Sugar #11 Jul’21

Early buying was noted for Jul’21 and we traded to 18.24 on the opening and then a single point higher to 18.25 soon afterwards as the life of contract high’s continue to roll in. Maintaining the recent low volume conditions the market held near to these new highs throughout the morning, seeming content to consolidate ahead of this afternoons release of the UNICA numbers for 2H April, while the firmer nature of energy values, a strong ethanol price and USD movements are not encouraging specs to exit longs at present. As the US morning dawned so prices began to ease back to unchanged levels and while the volumes remained light with most of the activity confined to day traders and algo’s the slide continued with long liquidation sending Jul’21 down to 17.78. We did not spend too long at these lower levels with buying remerging ahead of the UNICA publication to pull the price back above 18c. When the release arrived it showed the crush at 29.59m (-22.5%), sugar production at 1.52m tons (-25.5%) with a sugar mix at 44.54% and led Jul’21 to rally back to 18.15 soon afterwards, though with such numbers having been well anticipated the recovery halted there and we held sideways within the range. A downward bias resumed during the latter stages as the lack of buying prompted a little more long liquidation, alongside which we also saw the Jul/Oct’21 spread return to an inverse at -0.05 points. The final 15 minutes saw Jul’21 match its earlier low at 17.78 and though some buying emerged from the close it merely pulled values away by a few points with a settlement value at 17.84.

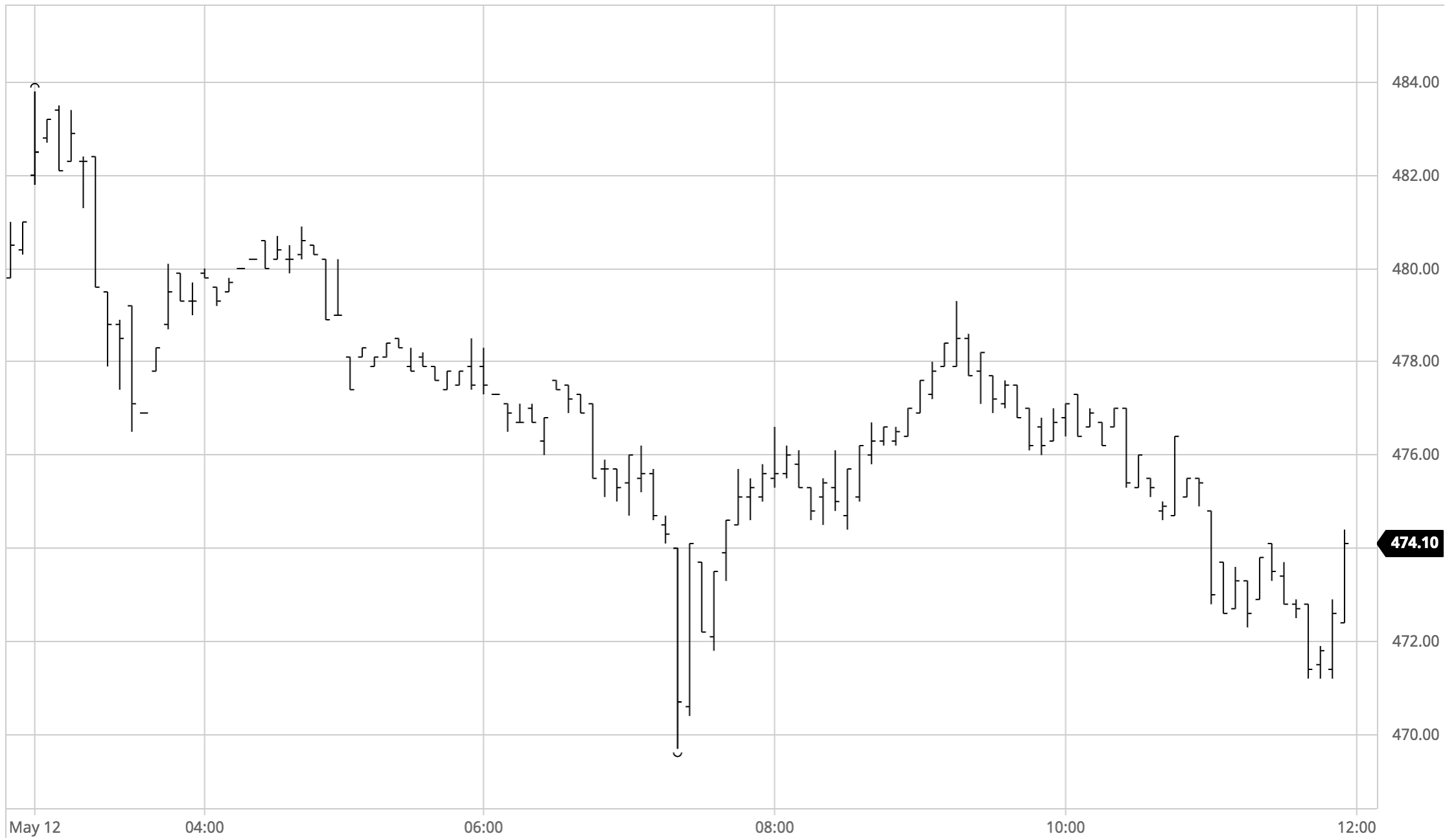

Sugar #5 Aug’21

Last night’s positive settlement value just 0.60c beneath contract highs provided the impetus for early buying and Aug’21 immediately traded up to a new lifetime high mark at $483.80, with new highs also being made elsewhere down the board. Somewhat unexpectedly given the strong technical nature of the picture we encountered selling soon afterwards which in the thin environment sent the price quickly down to $476.50, and while the move saw only around 500 lots change hands it has a dramatic impact upon the Aug/Jul’21 white premium which narrowed from almost $83 on the opening highs to be trading back at $76.50. Though we then attempted to stabilise there was insufficient buying to take us back to the highs and stalling in the $480 area we then started to decline again to be making new session lows by the end of the morning. Further weakness followed as we spiked down to $469.70 in tandem with No.11 weakness though a recovery got underway almost instantly and just two hours later we were $10 above the lows having eradicated most of the losses. Movement within the wide daily range continued through the final couple of hours with the front Aug/Oct’21 spread weaker at -$1.00 discount we saw prices slide back to the lower end ahead of the close. The call was played out in this same area and though we saw a late push back to $474.40 it came on the post close with settlement made at $471.80.

· 2021 white premiums ended lower on the day though away from session lows with Aug/Jul’21 closing at $78.50 and the Oct/Oct’21 ending the day at $78.25. 2022 values were stronger however and March/March’22 closed at $81.25.

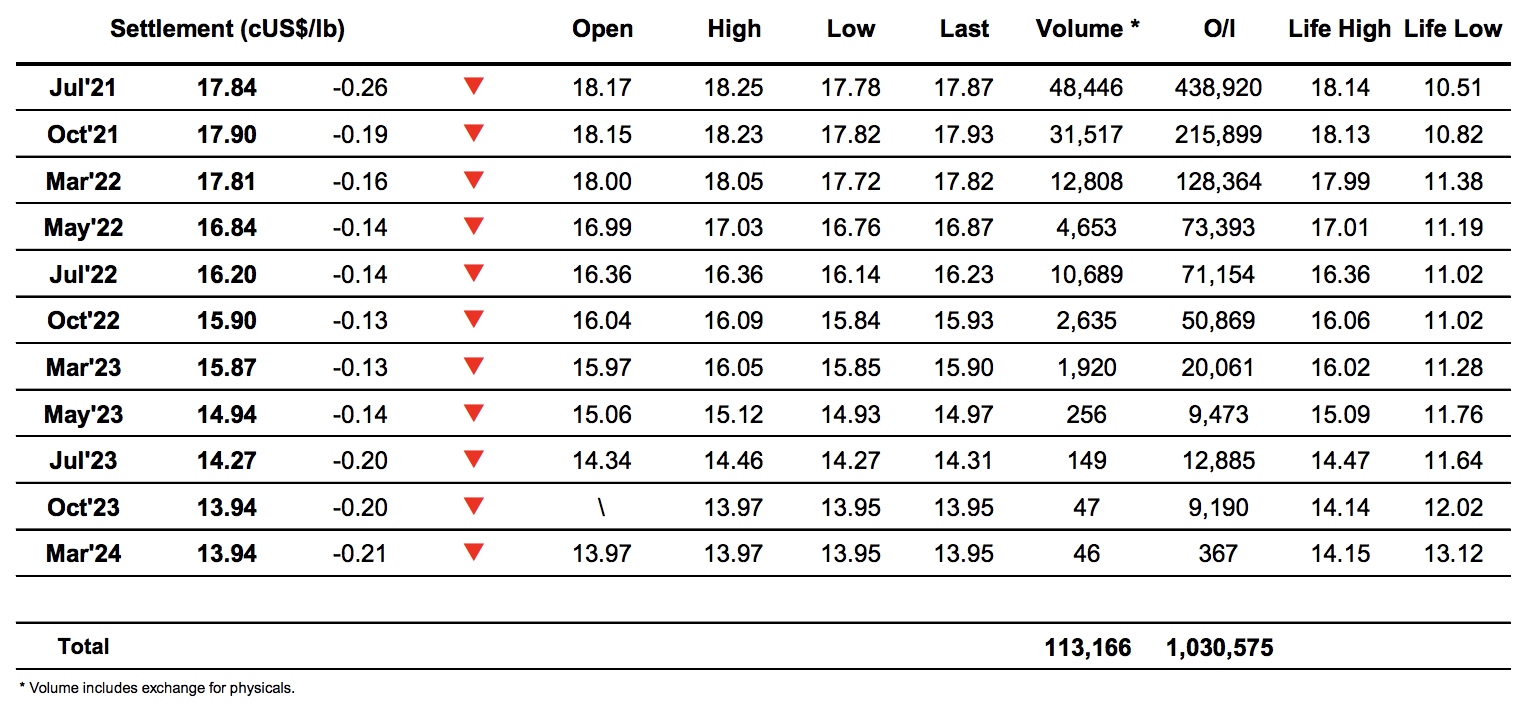

ICE Futures U.S. Sugar No.11 Contract

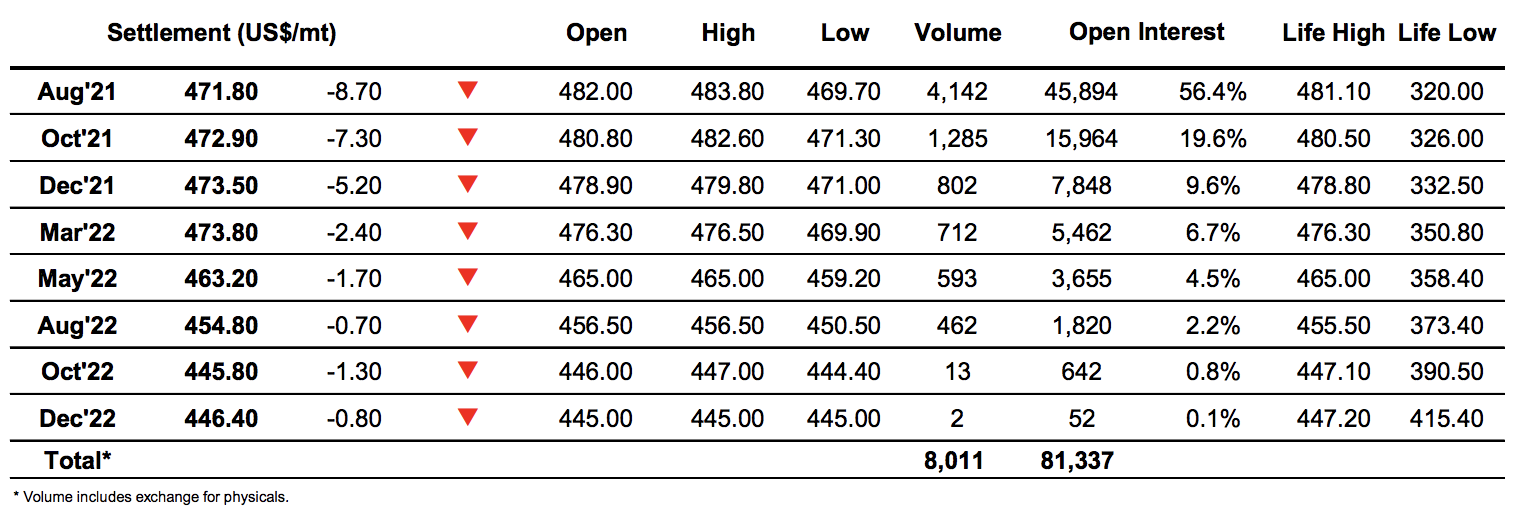

ICE Europe Whites Sugar Futures Contract