Mar 21 – Sugar No.11

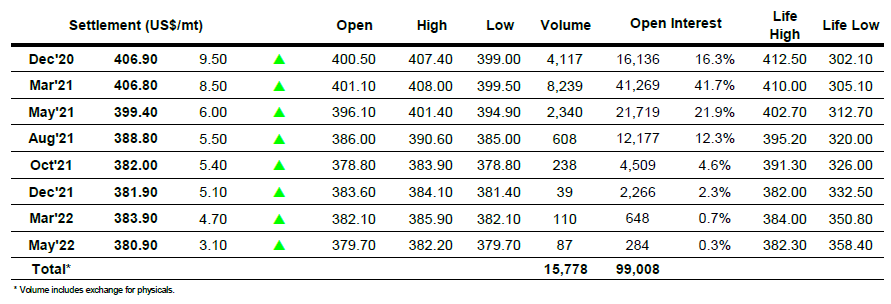

In recent days the market has proved to be contrarian in nature and today proved to be no different as we began the day firmly despite a slightly lower macro world. Most notable during the initial rise was the return of buying to the March’21 spread complex to begin turning around the recent slump with morning activity pushing the March/May’21 back up to 0.78 points while facing little resistance. Outright values meanwhile were seeing a moderate flow of buying to aid the progress and ahead of the US morning prices were consolidating healthily around the 14.80 mark. A surge of spec buying followed soon after to send March’21 to 15.00 however from this point on progress became harder as the higher level naturally drew in the first noteworthy resistance seen on the move, and despite the March/May’21 continuing to be pushed all the way to 0.90 points the outright could still not push through. A correction followed with some long liquidation seen from day traders on route back down to 14.70 however we know that in recent times longs look to protect the close more often than not and today was no different, proving remarkably easy to push March’21 from 14.77 to 14.93 on just 1,200 lots of volume and holding the recovery to see the front month settle at 14.92. This left sugar well clear as the top performer in a now flat macro though we will have to wait and see whether it can lead to a sustained break from the 14.40/15.00 band which has dominated recent weeks.

Dec 20 – Sugar No. 5

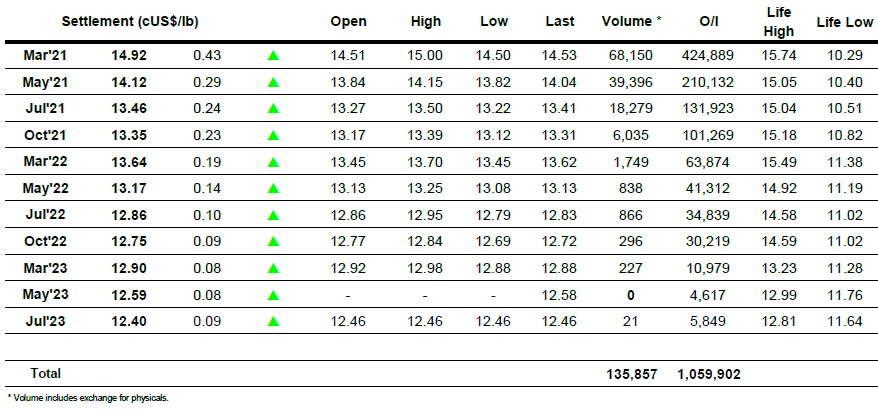

Opening buying sent March’21 immediately above $400.00 this morning in response to an already firm No.11 market though reasons for the move were sparse with a lack of any fresh news. That did not stop prices from forging on upward however to be consolidating around $403.50 by late morning with the environment looking positive once more following the recent wobble lower. Dec’20 meanwhile was keeping pace and finding some solid buying for the Dec’20/March’21 spread which brought the differential back to only a very small discount, showing signs that the receiver is keen to maintain a firm spread into the expiry with the still large OI figure of 16,136 lots suggesting we will see a sizable tender. Further strength was seen as we moved through the early afternoon and the whites premiums rose as nearby values moved to new recent highs, March/March’21 touching $79 for the second successive day while the May/May’21 worked beyond $90. Both the premium values and the outrights then fell back as some long liquidation took place before a choppy final hour saw values pulled back up to ensure positive settlement values at the upper end of the range. Dec’20/March’21 moved back to a small premium against MOC buying to enter its final day of trading positively.

ICE Futures U.S. Sugar No.11 Contract

ICE Europe White Sugar Futures Contract