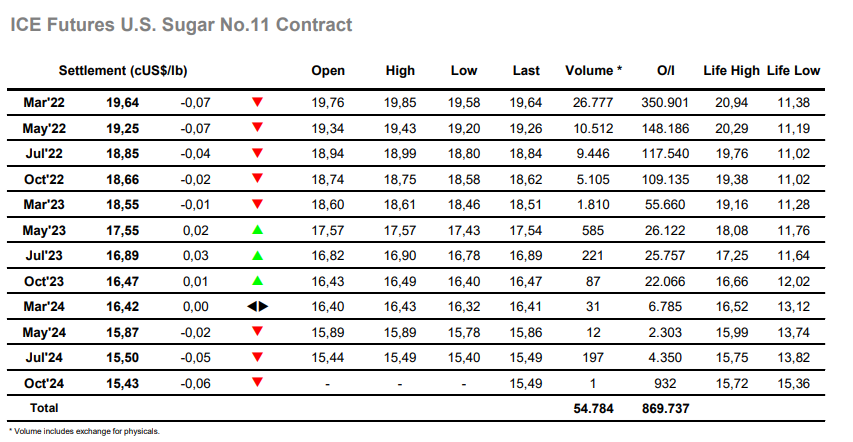

Sugar #11 Mar ’22

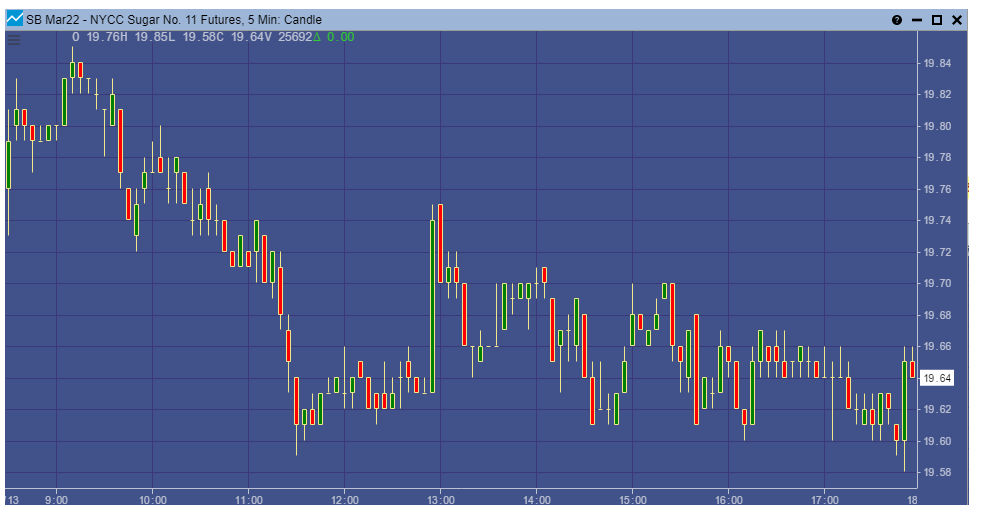

There was some early buying around which enable March’22 to move up to 19.85 however progress quickly stalled with values retreating to spend a period sat in the 19.70’s. On just a small amount of liquidation the market slipped quickly to 19.59 however quiet consolidation followed ahead of the US morning as we held within the same band that has dominated the last few sessions. A small spike back up to 19.75 provided a brief interlude to the otherwise dull conditions however this was very short-lived, and prices retreated to sit rangebound within the 19.60’s. As the afternoon progressed so things became increasingly slow, interest from both sides of the market was minimal while a calmer macro means that spec activity has also considerably reduced. The range tightened up further still during the final couple of hours and it was something of a relief when the close arrived with settlement made at 18.64. Having seen daily highs between 18.84 and 18.90 for each of the last four sessions the recovery seems to have topped out for the time being. Only eight sessions now remain until the Christmas break and while year end can bring some excitement the immediate period may well bring more of this same tedious pattern unless the macro brings fresh news.

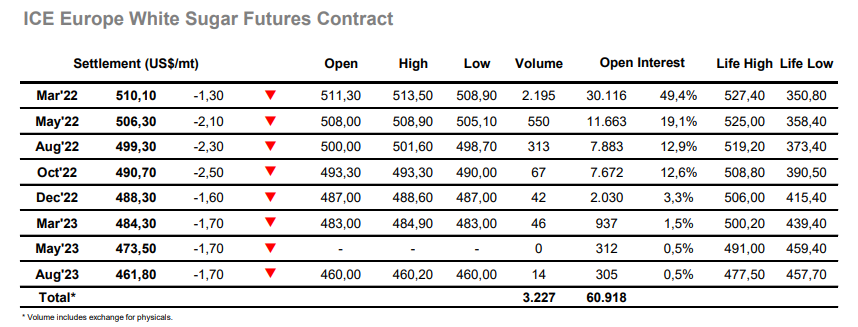

Sugar #5 Mar ’22

The new week commenced with buyers pulling March’22 up by a couple of dollars before easing back to be little changed once the initial interest had concluded. There was little guidance being received from the macro which has settled down in recent days and so it was that sugar continued in a broadly sideways fashion despite extending the range by a couple of dollars in slipping towards $509. With so little flat price movement we were seeing only moderate change for the spreads, while white premiums performed steadily with March/March’22 recovering from a slip during the morning to spend much of the day trading between $76 and $77. The afternoon proved to be less interesting than the morning with prices holding a $2 band at the lower end of the range showing no sign of escape through several hours of uneventful trading. Some MOC buying ensured a March’22 settlement away from the low at $510.10, this concluding a technical inside day which suggests we may see a continuation of the recent calmer trading for the near term.