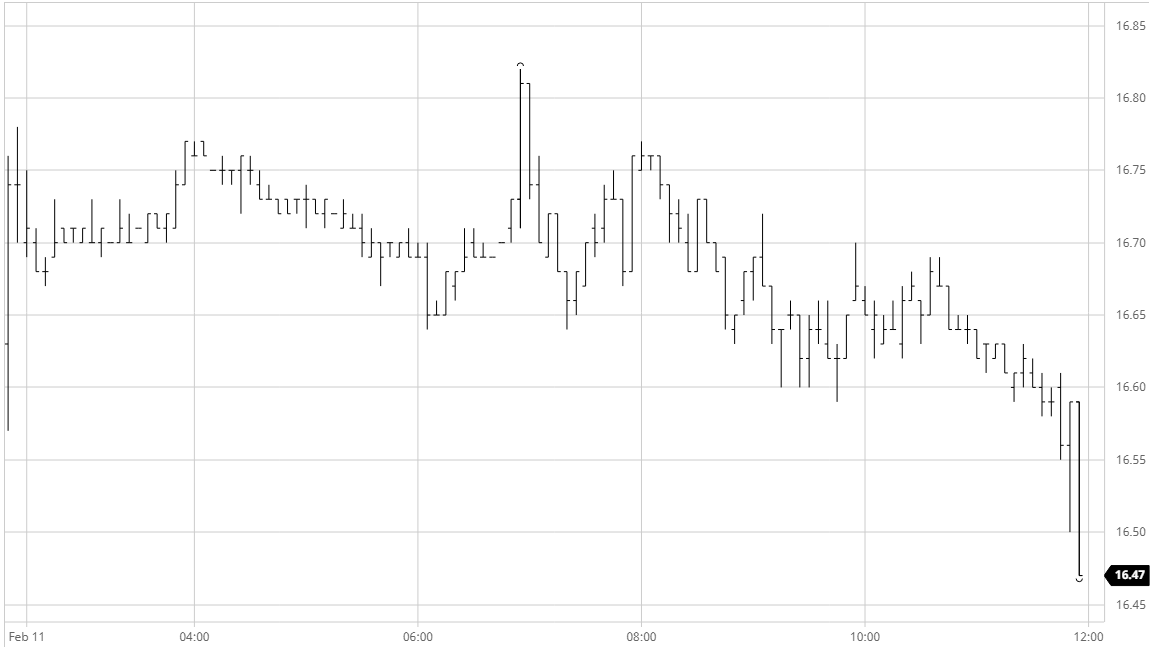

Sugar #11 Mar ’21

The fanfare of the move above 17c yesterday afternoon was long forgotten as the first four hours of today’s session saw March’21 meander quietly along within a mere 13 point range. Spreads were also quiet during the morning although that at least was sure to change with the final day of the index roll taking place and sure to lead to another bumper March/May’21 volume. The start of the US morning did bring a very brief kick higher from specs as March’21 was pushed up to 16.82 however it did not garner any momentum and values soon slipped back into the range where quite frankly the market went to sleep. The only movement was coming via the March/May’21 spread which through the afternoon was steadily giving back the gains made just 24 hours ago as both index funds and hedge funds chiselled more of their March’21 long positions forward and while this led to a small widening of the range to the downside it really was rather insignificant. Only during the final 15 minutes did we find some more aggressive activity with spread selling into 0.73 points dragging the market a little lower and making session lows at 16.47 (March) and 15.73 (May) though settlements remains a little above. This leaves March’21 some 50 points shy of yesterdays highs though with the main index roll now complete maybe another push from the longs ahead of the weekend is not out of the question.

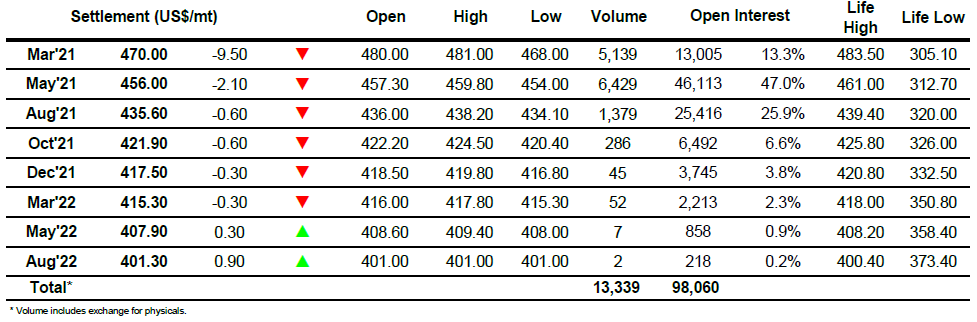

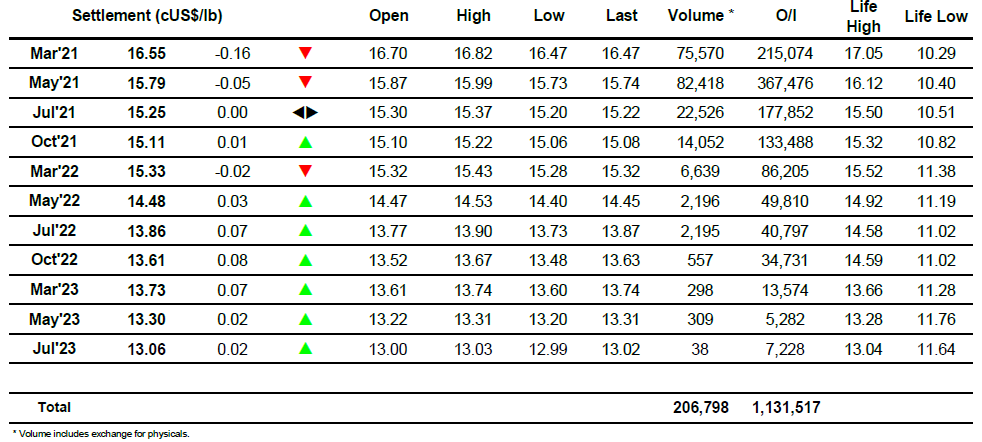

Sugar #5 May ’21

Following on from the fireworks of yesterday afternoon the market opened remarkably calmly this morning with values confined to a tight $2 range on very low volumes. Even the spread was quiet through this period with March/May’21 continuing to hold above $20 on the penultimate day of trading for March’21. A little more interest followed as the US morning got underway to widen out the range a little to both sides, and though volumes were picking up through this period it was only really the March’21 which showed any significant flat price movement, working downward as more selling emerged for the spread. A sharp collapse for both March and the spread midway through the afternoon sent the front month tumbling and the differential to a session narrowest of $11.70, and though the spread recovered against the constant of the May’21 bringing the spread back up it was never able to return to the morning highs. March’21 OI was standing at 13,005 lots today which given the expectations for around 500,000mt of mostly Indian origin sugars to be tendered combined with a March’21 volume of 5,139 lots suggests that there remains only fine tuning to be done tomorrow. MOC selling did drag May’21 to a session low $454.00 with March’21 recording its own low mark of $468.00 and we wait with anticipation to see how the respective participants in the delivery look to send things out tomorrow.

ICE Futures U.S. Sugar No.11 Contract

ICE Europe White Sugar Futures Contract