Sugar #11 and #5 Mar’22

March NY world sugar #11 (SBH22) on Tuesday closed down -0.26. Dec London white sugar #5 (SWZ21) closed up +2.20 (+0.42%). This comes after sugar prices on Monday rallied to new 4.5 year nearest-futures highs. Strength in WTI crude oil prices gave sugar prices a boost after crude oil climbed to a 7-year high. Higher crude oil prices benefit ethanol prices and are bullish for sugar as strength in ethanol prices may prompt Brazil’s sugar mills to divert more cane crushing toward ethanol production than sugar production, thus reducing sugar supplies. Sugar prices have fallen back from their best levels on weakness in the Brazilian Real against the Dollar. The Real (^USDBRL) now sits at a 5.5 month low against the Dollar, which encourages export selling from Brazil’s sugar producers and is bearish for sugar prices. Sugar has underlying support from the recent damage to Brazil’s sugar crops from frost and drought. The International Sugar Organization (ISO) on Aug 27 raised its global 2021/22 sugar deficit estimate to -3.83 MMT from a May estimate of -2.65 MMT after frost in July damaged Brazil’s sugar crops.

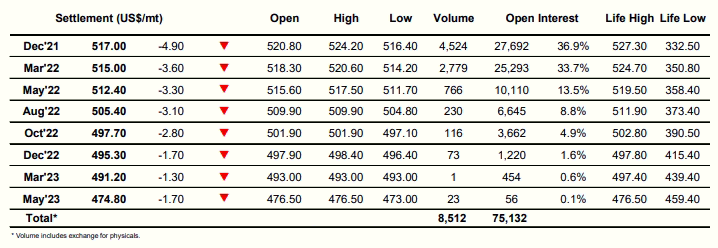

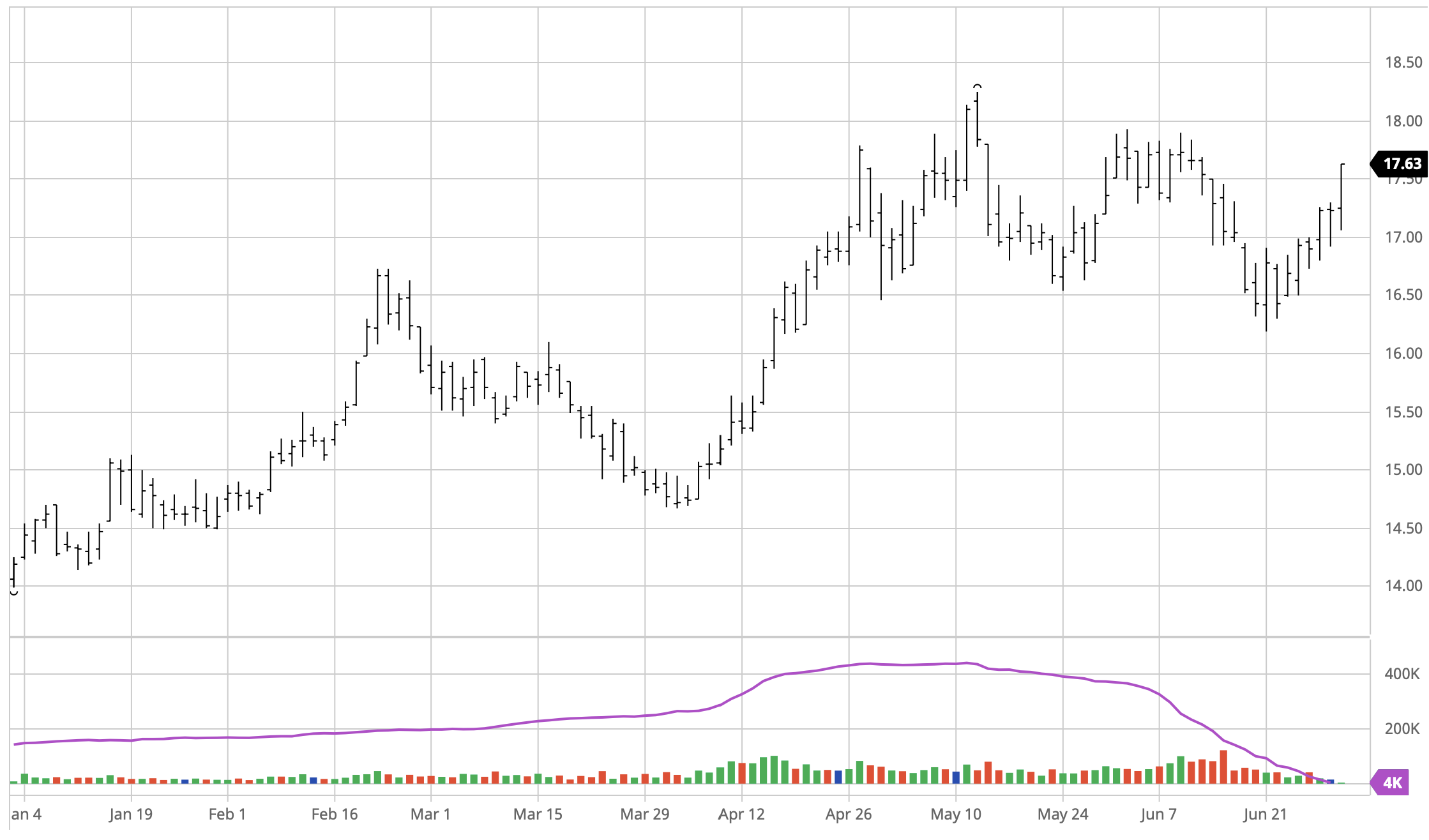

No.11

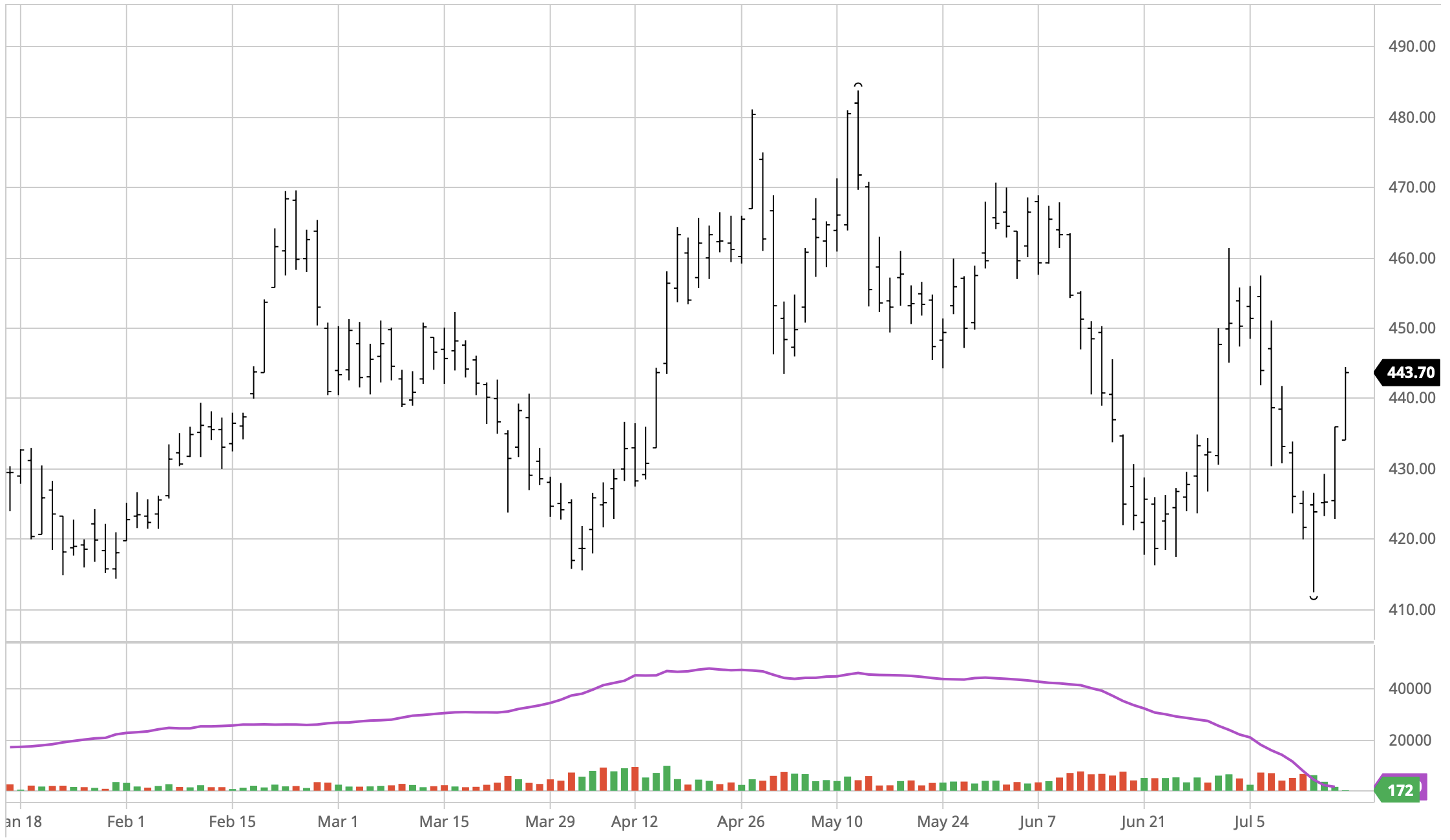

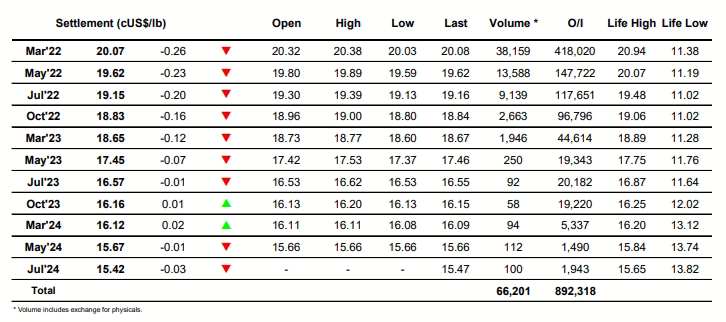

No.5

ICE Futures U.S. Sugar No.11 Contract

ICE Europe Whites Sugar Futures Contract