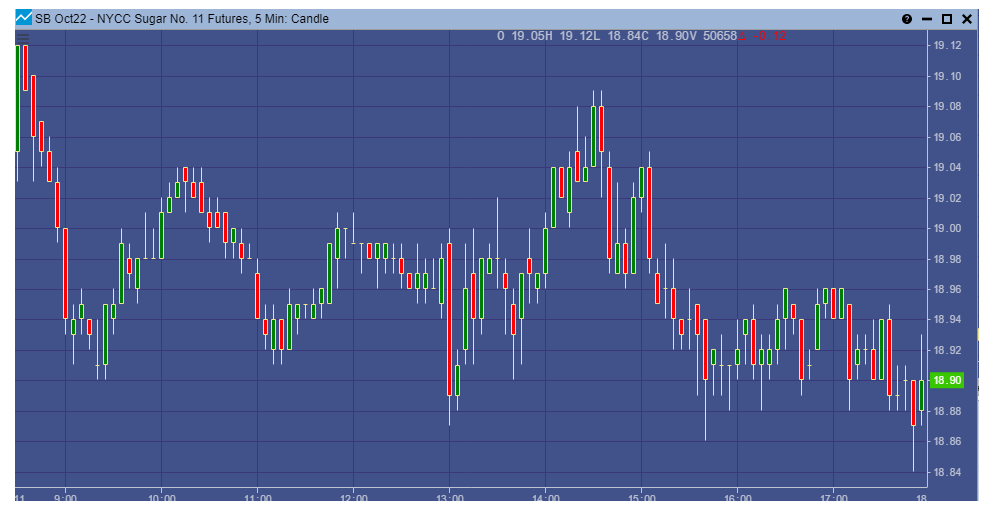

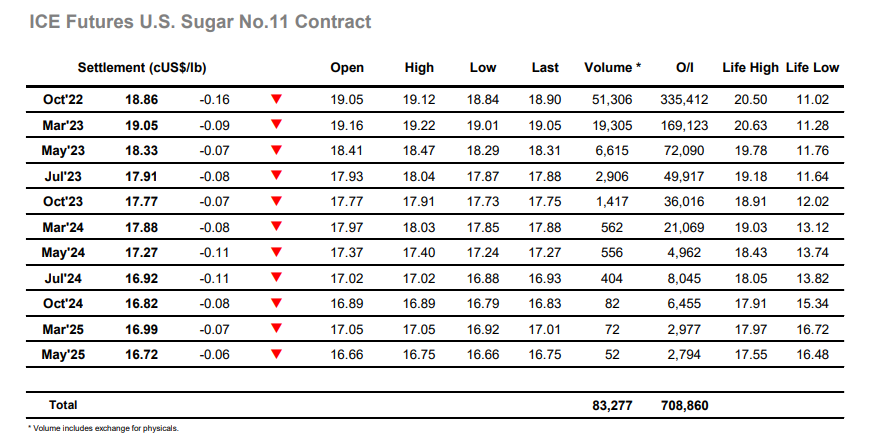

A mixed start to the week saw Oct’22 trading between 18.90/19.12 over the first hour as endeavours were made to consolidate the gains made during the latter part of last week. Friday evening’s COT report showed that specs/funds had added almost 50,000 net shorts over the week to Tuesday 5th July, turning the total net position short at -36,736 lots, the first time we have seen a net short reported in more than two years. A good deal of this short may well have been covered back over the past couple of sessions to reduce to a small net short on a live basis, with that action suggesting we may see the position continue to flip either side of flat in the near term as the smaller specs dominate proceedings. For several hours the market struggled to climb back above 19.00 with each effort soon exhausting itself above this level, and it was not until well into the afternoon that a more concerted push reached 19.09, still a few points shy of the morning highs. While the macro picture was mixed there was weakness for both wheat and crude oil, two of the recent drivers, and this seemed to resonate with specs who retreated, leaving values to slip back down the range and sit near to 18.90. They remained here until some MOC selling sent Oct’22 to a new daily low at 18.84, and while settlement at 18.86 is not constructive it merely suggests that we will continue within the broad recent range.