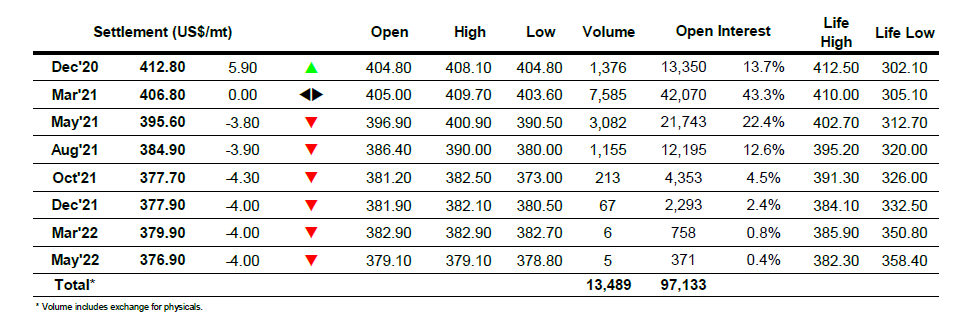

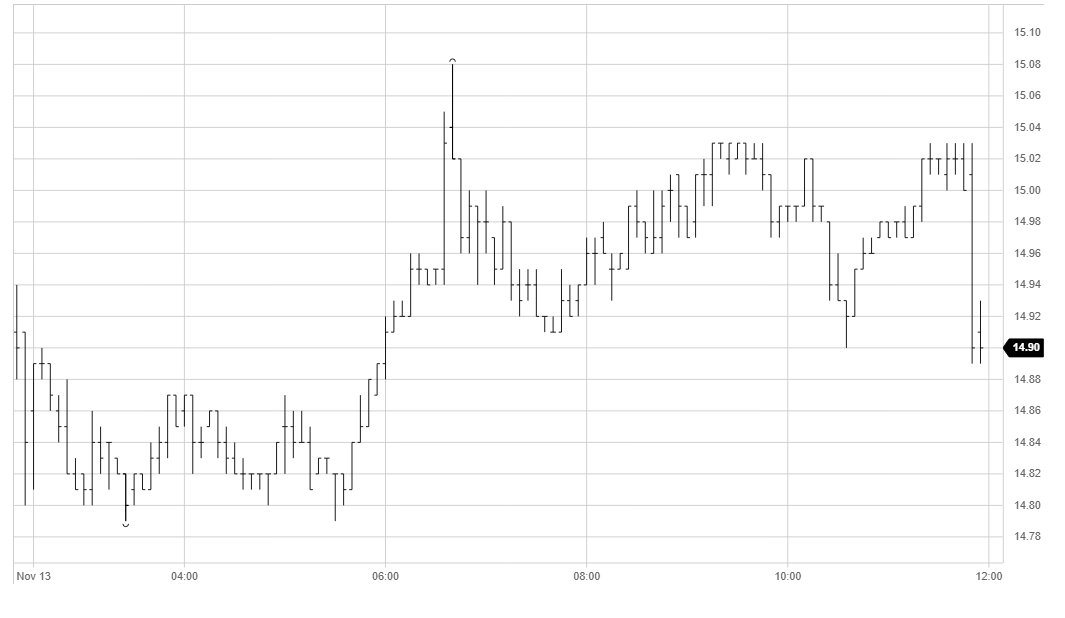

Mar 21 – Sugar No.11

Early trading saw prices retrace back by around 10 point from overnight values with yesterday’s recovery having drawn in some light selling, and in very quiet trading we dribbled along within the 14.80’s for a few hours. Buying emerged ahead of the US morning and provided the impetus to accelerate beyond 15c but like so many recent occasions it lack any sustained continuation and it was not long before prices slipped back into the range. There was continuing support for the Oct’20/March’21 spread which widened back out to 0.88 points however as the flat price waned so too the spread and both re-entered patterns of quiet consolidation. Afternoon trading remained rather calm though we never fell too far from the 15c area for March’21 with the longs keen to maintain the firmer picture for the weekly charts, while there is also the consideration that Monday sees the Dec’20 options expiry and so the 15c strike is liable to remain in play, and maybe even the 14.75 and 15.25 strikes subject to those involved. March’21 ended the day at 14.96 with the failure to settle above 15c maybe disappointing to some as the quest to push out from the range continues into another week.

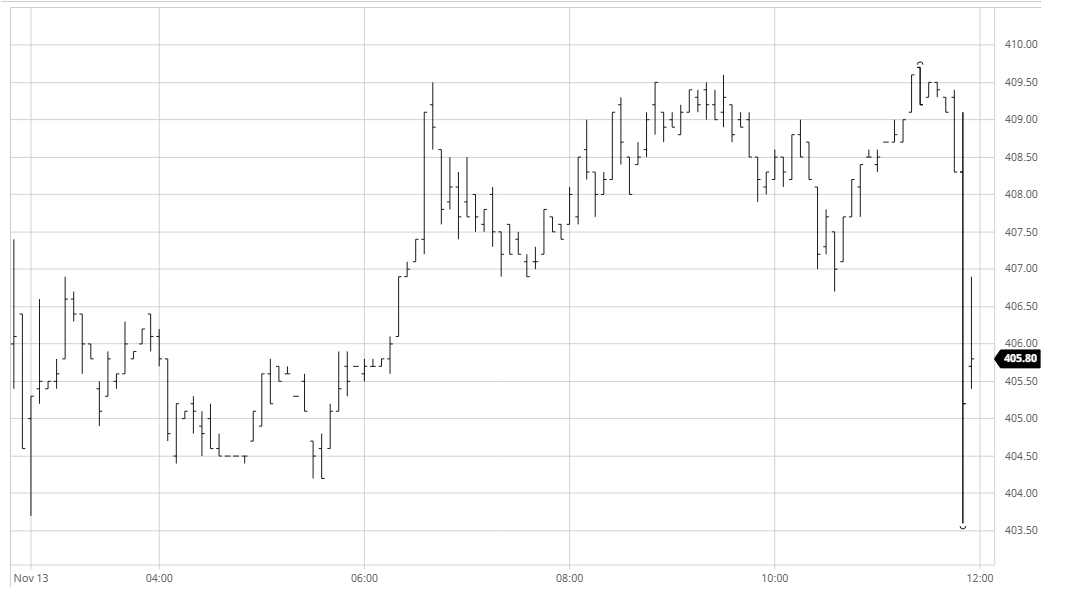

March 21 – Sugar No. 5

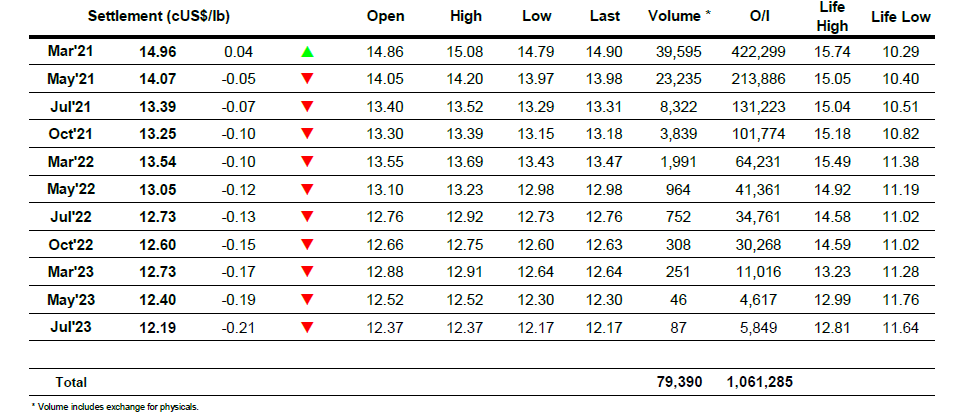

A slow morning saw nearby values looking to consolidate following yesterday’s recovery and on sold volumes we saw March’21 sitting either side of $405.00. Dec’20 was the only exception to this pattern with the final day of trading finding spread buying as receivers look to protect the expiry value, printing the differential up to $4.00 premium over the course of the morning. A mid-session push to new recent highs fell just short of the Feb20 $410.00 high mark for the March’21 contract and with sustained volume still proving impossible to find from both side of the market we disappointingly slipped back into the range. Long holders remained determined to continue pushing and the remainder of the afternoon saw two further attempts higher though on both occasions we stalled just ahead of the same $410.00 area. White premiums were a little calmer after yesterday’s new recent highs with March/March’21 holding around $78 during the afternoon while May/May’21 centred around the $88 area. The close saw some aggressive selling (long liquidation) which from a wide 5 minute band covering virtually the entire days range left March’21 settling at 406.80.Tonight’s Dec’20 expiry has seen a large tender of 12,366 lots (618,300mt) after FDec’s02 March’21 expired at $6.00 premium. Talk is that Tereos, Sucden and Antei are tendering with Man and Wilmar the receivers. Full details will be published by the exchange on Monday.

ICE Futures U.S. Sugar No.11 Contract

ICE Europe White Sugar Futures Contract