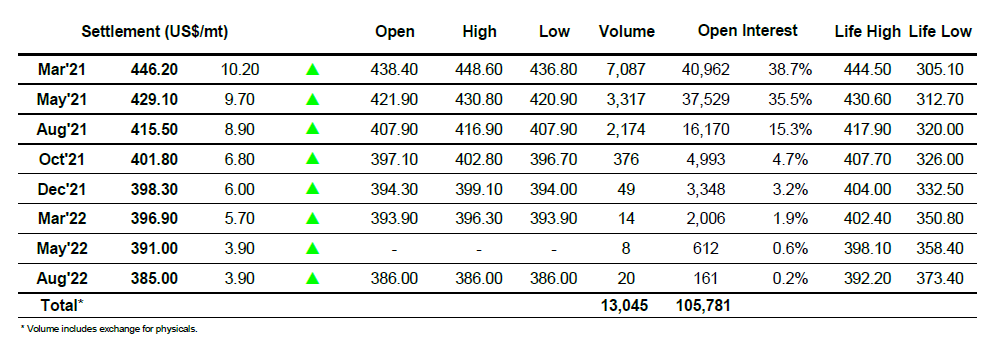

Sugar #11 Mar ’21

There was buying around immediately this morning as overnight hedge lifting combined with some spec support against a firmer macro picture to take March’21 up into the low 15.60’s where a period of consolidation ensued. With the wider commodity basket remaining firm due to a lower dollar index we saw the early afternoon bring a fresh wave of buying to the fore which in two waves sparked March’21 up towards yesterday’s 15.94 high, while the nearby spreads recovered the ground that had been given back yesterday as March/May moved back out to 0.95 points. The move was being aided by the recovery of the BRL which was taking advantage of the USD situation to return back to 5.28 and so reducing the attraction for producers to price, and with only limited selling on show we broke above yesterdays high mark to touch 15.98 before retreating to consolidate a small way below. Market depth showed that the volume of selling in place around 16c was not as big as may have been expected for such a psychological level however having stalled we struggled to mount a fresh push towards this level and instead maintained the consolidation for the rest of the day. There was some MOC buying which ensured that March’21 settled above 15.80, a solid conclusion though we will need to push back above 16c soon if we are not to simply settle into a short term range.

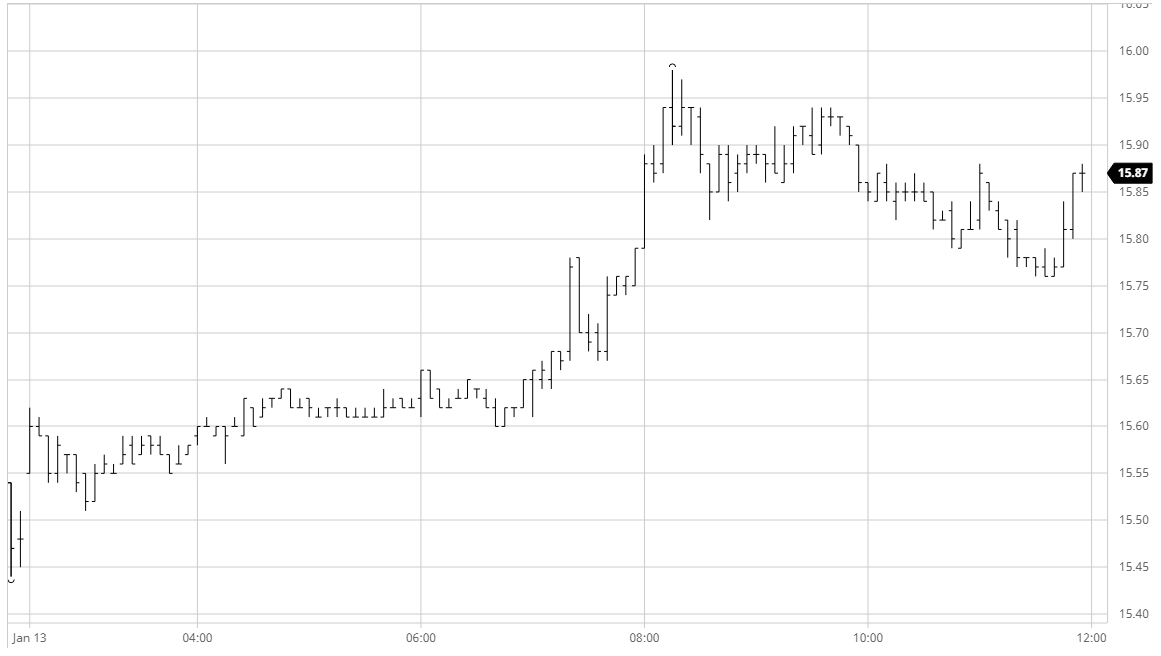

Sugar #5 Mar ’21

Despite a weak conclusion to yesterday’s session we found early support with the lower levels seemingly having brought out some physical interest which combined with a firmer macro picture to take March’21 up to $439.00. This provided the platform from which to put all of last night’s questions behind us and continue building with both spread and outright support aiding March’21 back into the low $440’s by early afternoon. The pace of increase picked up as we moved through the early afternoon to bring the recent highs back into sight and when these were broken there were some light buy stops triggered which sent the front month quickly onward to a high of $448.60 with the March/May’21 spread reaching $18. As with recent sessions the whites were driving the sugar sector, pulling ahead of the No.11 to further widen the white premium values which saw March/March’21 reach $97.50, May/May’21 touching $100 and Aug/Jul’21 nudging into selling at $97. The rally in the premiums is being driven by questions as to the availability of deliverable whites, though should we widen beyond $100 it will surely encourage some refining capacity to be switched on to begin to reduce this issue. While the rest of the afternoon became a calmer affair with prices entering a sideways pattern, they did so above the former contract high and March’21 ended at $446.20 which puts a positive technical gloss on things moving forward, particularly so should the macro environment remain favourable.

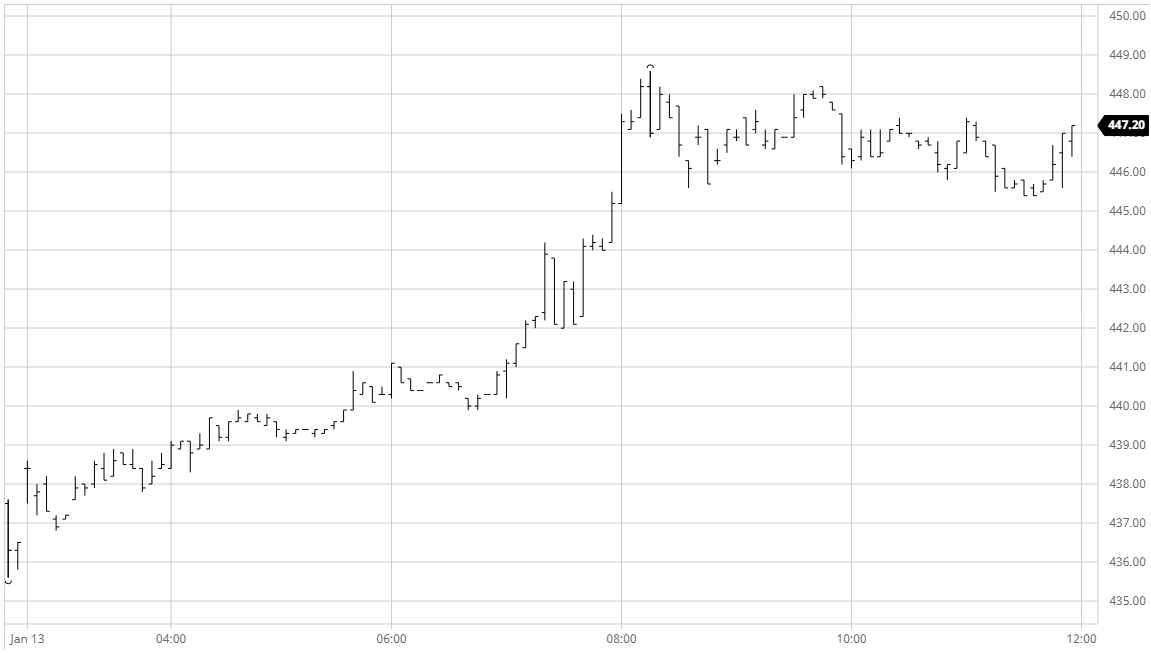

ICE Futures U.S. Sugar No.11 Contract

ICE Europe White Sugar Futures Contract