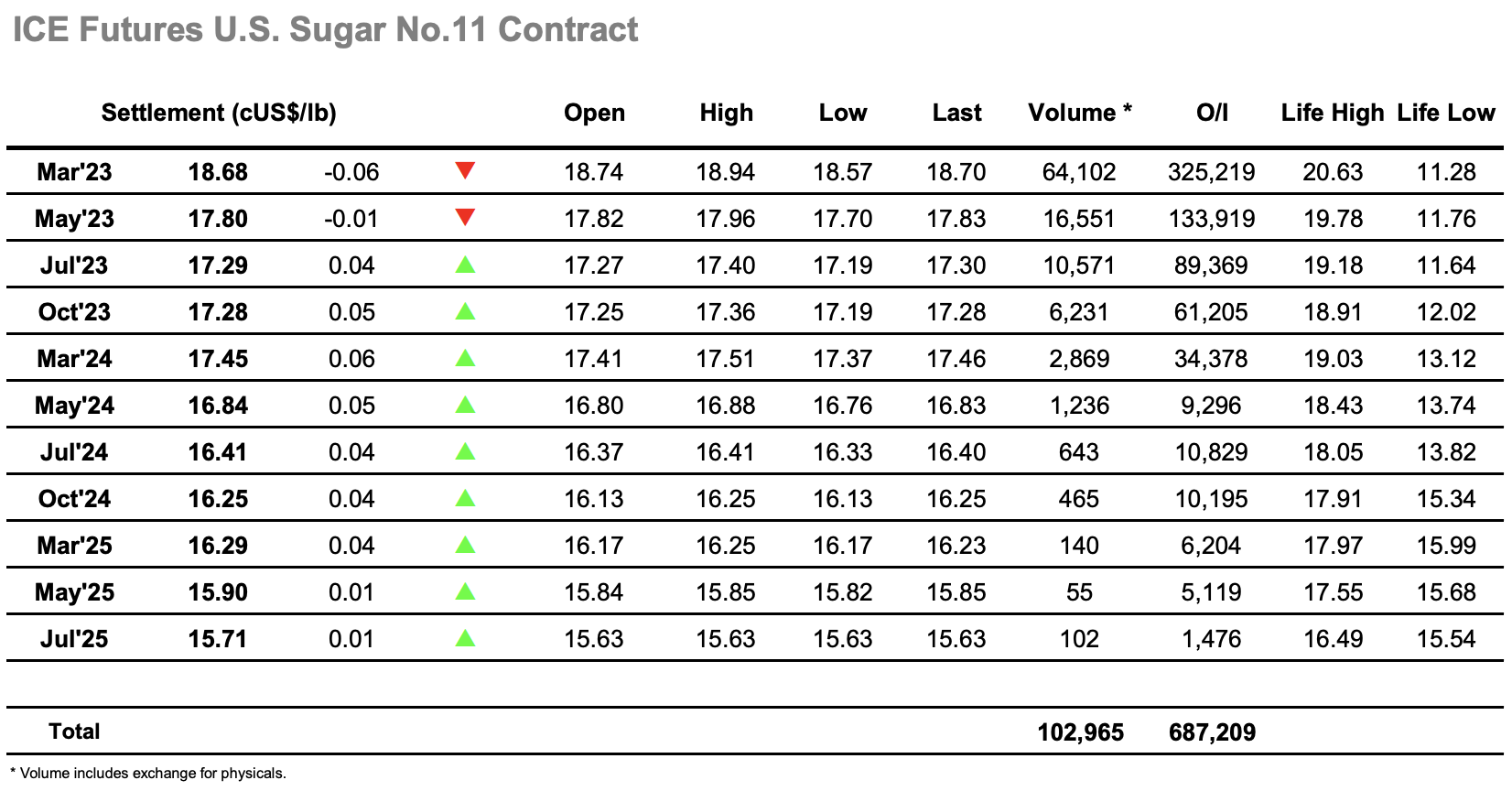

Yesterday’s recovery provided the platform to continue pushing upward this morning, as despite a negative leaning macro we saw a sufficient quantity of spec interest to reach 18.94 by mid-morning. Volume was decent by usual morning standards with the anticipated pick up in scale selling from producers emerging, and this acted as a wall fro0r the rest of the morning, leading to some of the specs to flush back out of longs. As ever some colour arrived with the US morning and a short push back to 18.86 ensued, however there was no follow up interest from the specs and instead prices moved to a consolidation phase either side of 18.80 with longs content to try and hold recent gains to build a more solid foundation from which to work higher. This sideways pattern broke midway through the afternoon with the further weakness of the macro board spooking some of the recent specs longs to liquidate a little more and send March’23 quickly to the lower 18.60’s and new session lows. With few supportive elements from the wider world process continued quietly with side of 18.60 until the closing stages when some defensive buying from recent longs ensured a settlement at 18.68, only moderately lower as they continue to seek an unlikely path higher.

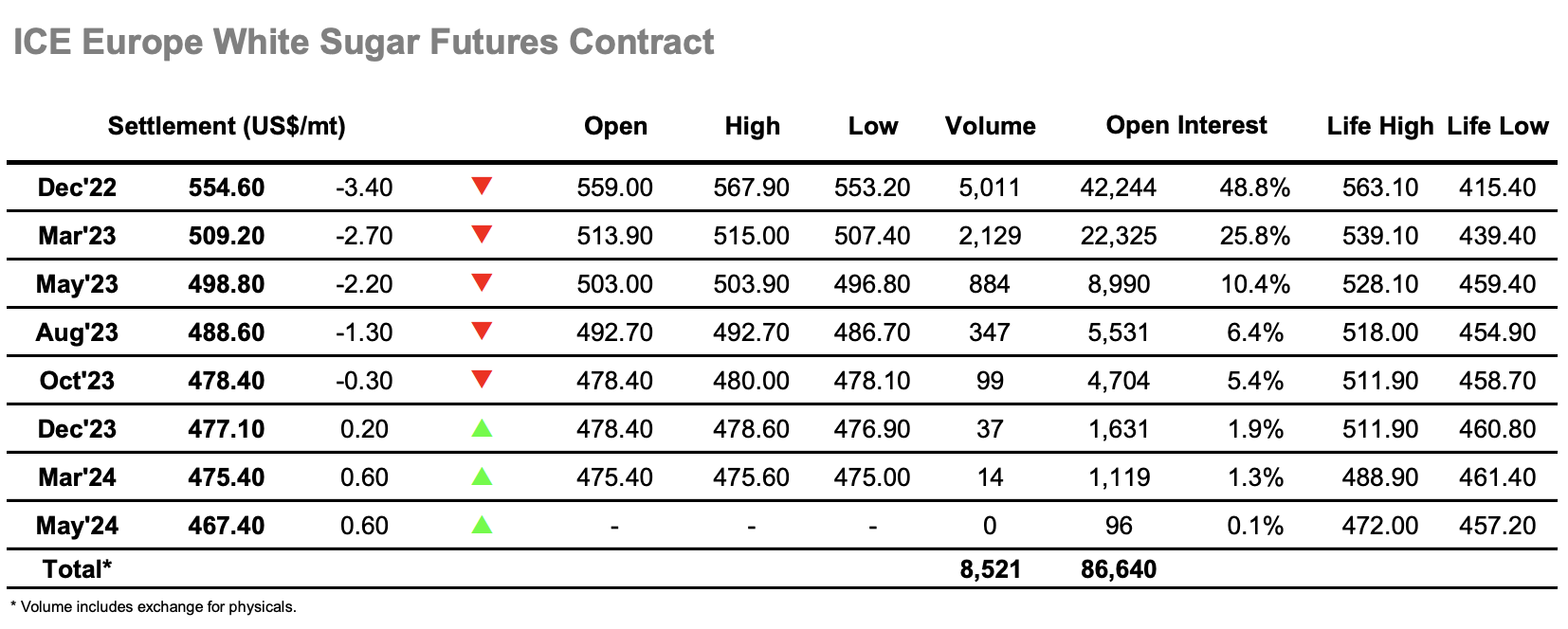

The $40 rise in whites values seen over the past week continues to encourage specs to further capitalise on their significant long holding, none more so than this morning when opening buying led to another life of contract high at $567.90. The situation quickly settled, and the rest of the morning was spent consolidating the lower $560’s on light volumes, leading to some small retraction of white premium values (Dec’22/March’23 below $144 / March/March’23 at $98) but little else. With indicators having moved to overbought and the specs having limited capacity to continue buying the situation remained calm into the afternoon, volumes diminishing with very few new orders appearing within an already thing environment. The wider macro was under increasing pressure as the day wore on and so some light long liquidation which sent the price down to $553.20 was not unexpected, though in the main the specs remain content to continue holding their longs and so once the flurry was concluded prices held just ahead of the lows. A little defensive buying during the closing stages bore little fruit and despite the desire to hold longs a settlement at $554.60 suggests some near term fatigue may be creeping in.