Sugar #11 Mar ’22

As we started the final session of the week the question to be answered was clear: does the raw sugar market have enough momentum to break through the psychological 20c level? To do so would be an exceptional recovery with the market trading at just under 18.5c only six sessions ago. The dip below 19c uncovered decent consumer buying, helping to bring the market back into the broad range of 18.5c-20.5c that we have seen since August of this year. It is telling then that today’s session produced the lowest daily traded volume in the spot month since the end of August, with only 28k lots of March-22 futures changing hands. The day began on a negative note, with prices opening slightly below yesterday’s settlement of 19.69 at 19.66. Immediately the market faced selling pressure, and only ten minutes into the session we traded to 19.52 on just over 2,000 lots. Fears that the recent recovery in the market may have been overdone would certainly have added an element of worry to long positioned speculators, however this worry would prove to be very short lived as we bounced almost immediately back to unchanged on the day. Very little followed, with the market content to trade around the previous settlement price until the US came online. It was here that we saw a frankly halfhearted effort to push the market into the 20c level, with around 3,000 lots of buying good enough to take us through to 19.84, but no further. This move was driven by a push in values across the commodity sector, with various contracts including brent crude exhibiting a similar push higher. Predictably the market then fell away along with the wider commodity space trading back to around the opening price and not straying far afterwards. The recent recovery in the board structure came under pressure today with 2H 2022 and 2023 levels all higher, most notably March 2023 which settled 16pts higher at 18.57. Not enough to alter the backwardated structure in the market but a sign that consumer buying could be starting to rear its head down the board. If we can learn two things from today’s session it would be: the nearby sugar market is continuing to be dictated by momentum in the wider commodity space, and, a large proportion of the sugar trade are enjoying a three day weekend.

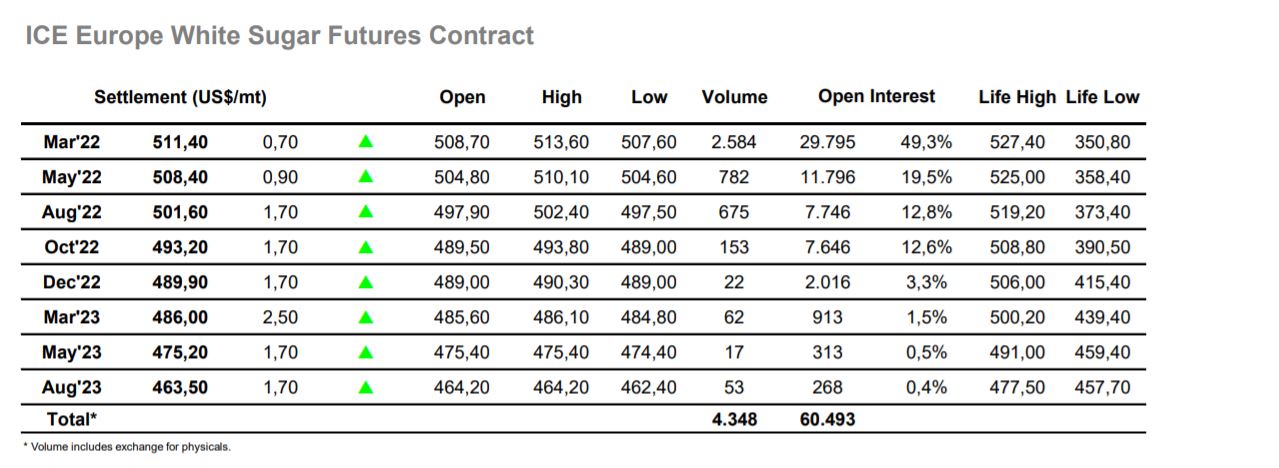

Sugar #5 Mar ’22

The white sugar futures market fell to $507.6 at the start of trading, mirroring the weakness in the raw sugar market which had opened 15 minutes prior. The similarities did not stop there, with the refined market following raw sugar in an almost regimented fashion, recovering from the lows to trade around the $510 mark until the US came online. A brief foray into the mid $513s was driven by a rally in the wider commodity space where both raw sugar and crude oil saw gains. This spike was short lived, and prices relented to the daily range between $510 and $511 where we eventually settled at $511.4. Interestingly the March-May 2022 calendar spread came under some pressure today, falling below a $2 premium before recovering at the close with decent(ish) volume pushing the spread back to a $3 premium. With deliverable sugar against the March contract appearing scarce and a historically low open interest figure (you need to go back to the March 2012 contract to find a lower open interest figure at this point before expiry) it appears that the contract could be vulnerable to a squeeze on prices if demand materializes. The March-March 2022 white premium continues to trade at the higher end of the recent range at $76, just off the 5 month high seen in October of $77.8.