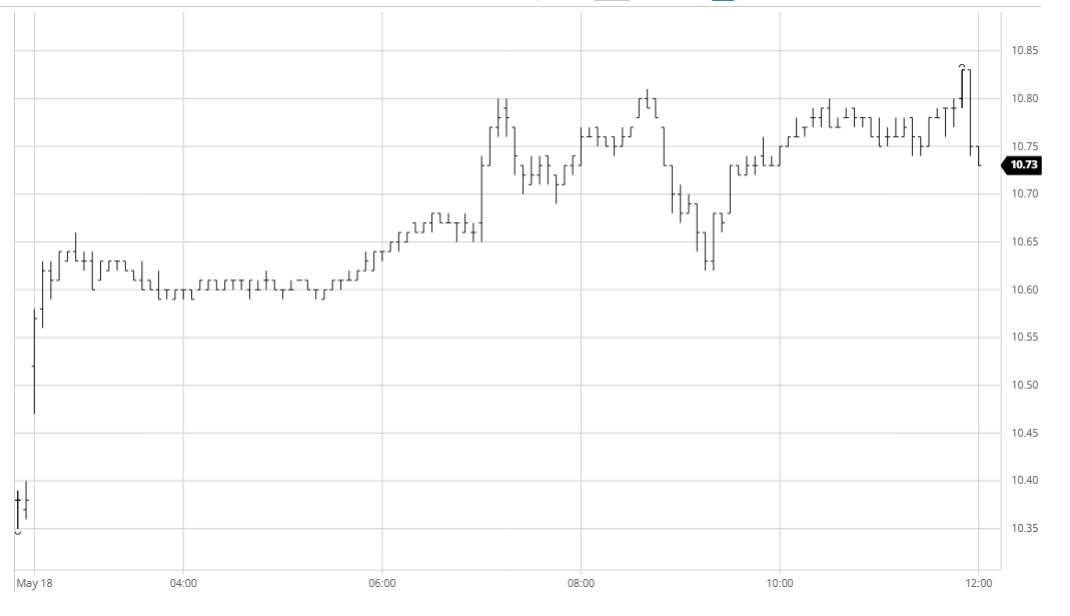

The slide in values on Friday afternoon couple with news that the funds had reduced their short holding to -36,860 lots might have been anticipated to limit the upside, however from the word go we saw buyers resume by pushing Jul’20 quickly into the 10.60’s. A prolonged period of consolidation followed with the longs content to hold the gains ahead of the busier afternoon period, while scale sellers above the market sat back to allow the market to move to them. This occurred right on cue as the 1pm “US opening” brought with it a fresh wave of fund buying that sent Jul’20 up further to 10.80. Sugar talk was centred around Brazilian port concerns with the stronger BRL values following the opening also encouraging the buyers, though how relevant these factors are could be questioned by a look at the intra-day sugar and WTI charts which showed an incredibly similar pattern that suggests the specs/algo’s are continuing to tie themselves to crude at present. Prices remained firm for most of the afternoon and this technical strength and the target of the recent 11.01 high provided the platform to push ahead to new session highs late on. Settlement was established at 10.80 though end of day long liquidation followed the call to leave the July trading at 10.73 last.

n.11 Futures

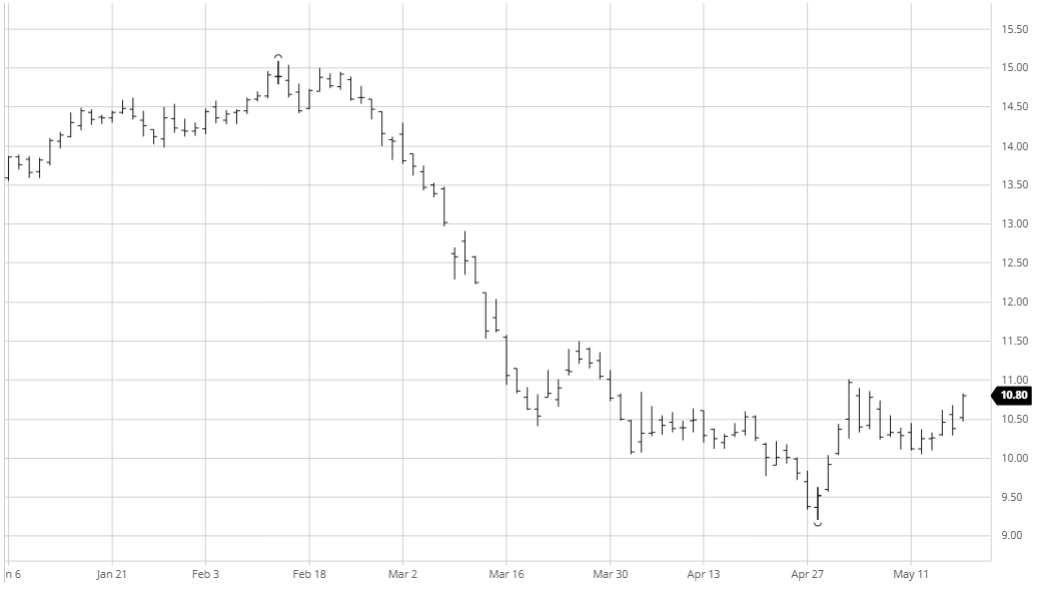

n.11 Futures

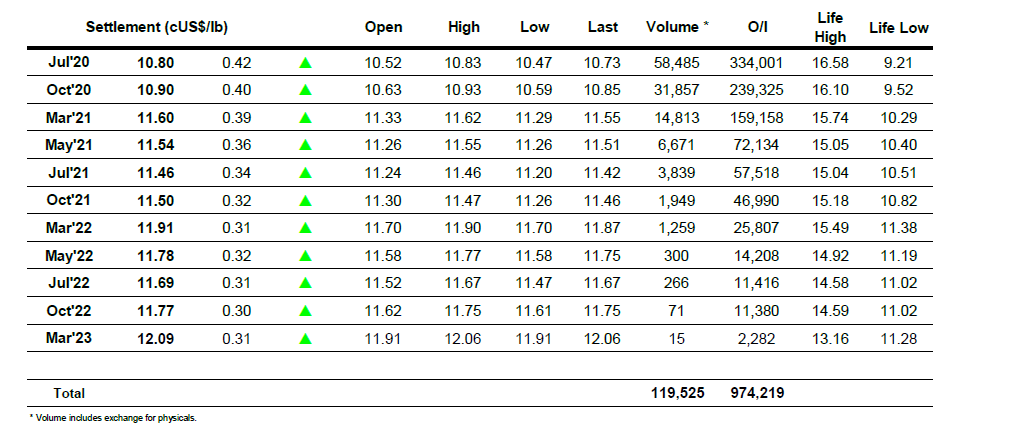

ICE Futures U.S. Sugar No.11 Contract

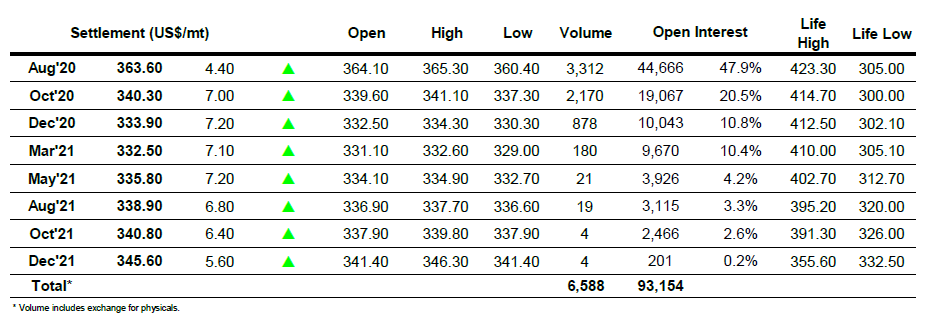

ICE Europe White Sugar Futures Contract