Noisy market today, with not many fundamental drivers and low liquidity almost everywhere.

Speculators continued to try to drive the market up on the wake of the recent bullish news. At 8:30 am, a single order of about 1300 lots kicked off the NY trading day, bringing the market to the mid 13.20s, followed by a rather a rather flat market until 10:30. Some spot hedging in between, with some V0 commercial flow seen due to the increasingly better USDBRL rate.

After that, renewed buying pressure brought the market to 13.28, the highest level since March. What happened next looks like a mix of spot hedging and profit realization before the weekend, that without a lot of resistance brought back the market to the lows of 13.06, again prompting a bit more buying from the funds.

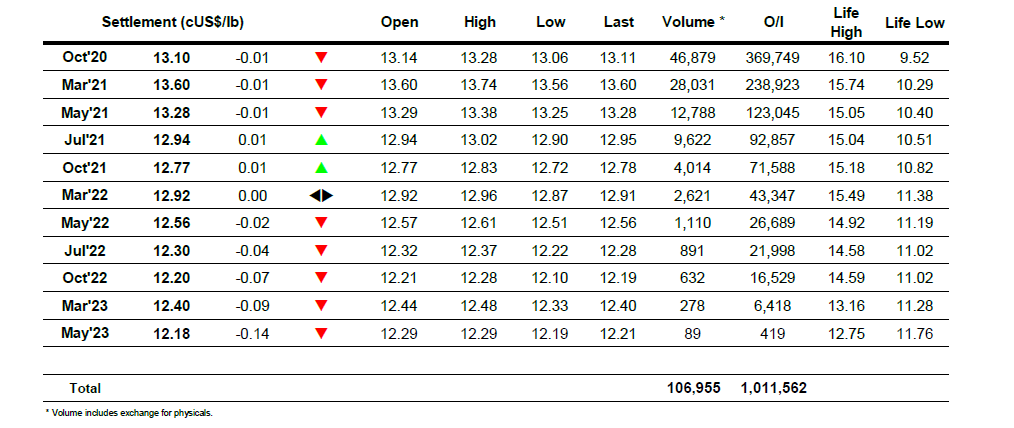

In the end, though, the shorts won. V0 closed at 13.10, 1 pt below previous day settlement price. On the whites, the funds reached a 5-month high bullish position of 25,381 net longs, with the VV0, V0Z0, H1H1 and K1K1 white premiums all going up by more than 1% today.

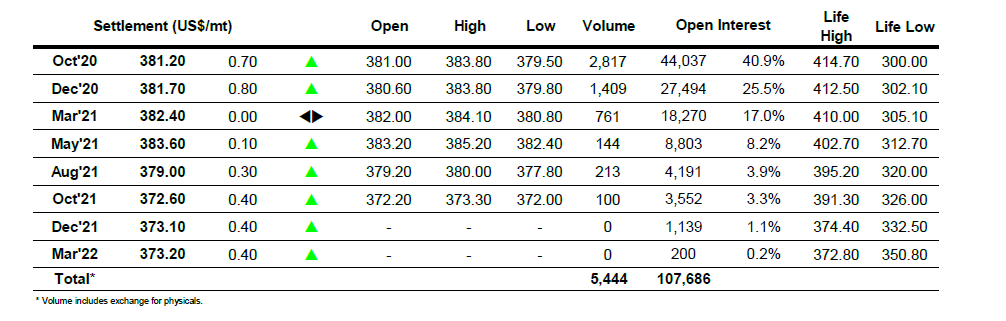

Oct – Sugar No.11

ICE Futures U.S. Sugar No.11 Contract

ICE Europe White Sugar Futures Contract