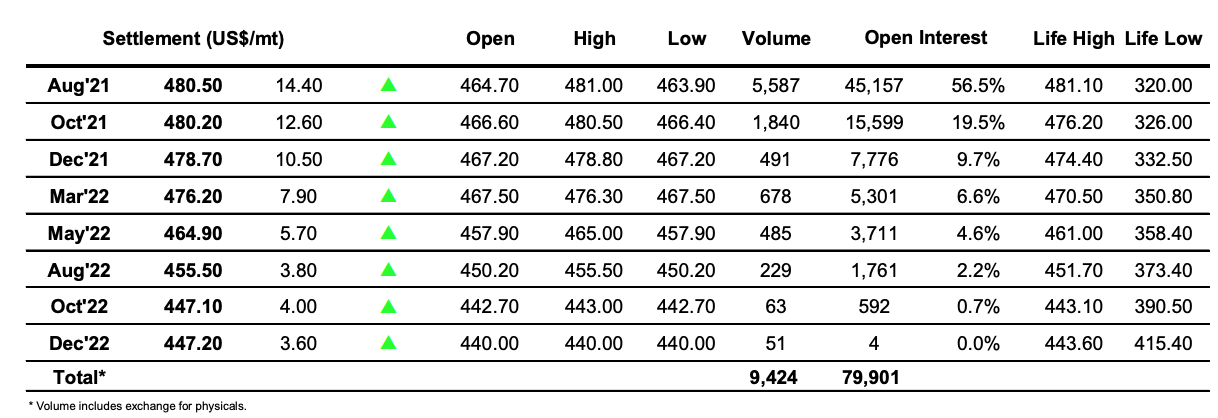

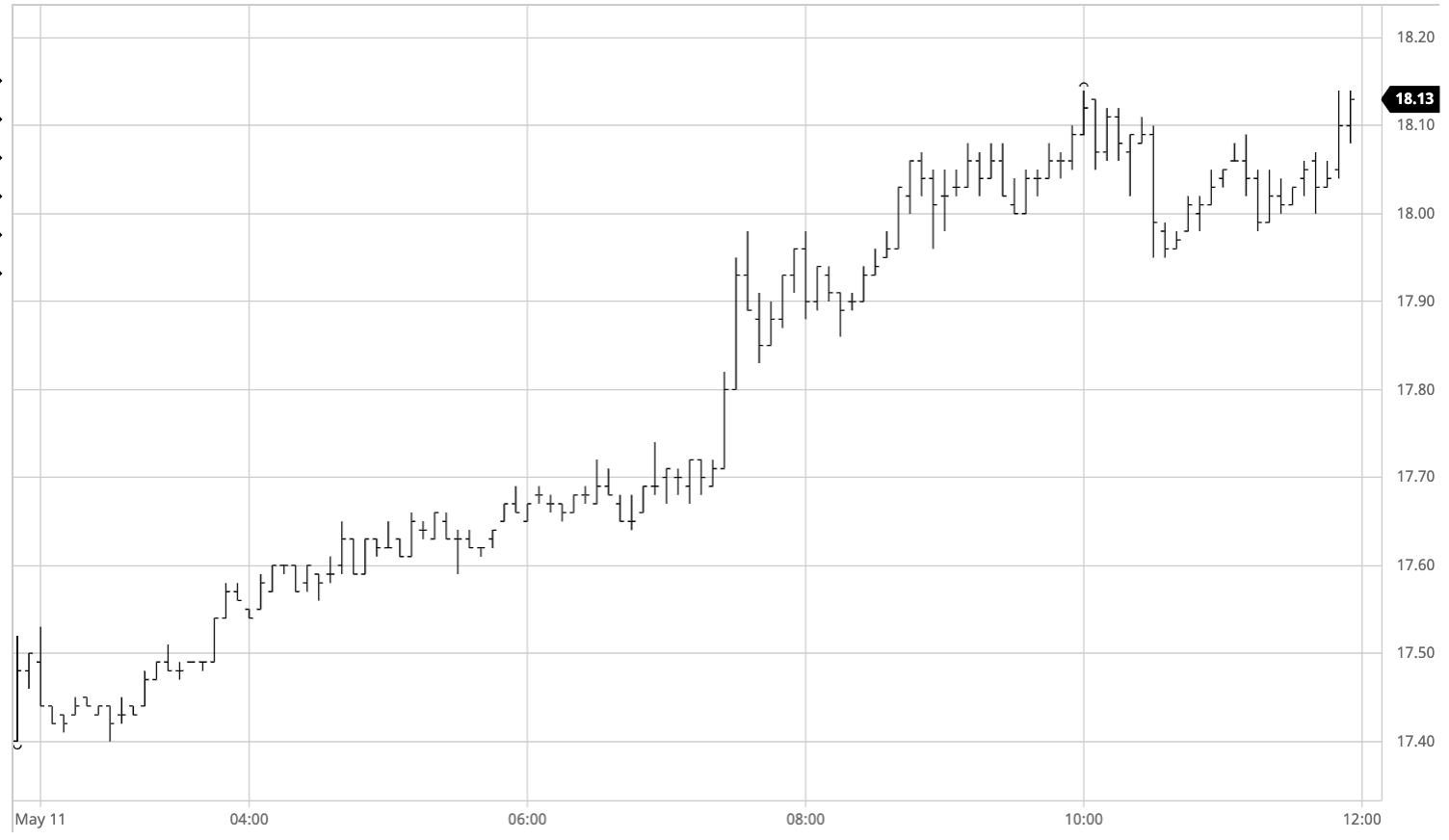

Sugar #11 Jul’21

The day commenced with values a little below overnight levels but the red was soon removed from the board and a morning of slow but steady buying ensued to take the price gradually upward into the 17.60’s. This provided a platform to look ahead once again as the US based specs came on board with upside targets basis yesterday’s high 17.75 and the contract high 17.89 and we did not have to wait for long to explore this area with a surge to 17.98 on around 5,000 lots following. The surge took us to the top of the commodity charts for the day despite the fact that many products were struggling and the CRB showing a negative, and having paused for a while we strengthened beyond 18c to further extend the contract highs. Volume picked up a little in this area with slightly more selling emerging to provide moderate resistance however unlike previous session this did not cause the spec’s (and trade?) to change path and liquidate longs as we dug in and held above the 18c mark. Reasons for this most recent push were varied with some talk that the lower Cuban crop had prided encouragement for the specs while tomorrow will see the next set of UNICA numbers released so may be encouraging some buying in expectation that the continuing dry weather will produce disappointing figures. Aided by USD movements during the afternoon we saw the CRB turn positive with sugar continuing at the top of the pile despite dipping back beneath 18c as a few of the longs began to take some cover. Buying returned for the closing stages to ensure a very strong settlement level at 18.10 and the longs will no doubt be keen to use any bullish news to maintain this push in the knowledge that a failure could see a sharp correction given the still thin nature of the resting orders in the market.

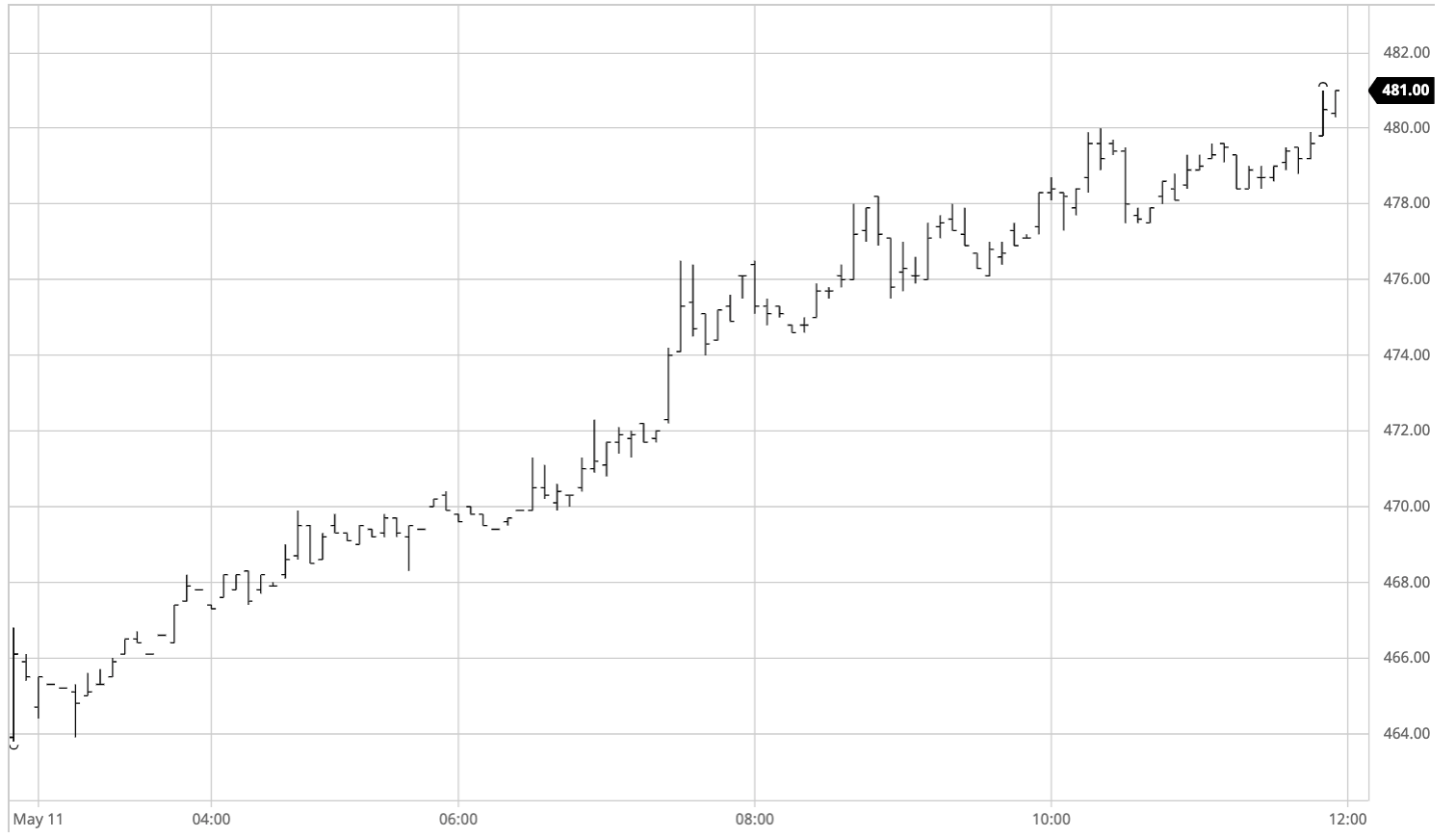

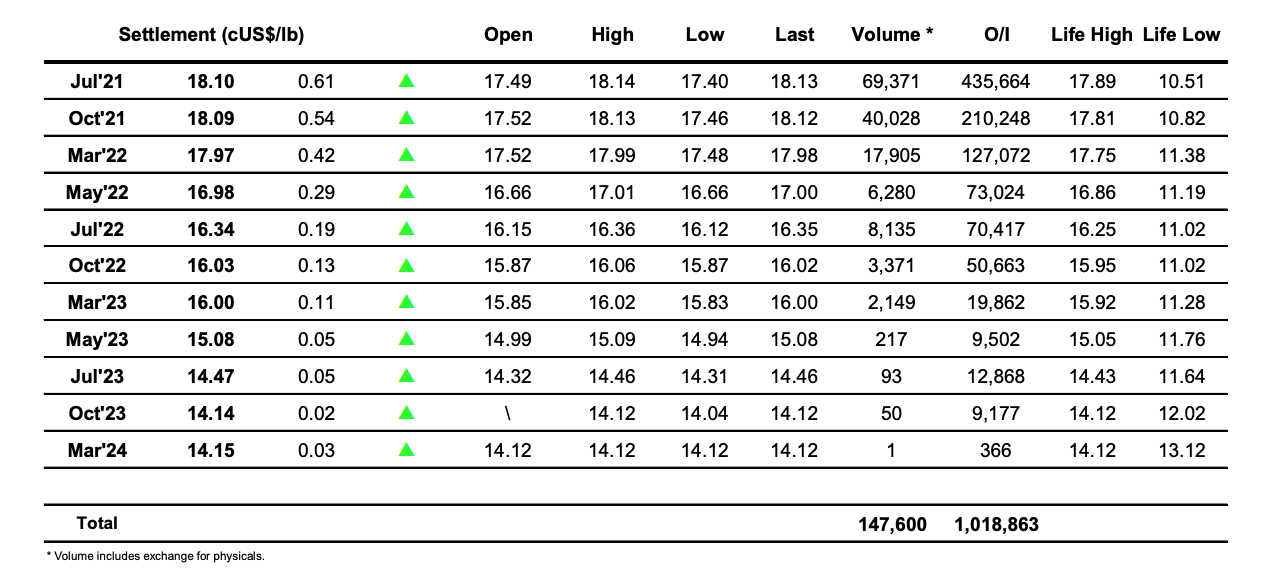

Sugar #5 Aug’21

A solid start to the day for Aug’21 looked to build upon last night’s closing surge to maintain recent progress and while volumes were low during the first few hours there was sufficient support to climb to the $470 area. The continuing recovery has brought the $481.10 life of contract high back into view and during the early afternoon a spike upwards to $476.50 followed as spec buying emerged into sugar once more with us keeping pace to No.11 on a rally led by the raws while the Aug/Jul’21 white premium value held constant at $80. With the tone now well and truly set a little more volume came into the whites as buyers went in search of $481.10 and new contract highs and as the afternoon progressed this allowed the white premium to widen out a touch further towards $82 while alongside the Aug/Oct’21 spread made its way back to a premium for the first time this month with a high mark at $0.90. The buying was maintained through into the closing stages and on the call we reached a daily high of $481.00 to place Aug’21 just 0.10c beneath its contract high though other prompts were making their own new high marks. Having dismissed short term doubts through todays movements the specs will no doubt to be keen to maintain progress tomorrow to avoid a technical double top and maximise the potential of the move.

The front month WP mad further gains today with Aug/Jul’21 closing at $81.50, though down the board we were unchanged to a little lower, Oct/Oct’21 at $80.75 and March/March’22 at $80.00.

ICE Futures U.S. Sugar No.11 Contract

ICE Europe Whites Sugar Futures Contract