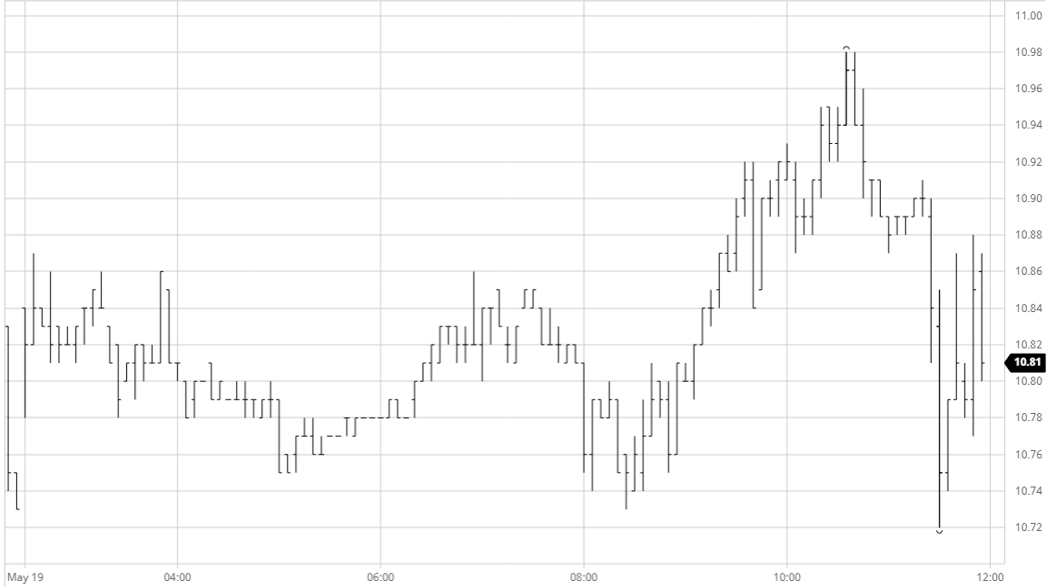

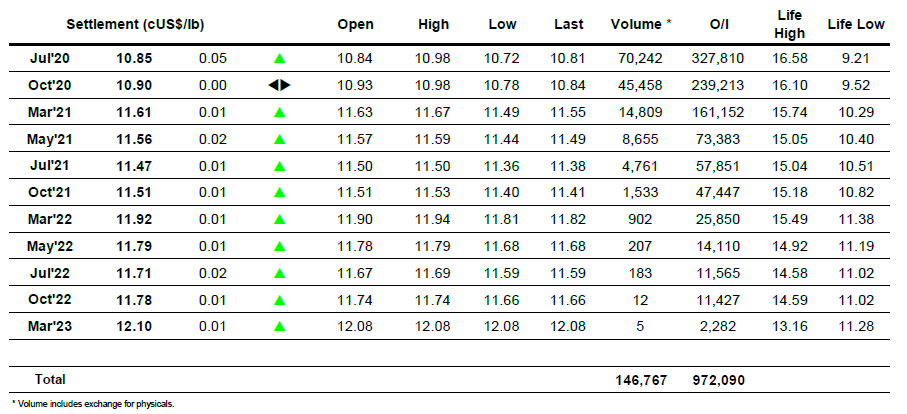

• The continuing recent strength has contributed to a positive recent dynamic that has brought the 11.01 high from 1st May back into focus, and the market commenced steadily enough to hold near to unchanged values through the morning to keep the target within sight. Crude values by this time were much firmer with hopes that storage concerns are easing and the expectation that gradual easing of lockdown measures around the globe will lead to increased consumption as both road and air travel increase. In spite of this sugar remained little changed with some stronger producer selling starting to be seen within the 10.80/11.00 band, and it was not until the afternoon that the stronger fund interest renewed the upward path to take values to new session highs. Buying was emerging for both Jul’20 and the Jul/Oct’20 spread and it was an aggressive burst of spread buying that led us to session highs as 6,000 lots traded to take Jul/Oct from -0.02 to +0.04 points, in the process sending the front month to 10.98. The highs were not maintained however and an eventful final hour saw specs stop out of some longs, sending Jul’20 to a new session low 10.72 before defensive buying appeared to ensure a positive settlement at 10.85, while leaving an interesting short term double top overhead at 11.01 / 10.98.

• News that Sao Paulo have moved three public holidays to tomorrow, Thursday and next Monday (with many expected to remain closed on Friday also) in order to try and restrict the movement of people in the face overwhelmed hospitals due to coronavirus may have a significant impact upon flows for the rest of this week (markets are already closed next Monday for UK and US holidays). The announcement was being considered by the stock exchange operator B3 with any decisions made by them significant to currency activity and potential hedging activity for the coming days.

N.o 11 Futures

ICE Futures U.S. Sugar No.11 Contract

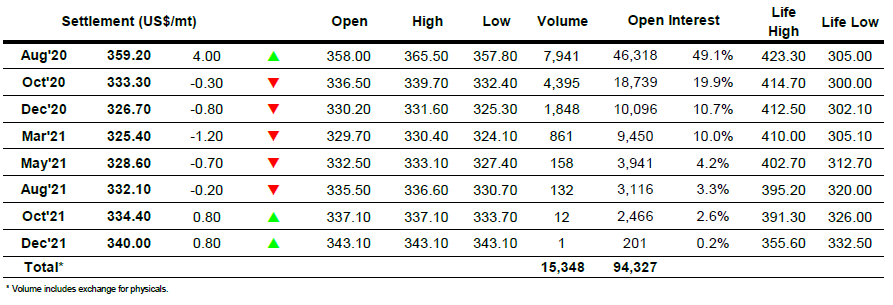

ICE Europe White Sugar Futures Contract