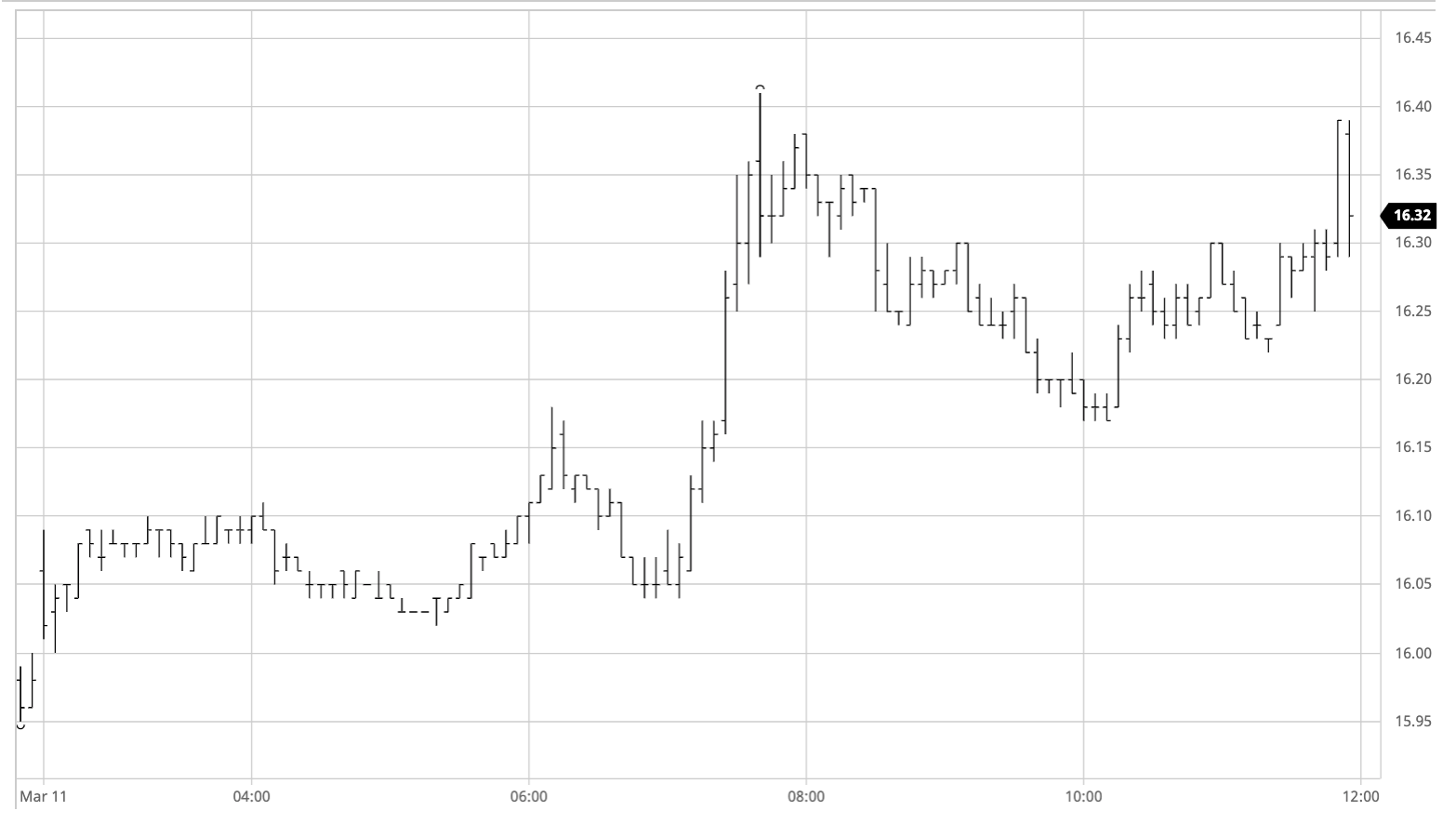

Sugar #11 May’21

In keeping with recent days the lower levels brought out some early buying which took May’21 back above 16c, but unlike previous efforts we actually then consolidated the slight gains with a little more buying emerging on the back of a better showing from the wider macro. Following on from the quiet stability of the morning we burst into life as the US morning got underway with increased spec activity pushing values sharply upward and registering a May’21 high at 16.41 before easing back a touch as the weight of buying eased. The market environment remained fairly thin with producer activity virtually non-existent throughout the afternoon as has been the case for a while now, a position which will likely continue should the BRL maintain the recovery of the last two days which has pulled the USDBRL rate back to the 5.55 area. To the buy side it seems that it is the smaller specs and algo traders who continue to make all the running and in the absence of the large funds that remain content to sit on their well-established longs there was a setback with bits and pieces of long liquidation taking the price back beneath 16.20. Consolidation in the 16.20’s during the final couple of hours set the tone for a final push upward and with capacity again available the specs duly bought May’21 on the call, sending the price as high as 16.39. May’21 settlement was established at 16.36 which provides a more positive outlook, though with no change to the fundamental picture we may need to rely on the macro to pull things along if we are to break from the broad 15.85/16.55 recent range.

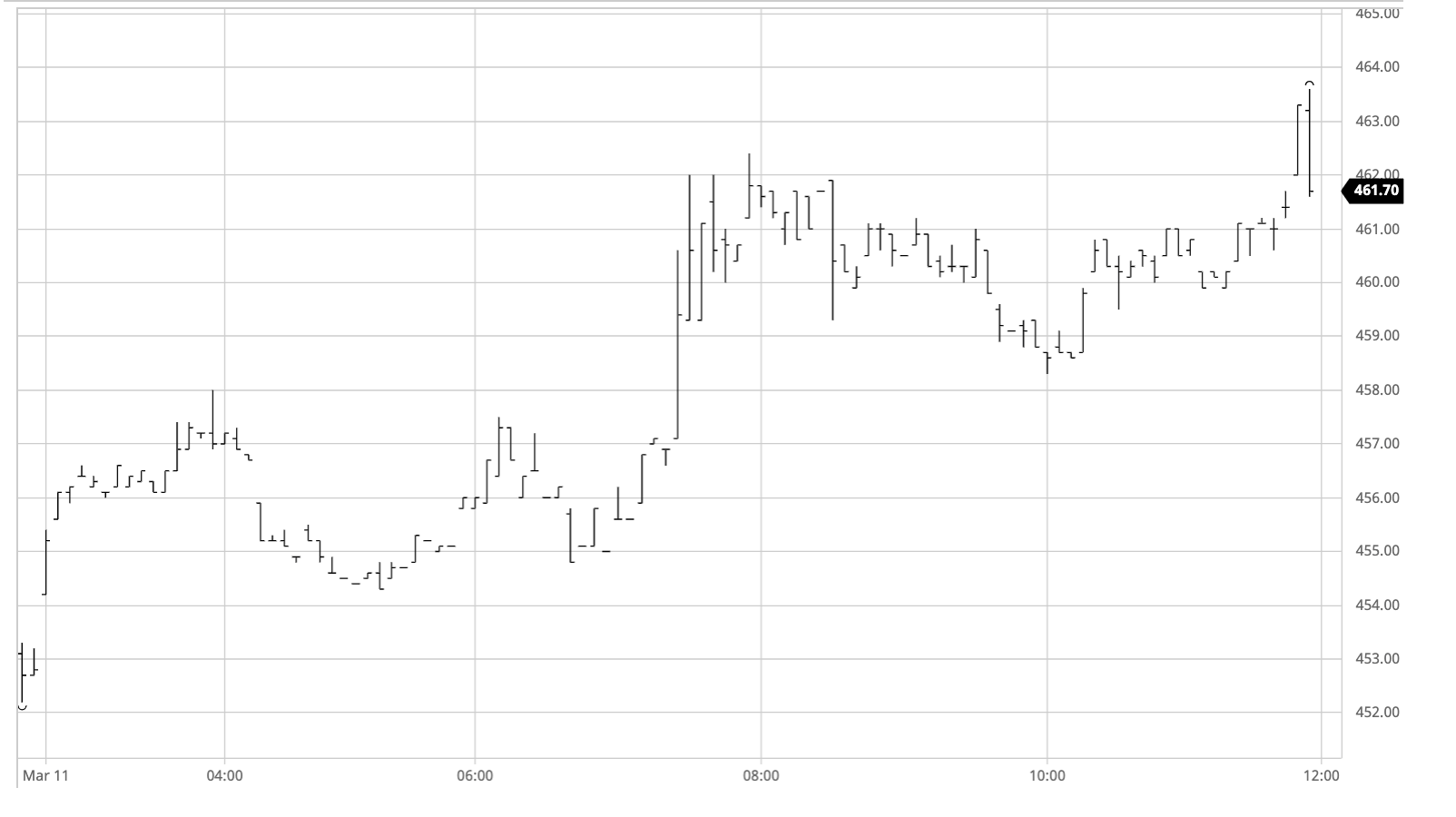

Sugar #5 May’21

From a weak starting point the market made a positive leap during the early stages of the session that saw May’21 trade as high as $458.00 before easing back into the confines of the early range. There was little selling on show and volume was very thin however that did not detract from the fact that we were higher despite a fairly weak technical close last night as we continued comfortably within the range throughout the remainder of the morning. The sideways pattern was broken with a sharp surge upward midway through the session when soon led the front month as high as $462.40, the catalyst seemingly being spec buying of our No.11 counterpart in reaction to a firmer macro environment. This move allowed nearby white premiums to make back the small amount of ground lost yesterday as they continue to hold within the same trading band, taking May/May’21 back to $103 before it settled down to hold around a dollar below this level. For much of the afternoon we then saw the flat price settle into a range either side of $460 with volume again thinning out but despite a continuing firm macro picture we seemed to have done enough and there was no fresh push to the highs, possibly not helped by the May/Aug’21 spread which while higher at around $12.50 was not making the strides back upwards which may have been anticipated following recent losses. Holding near to session highs as we moved towards the close we saw a burst of MOC buying take May’21 to a new mark of $463.60 on the call, establishing a positive settlement level at $463.10 and ending the day positively in stark contrast to the negative conclusion just 24 hours ago

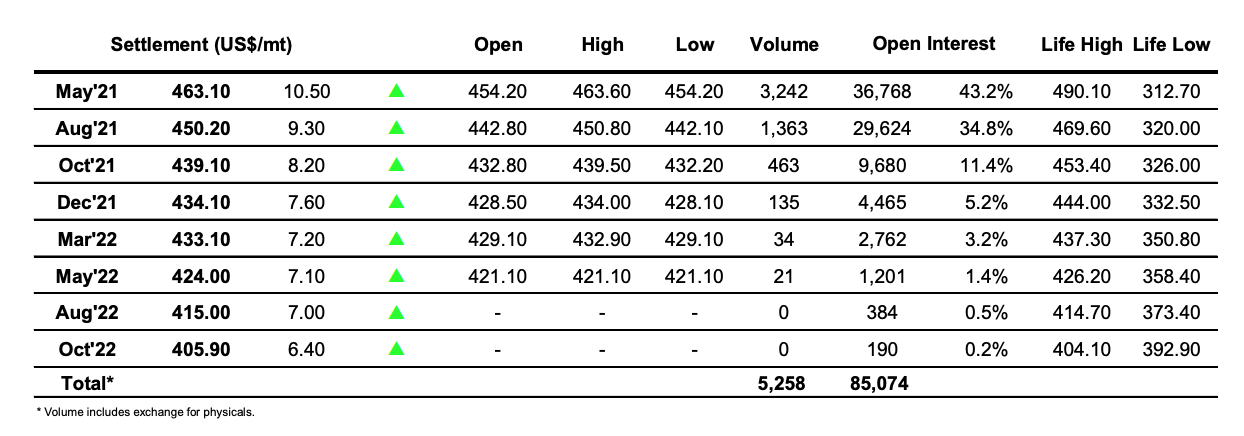

ICE Futures U.S. Sugar No.11 Contract

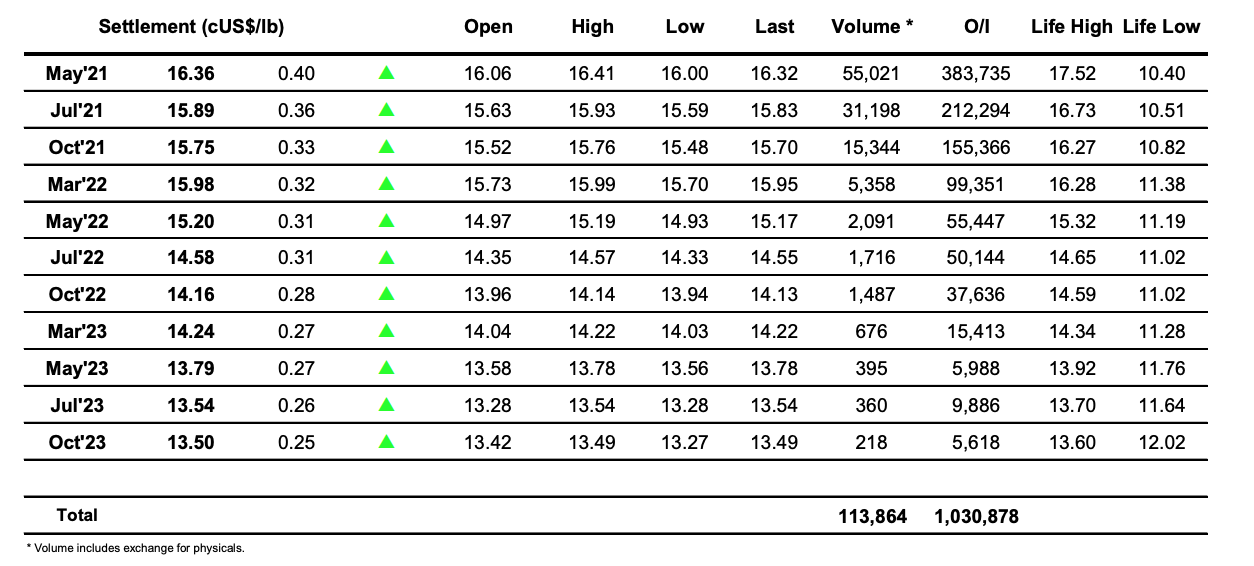

ICE Europe Whites Sugar Futures Contract