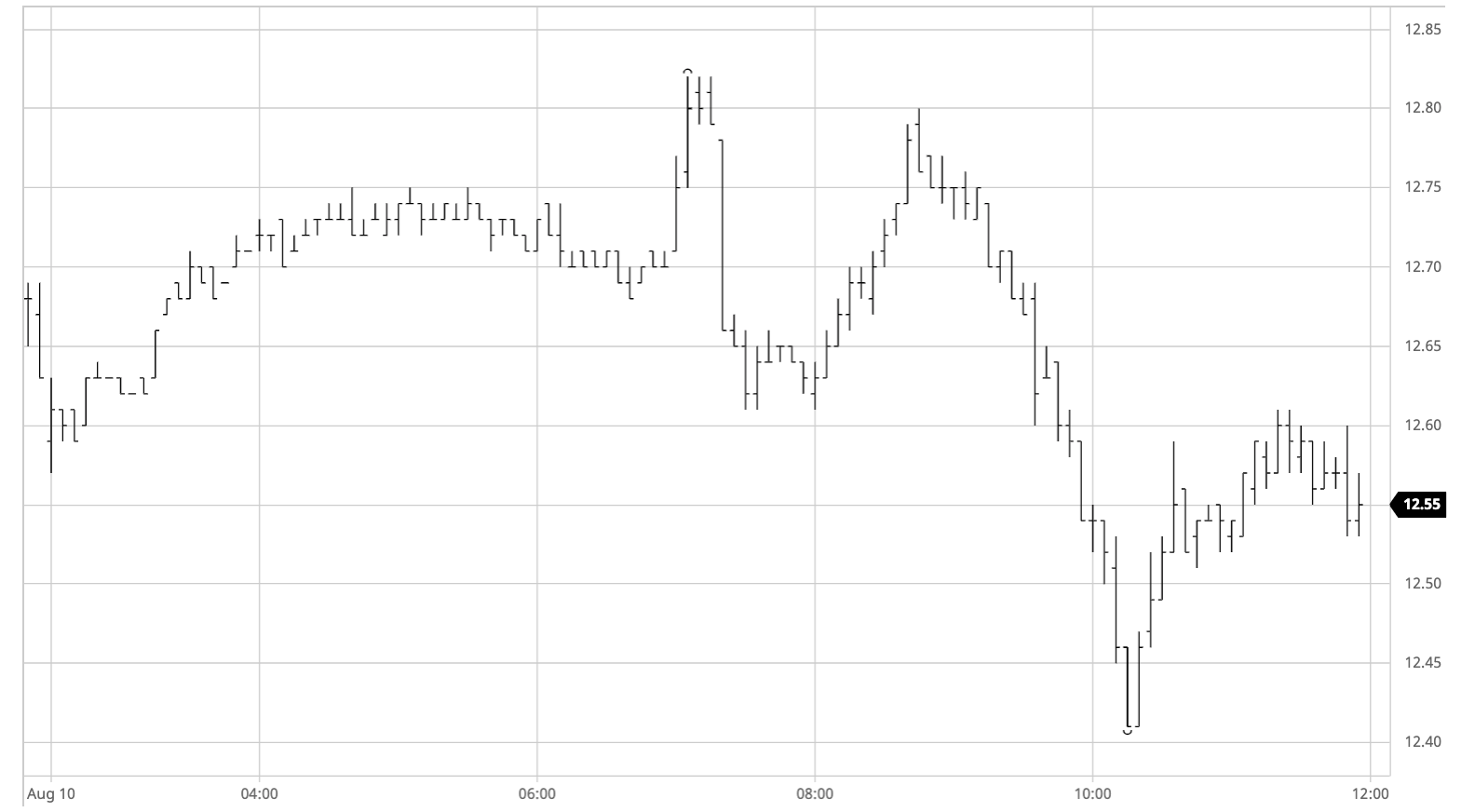

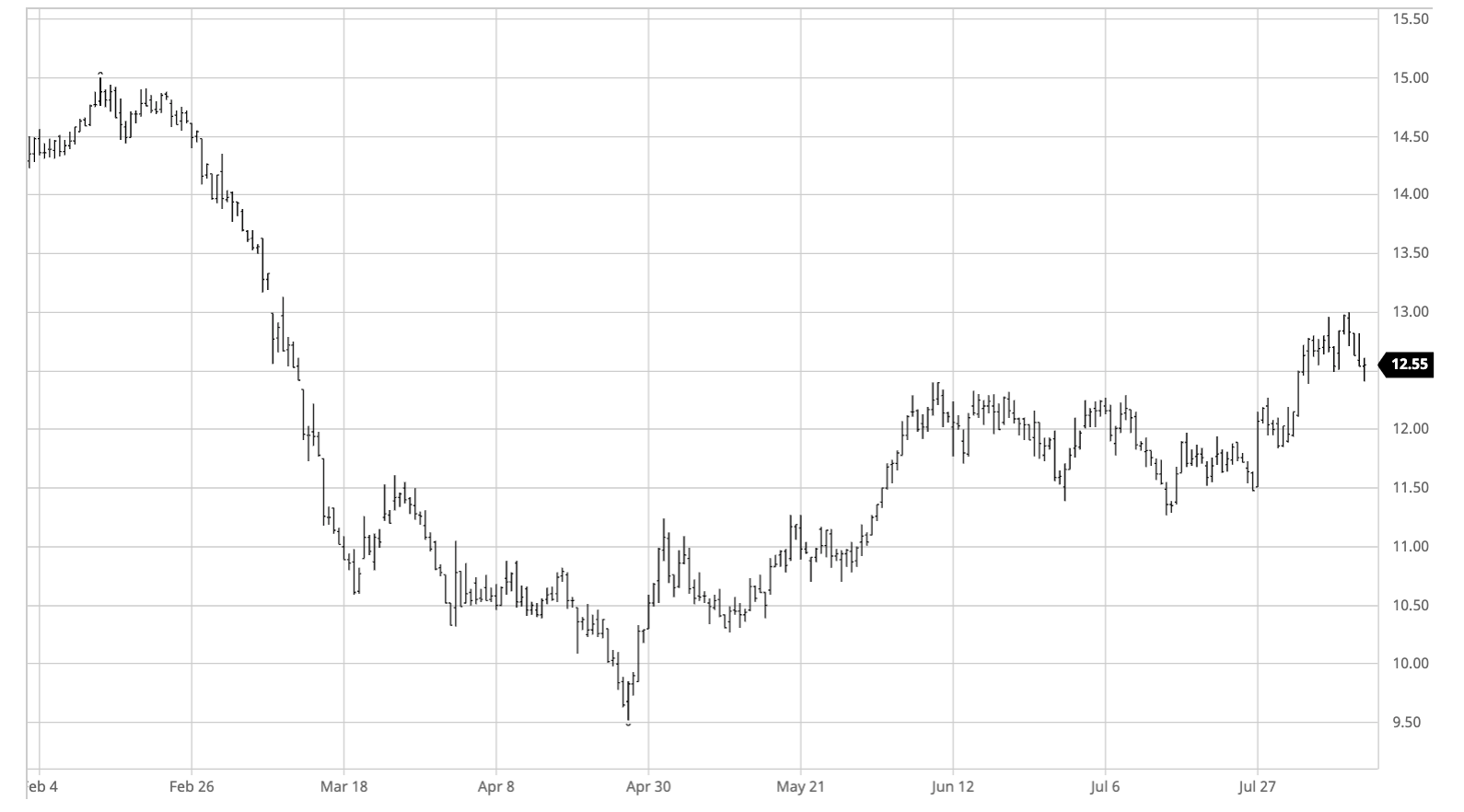

The day started with what it looked like a session of trading sideways. However, a surge in buying interest managed to push the market up by 20 pts, reaching the high mark of 12.82c/lb. The high was short lived, probably due to pricing pressure and impacted by news of better than expected rains in Thailand – which has been suffering significantly from dry weather. The increase in the average rainfall this month seem to have mitigated the market drought concerns for today. Also the downward movement between 10:45 and 12:20 was an aftermath of the WTI/Crude today, suggesting that there may be an additional macro factor, even though crude did recover later.

Another factor that could have prompted the lower price course was the BRL behaviour. Against the expectations, the dollar opened in a large fall today, with a huge volume of futures sales by Bradesco and Credit Suisse. However BRL got back on the weaking road as macro factors (US/China tension) took the driver’s seat.

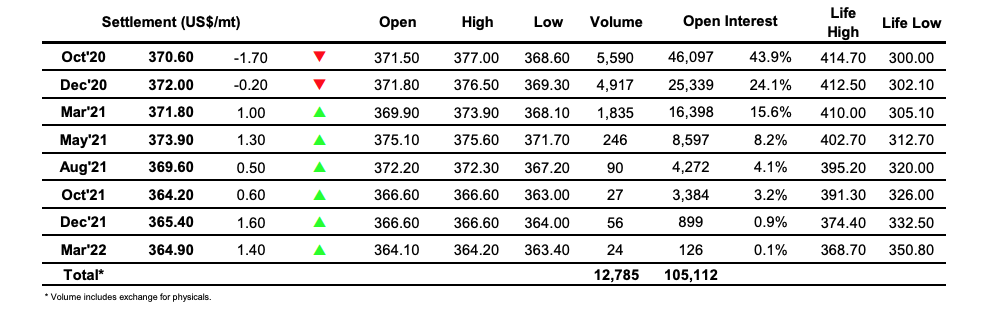

Oct – Sugar No.11

ICE Futures U.S. Sugar No.11 Contract

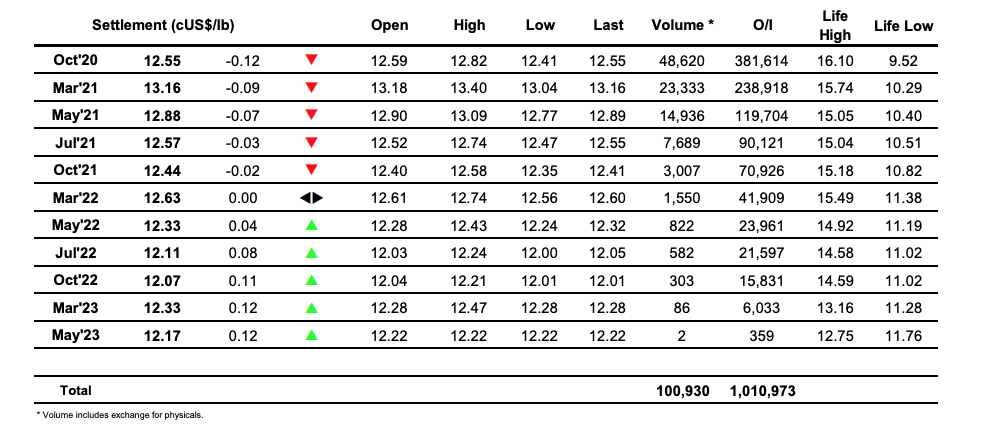

ICE Europe White Sugar Futures Contract