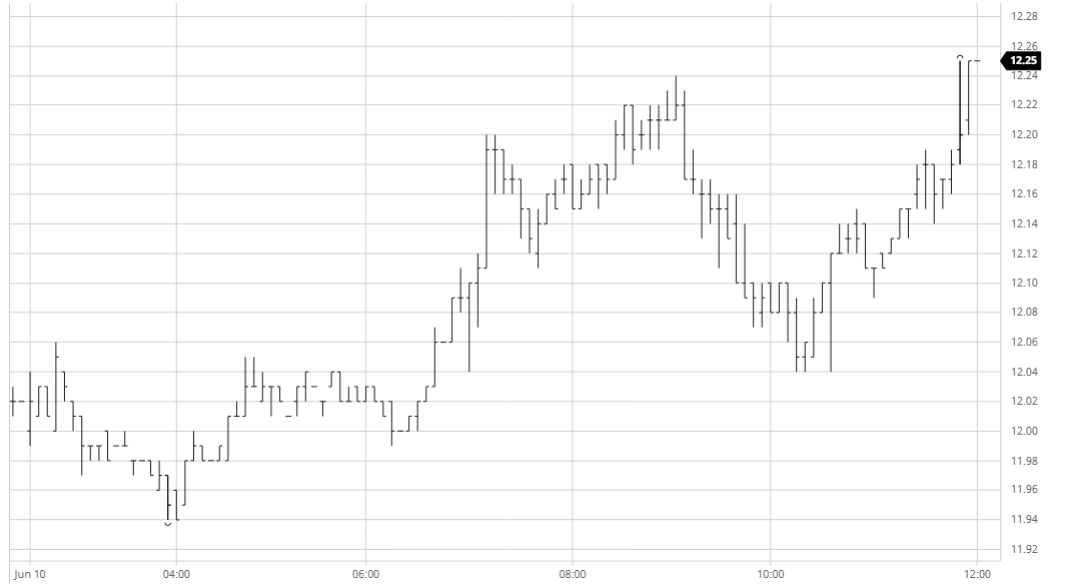

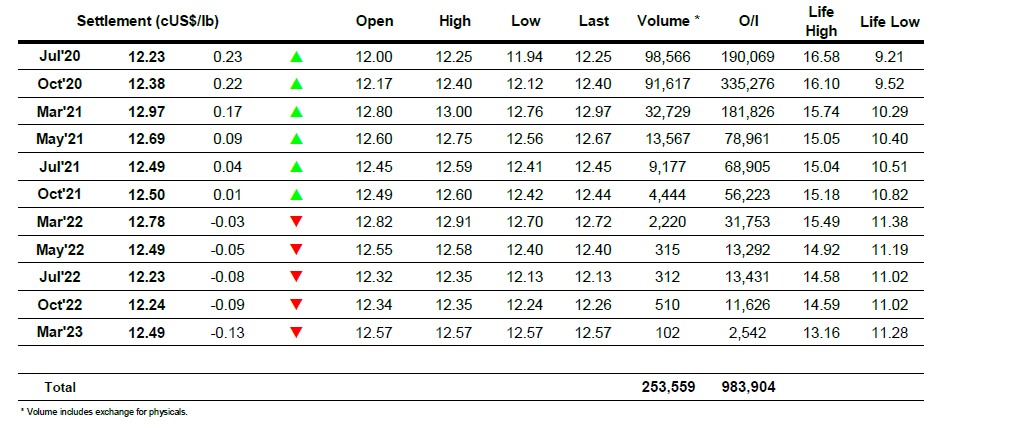

The market saw another quiet morning period with early trading seeing Jul’20 ranging a few points either side of unchanged against minimal volumes. The macro was rather mixed and in itself was not giving a great deal of guidance however with crude having made gains after our close yesterday there was clearly sufficient reason for specs to push higher once more to try and maximise the potential of their recently accumulated longs. The gains quickly extended to 12.20 and then on to 12.24 soon afterwards, however with scale selling on show we were unable to challenge the recent 12.27 high and instead slipped back down into the range. Jul/Oct’20 was continuing to generate more than 60% of the volume for the nearby two prompts as the index roll moved through its fourth day while nearby white premiums were firmer as we saw Aug/Jul’20 move out towards $130 once again. With crude recovering its earlier daily losses and the USDBRL remaining around 4.90 to limit selling from its producers the specs made a final late push upwards, and while falling short of 12.27 once again it was sufficient to provide a positive technical close at 12.23 from which they will look to continue challenging higher.

Futures no.11

Futures no.11

ICE Futures U.S. Sugar No.11 Contract

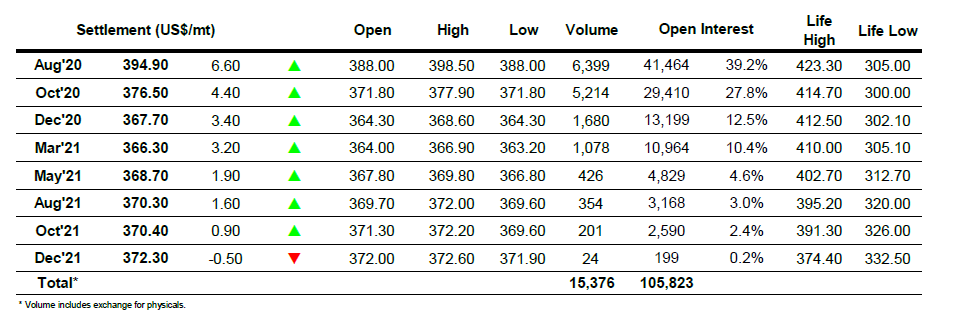

ICE Europe White Sugar Futures Contract