Sugar #11 Mar ’22

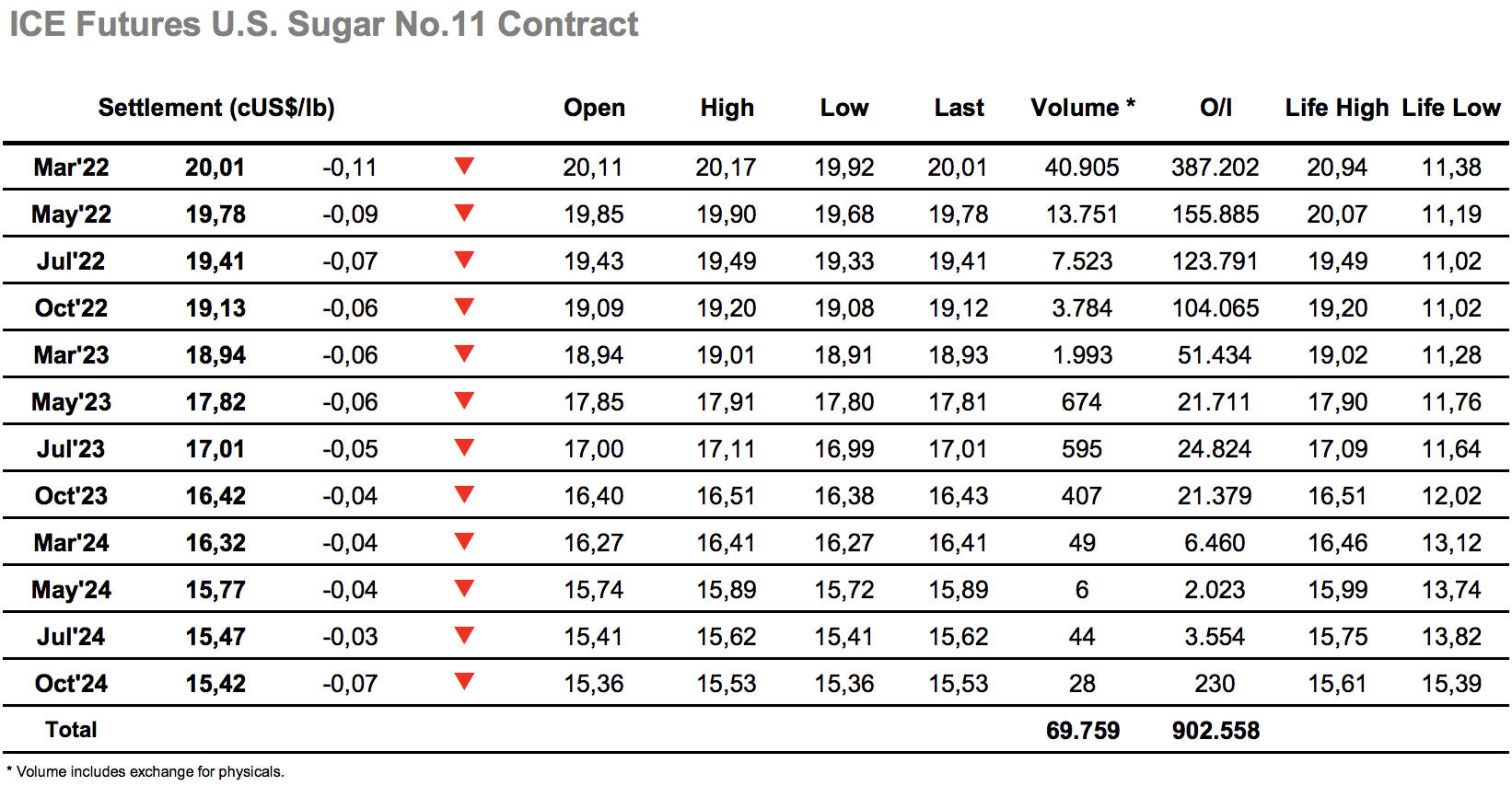

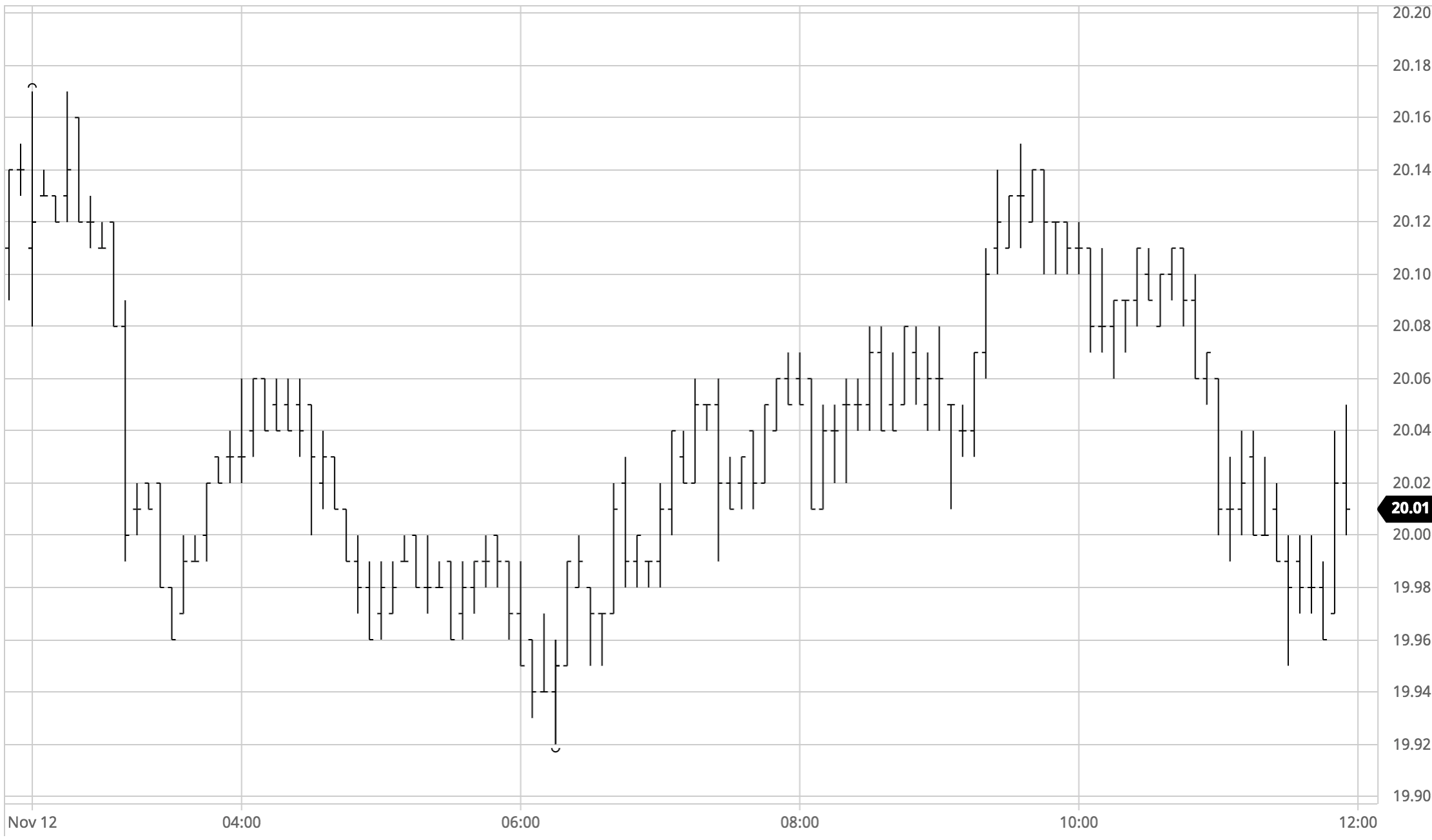

A see-saw week has seen the market swing around within the range based primarily upon macro factors, and while these continue to dominate with coffee in particular bringing strength to the softs sector we have also seen a degree of fundamental based interest from specs based upon the news that India will be increasing the ethanol mix. That opening buying took us a couple of points above yesterdays high to touch 20.17 was therefore to be expected however it failed to garner any follow on interest and before long we saw some profit taking/long liquidation of positions built yesterday, sending March22 back down into the 19.90’s. Activity then calmed and on small volumes the market settled into a dull consolidation pattern either side of 20c which lasted for several hours. With the macro providing mixed signals during the afternoon (coffee strong/CRB firm; energy weaker/USDBRL back to 5.45) the desire from specs appeared more limited/conflicted and though the flat price was able to push back within a couple of points of the morning high the rally petered out and we returned to the lower end an admittedly narrow range during the final hour. March/May22 softened back to 0.21 points during this period to further temper the short term spec aspirations and the week concluded calmly with March’22 settling at 20.01 to shed little clarity as to the next move.

Sugar #5 Mar2

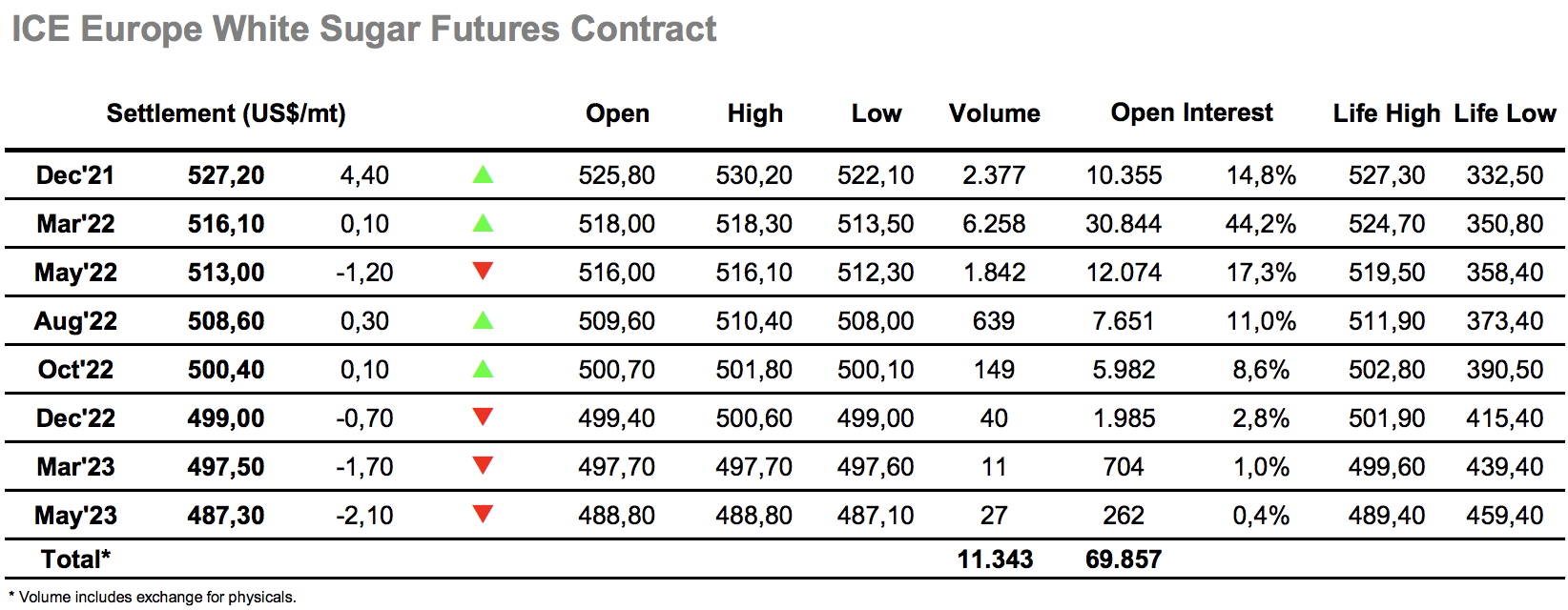

A higher opening was not sustained for March’22 and early trading saw prices a couple of dollars either side of overnight levels with no apparent direction emerging. The same could not be said of the Dec’21 which was resolutely firm once again as the last of the positions from those not wanting to be involved in Monday’s expiry are closed out, printing upward with the Dec’21/March’22 between $7.70 and $10 over the morning. Moving through the middle of the session we saw March’22 easing away from the morning lows however volumes remained light and the flat price lacked the necessary interest to renew the upside in a meaningful way. As such it was the spread that drew most attention despite seeing far lower volume than recent days, widening ever further with sellers suddenly hard to come by. Open interest for Dec’21 remains at 10,355 lots and suggests a sizable tender of mainly Indian sugars based upon todays limited activities with those on the short side standing back as the differential extended all the way to $13.60. March’22 meanwhile saw its afternoon rally peter out just shy of the morning highs and as we reached the closing stages it was trading back in the range at $515.30. Closing activity took March’22 either side of unchanged to end virtually unmoved at $516.10 while Dec’21/March22 heads into its last hurrah valued at $11.10.