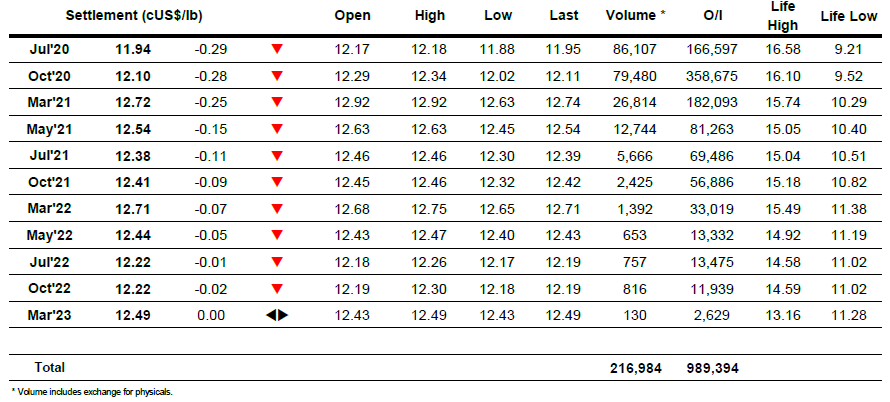

The hopes of the specs to look above the 12.27 recent high were seemingly quashed before we even began today. Last night’s Fed announcement that interest rates are set to remain low for some time had impacted upon the macro overnight, and combined with increasing fears of a 2nd wave of infections in the US it was to be expected that we wold join the herd and work lower initially. This initial lack of confidence sent Jul’20 briefly back below 12c although there was some defensive buying on show in this area as specs look to defend their longs, resulting in consolidation for the remainder of the morning period. With the BRL closed today for a holiday there was also reason to believe that selling could be more limited however a relatively small burst of selling during the early afternoon sent Jul’20 further south to 11.88, and while the market then dug in to further consolidate it did highlight a relative lack of buying and vulnerability. The final day of the index roll naturally dominated volumes during the afternoon, and while No.11 resisted any further daily losses the continuing weakness of crude (down 8%), softs generally and equities will be of concern to the longs given how reliant the recent performances have become upon the macro. Settlements at 11.94 (Jul’20) and 12.10 (Oct’20) were off of the lows though the fickle nature of the current market has been highlighted once again with last night’s positivity feeling some way away.

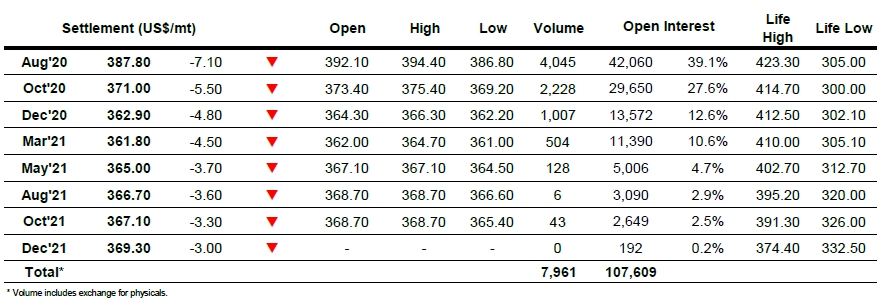

no.11 Futures, 5 min

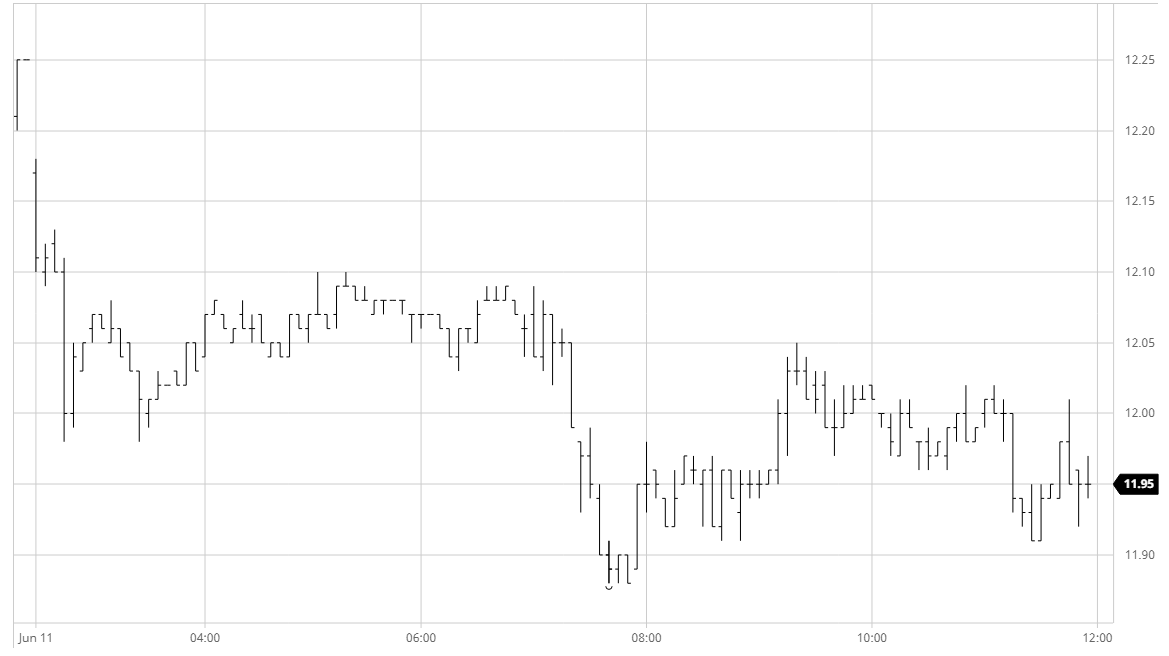

no.11 Futures, Daily

ICE Futures U.S. Sugar No.11 Contract

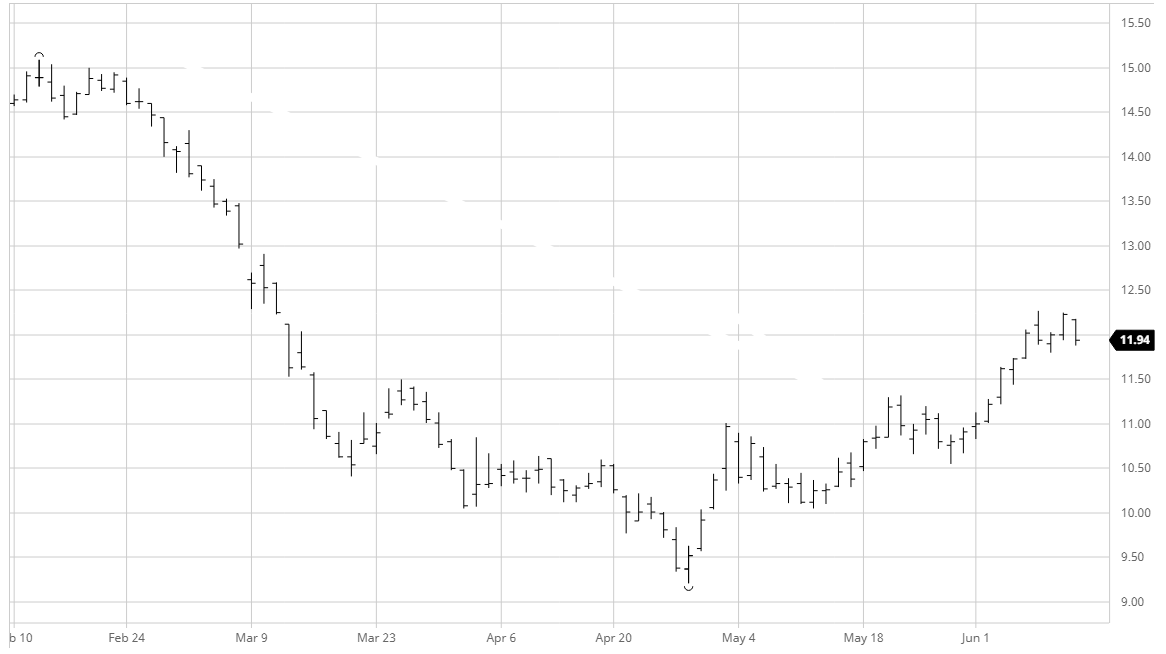

ICE Europe White Sugar Futures Contract