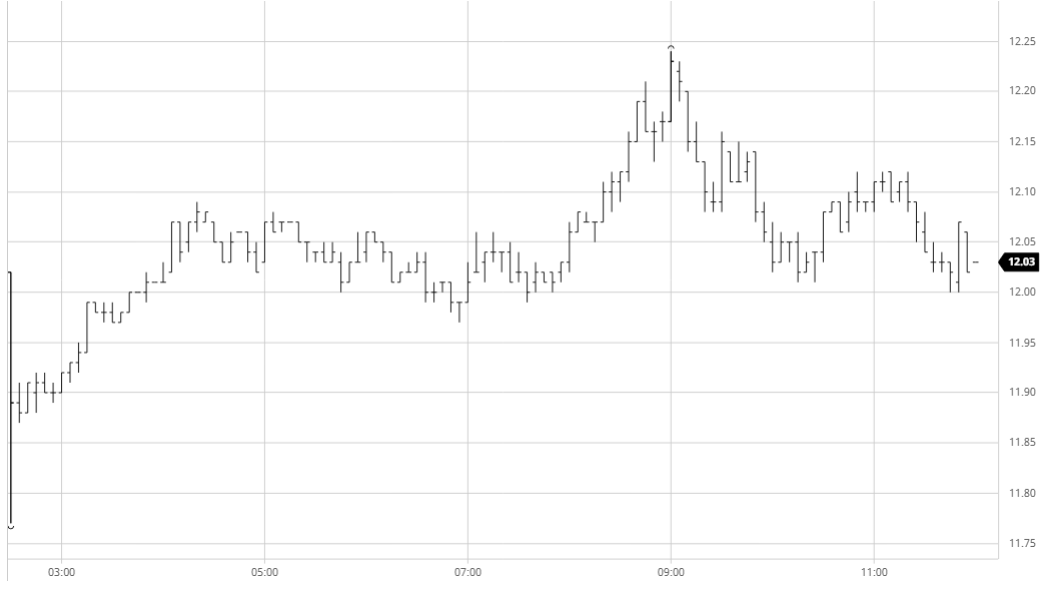

The market saw some early volatility as ongoing macro weakness sent prices lower from the get-go, reaching lows of 11.60 (Jul’20) and 11.77 (Oct’20) in the first few minutes as spec sell stops were triggered. Just as quickly however the recovery began with the initial stops having provided something of an overshoot and providing an opportunity for consumers to get some pricing under their belts. With the wider macro now beginning to recover from the losses of the previous 24 hours the market clambered back to within a few points of last night closing levels before entering a fresh period of consolidation. The USDBRL opened weaker at 5.09 however thoughts that this may draw selling in from producers were unfounded and instead we saw some fresh spec buying appear to push prices upwards once more, reaching highs of 12.09 (Jul’20) and 12.24 (Oct’20). With October now taking over as the virtual spot month following the index roll it was here that we were seeing more of the spec interest, however unable to maintain traction at the highs we slipped back and the latter stages were spent trying to defend Oct’20 above 12c. To this end the longs were successful, ensuring that Oct’20 ended the week at 12.04 but still providing no clues as to where the broad direction lies at present.

no.11 Futures oct 20

no.11 Futures oct20

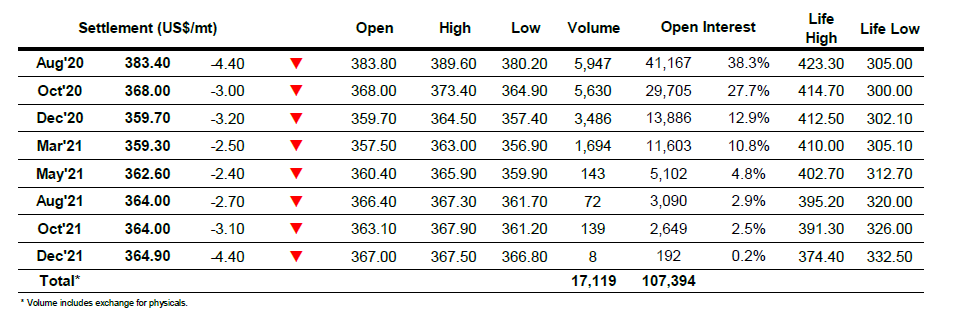

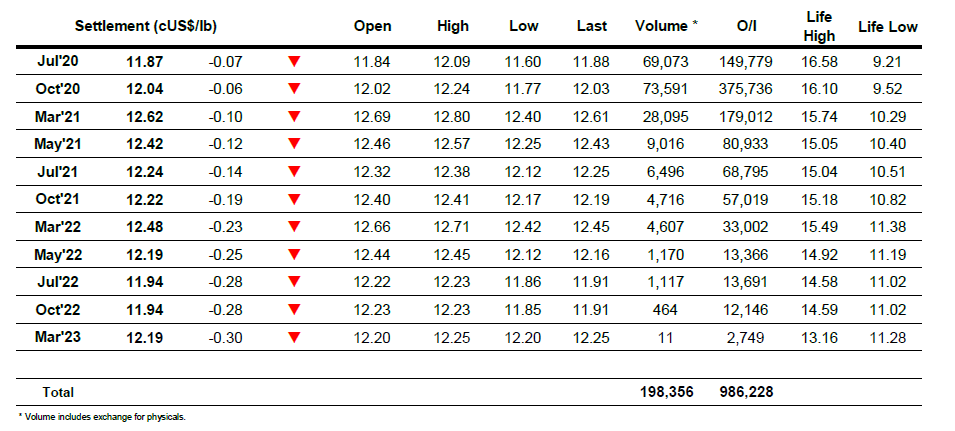

ICE Futures U.S. Sugar No.11 Contract

ICE Europe White Sugar Futures Contract