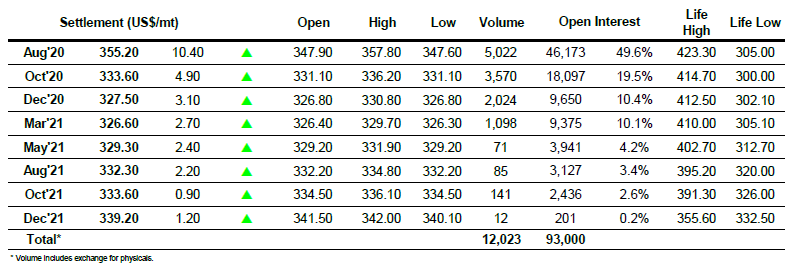

ICE Europe White Sugar Futures Contract