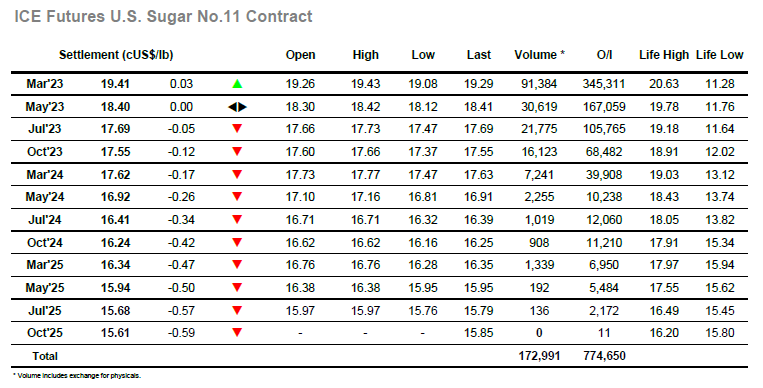

Despite a lower opening the March’23 contract soon moved back into the 19.30’s where it remained comfortably throughout a quiet morning. It seemed that the action was again priming the market for an afternoon push from specs, however as the Americas opened there was little reaction with the same range continuing to prevail. The afternoon saw the release of the latest UNICA numbers, covering the second half of October, which revealed cane production of 31.52mmt / Sugar production at 2.120mmt / Mix at 48.50% / ATR 145.13 kg. While these numbers were within the broad band of expectation, they were sufficient to cause the market a slight wobble, with some spec position covering sending March’23 back to 19.08 before the pressure eased. For the majority of longs the continued market presence above 19.00 means that they are content to hold firm and so once the selling eased a defensive push ensued which drew the price back up above 19.30 and leave it well poised for the final part of the session. Marginal new highs were recorded at 19.43 on the close, with settlement at 19.41 extending the recent strong run for another day.

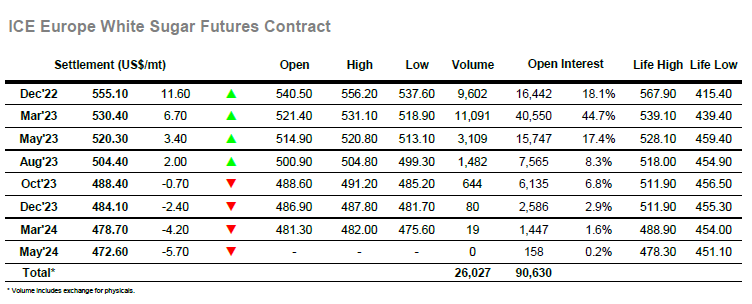

Lower opening values proved to be short-lived as buying gathered through the early stages to pull March though $524.00 and on to the highest levels seen for this contract since early June. By mid-morning, the outright value had extended to $526.80, while this strength was also resonating into the white premium where March/March’23 was recovering some of the recent losses to be trading back above $100.00. With the market now attempting to record a ninth successive “up day” there was understandably some reticence from buyers, and following a prolonged period of sideways trading the early afternoon saw a pullback to the $519.00 area on some light long liquidation. This did not represent the end of the move however and impressively the market regathered to push sharply high once more to another set of new recent highs, reaching to $531.10 late in the afternoon. Settlement was only just beneath at $530.40, extending the remarkable recent strength into Friday. Dec’22 continues to see a sizable open interest as we move towards Tuesdays expiry, currently standing at 16,442 lots, a smaller reduction than may have been anticipated given yesterday’s strong volume. Today saw the Dec’22/March’23 trading lower for long periods and sitting in the upper teens, however support emerged and by the end of the day it was valued back out at $24.70.