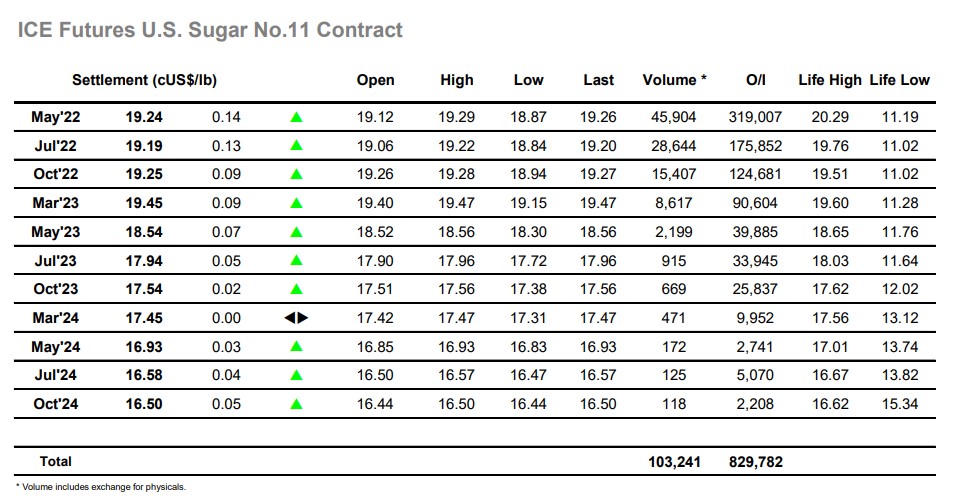

Sugar #11 May’22

A quiet opening saw May’22 trading either side of overnight values, the market calmed on news that Brazil is looking to pass legislation to lower federal fuel levies until the end of the year and soften the impact of yesterday’s price hike by Petrobras. Morning trading continued in the same vein with prices holding ahead of 19c, though with little interest from the specs now things had calmed again volume was light. There was an increase in volatility during the early afternoon with a little more of the recent long being liquidated down to 18.87 which encouraged some day trader selling into the mix along the way, however the lows did not last for very long with a short covering rally taking May’22 back up to the 19.20 area before stalling once more. With the spreads trundling along near to unchanged we saw volume fall away again for the final few hours with values edging along quietly within the range as specs stood back, reluctant to make any further moves ahead of the weekend. The final 15 minutes saw prices dressed up to new highs which ensured a positive settlement value at 19.24, though overall it did not disguise what was a session of consolidation following the recent volatility. Eyes will remain fixed to the news in the coming days to see what the geopolitical picture and macro have in store next.