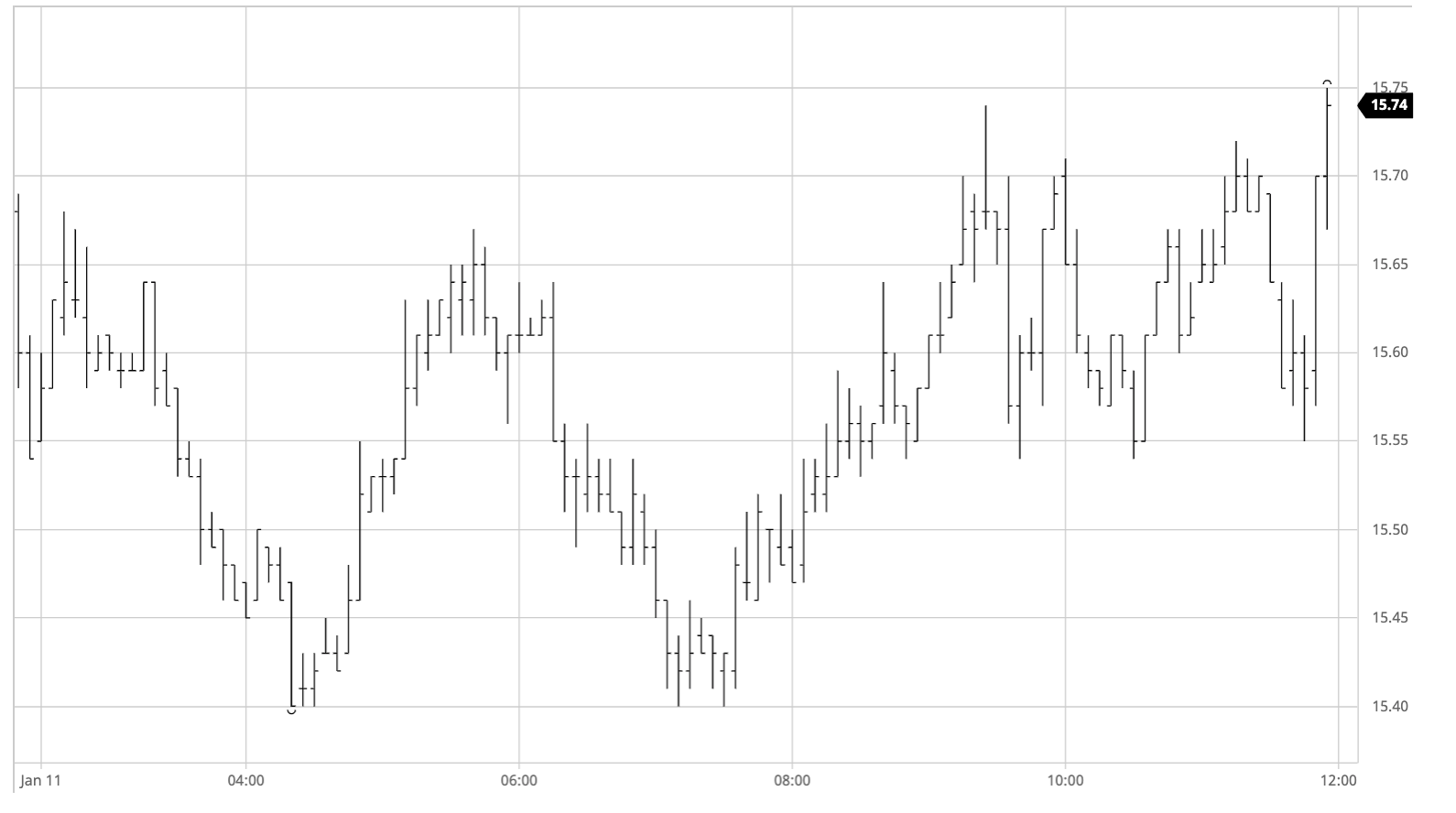

Sugar #11 Mar ’21

The new week commenced with some light buying, however that soon began to fade away and from an initial high of 15.68 we found March’21 sliding all the way down to 15.40 by mid-morning, filling in some scale buying along the way. The decline could easily have initiated more selling from specs who have grown increasingly long recently (Fridays COT report showed them long of 247,382 lots as at cob 5th January) however it seems that they remain determined to defend this position as instead some buying flowed in to pull values back towards the earlier highs. This set the tone for the afternoon with mixed trading continuing to provide a choppy environment for the front month, slipping back to 15.40 to form in intra-day double bottom before recovering once again to make a daily high at 15.74, though it was fair to say that both moves were on light volumes with limited depth showing within the range. There was increasingly strong support emerging for the March’21 spreads during the afternoon which aided the efforts to keep the front month in credit, with the March/May in particular finding decent volume to widen the differential by 10 points to a widest 0.93. The final couple of hours saw us continue to chop around within the upper half of the days range until MOC selling emerged to send March’21 out on a firm note, pushing from 15.57 to a new session high 15.75 over the final 10 minutes, with settlement a more modest 7 points higher for the day at 15.67.

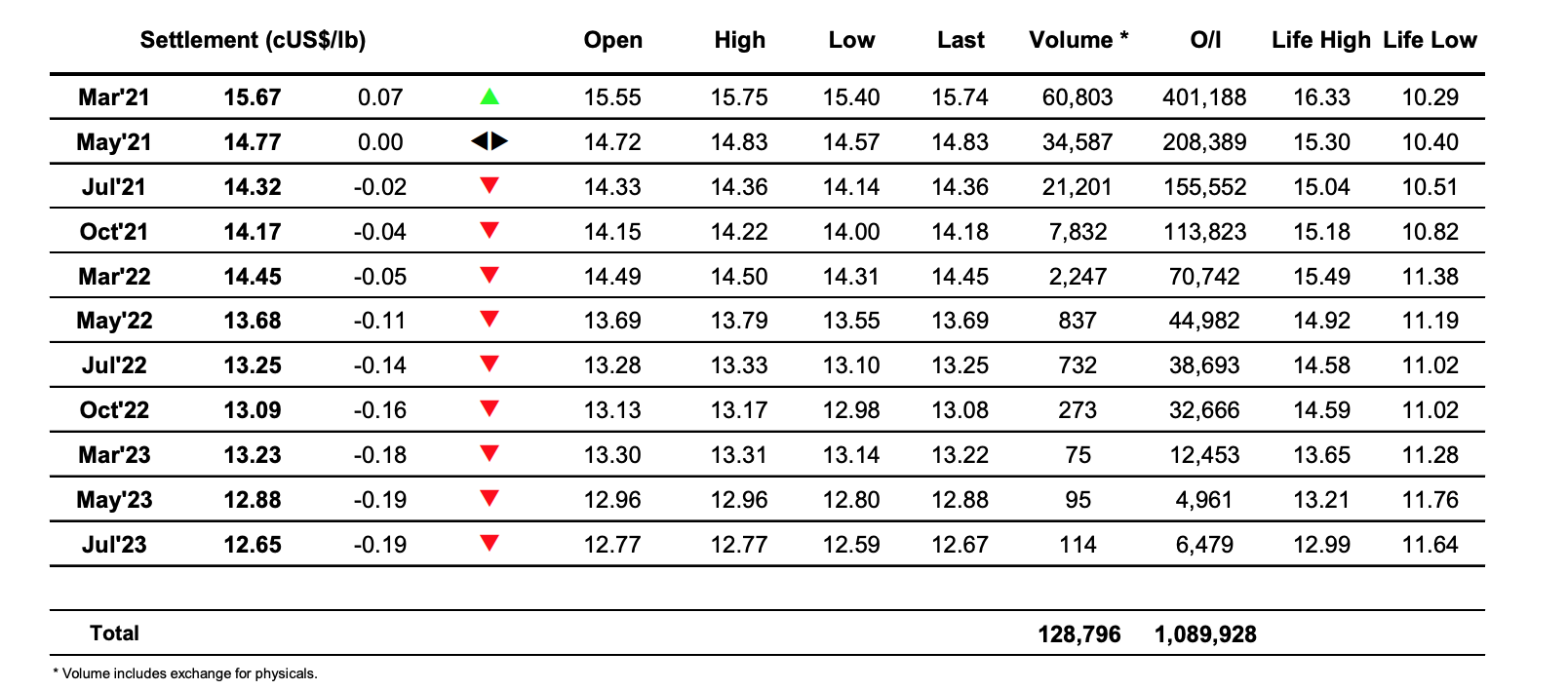

Sugar #5 Mar ’21

Morning selling emerged to put the market under some pressure during the first couple of hours with March’21 working down to $432.30 before finding some technical led support ahead of last Thursdays $431.00 low mark. A turnaround followed soon afterwards as some sharp defensive buying emerged, combining with some decent support for the March/May’21 spread to send values shooting back upward to reach $441 by the end of the morning. The action in the whites suggests that there is a potential squeeze developing for the March’21 contract with the spread roaring out to a widest $19.00, while the March/March’21 shot out towards $96 before both attracted some selling in and retreated back a little during the afternoon. The flat price spent the afternoon in a yo-yo pattern within the upper half of the days range, maintaining positivity without ever really threatening to drive back to challenge the recent highs. A surge of buying during the closing stages did ensure a positive settlement level of $437.90 and then continued through the post close to send us out trading at $440 last in the hope of setting a positive tone from which to continue tomorrow.

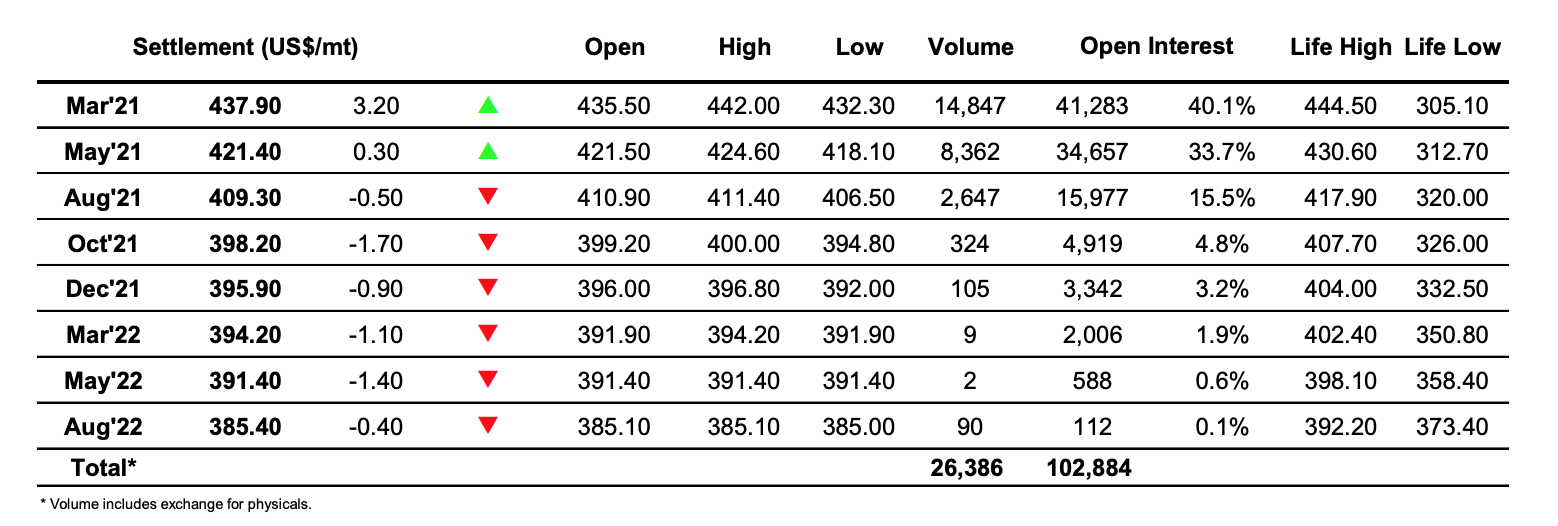

ICE Futures U.S. Sugar No.11 Contract

ICE Europe White Sugar Futures Contract