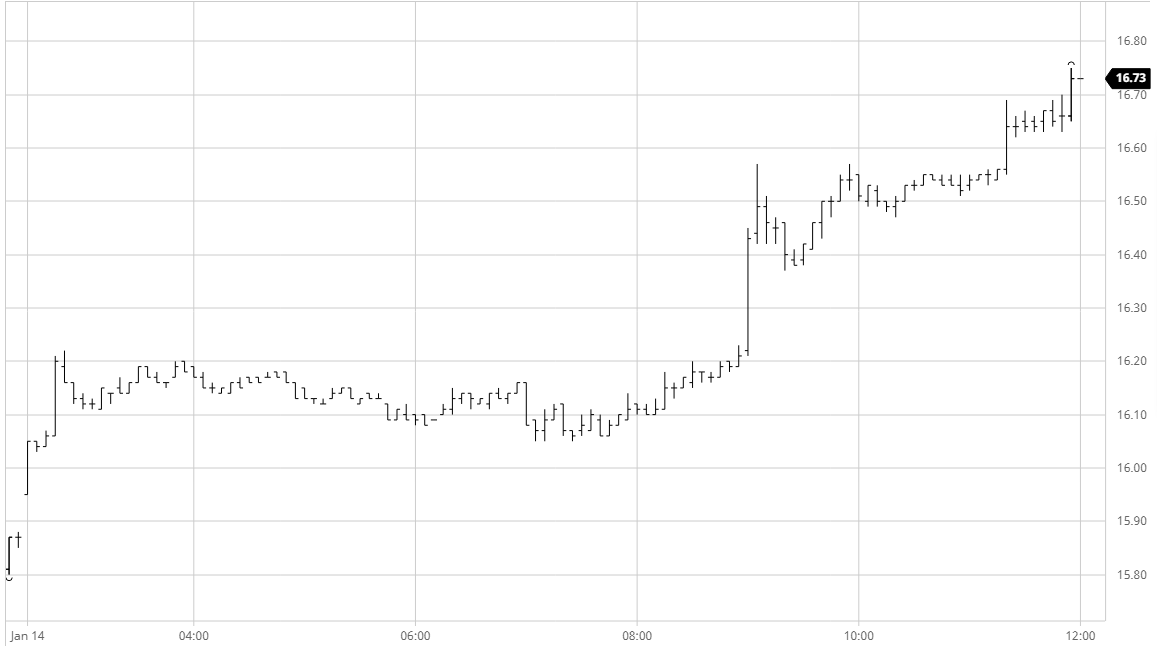

Sugar #11 Mar ’21

There was a need to build upon yesterdays momentum from a technical perspective and the market wasted no time in doing so this morning with moderate early buying pushing through a thin market environment to send March’21 up to 16.22 within the first 25 minutes. Such early gains naturally attracted in some selling interest and this nudged prices back a little from the highs, though with technical strength firmly back in control we did not slide by far, remaining above 16.05 throughout several hours of consolidation. What was becoming quite a slow day was brought back to life midway through the afternoon with a push through the 16.33 contract high that triggered buy stops and brought in a host of fresh buying from specs as March’21 reached 16.57 before again pausing against some profit taking. With such strength now established and surprisingly little producer selling showing up (USDBRL heading back towards 5.20 was clearly having an impact) the specs seized the opportunity to add further to their long positions and as we approached the close March’21 had reached all the way to 16.69 (+85 points). The flat price strength as ever was supportive to the nearby spreads, though maybe not to the extent we would have expected with March/May’21 reaching a widest 1.00 points but ending few points shy of this level though bigger gains were recorded for March/Oct’21 which reached a widest 2.01 points intra-day. There was some profit taking as we moved into the closing call before a final surge sent the March’21 to a new contract high of 16.75 on the post close. This concluded a massively strong performance with sugar sitting a long way clear at the top of a generally steady macro with seemingly the only question being whether we now consolidate and allow more headroom to develop against the RSI and Bollinger bands before looking towards 17c.

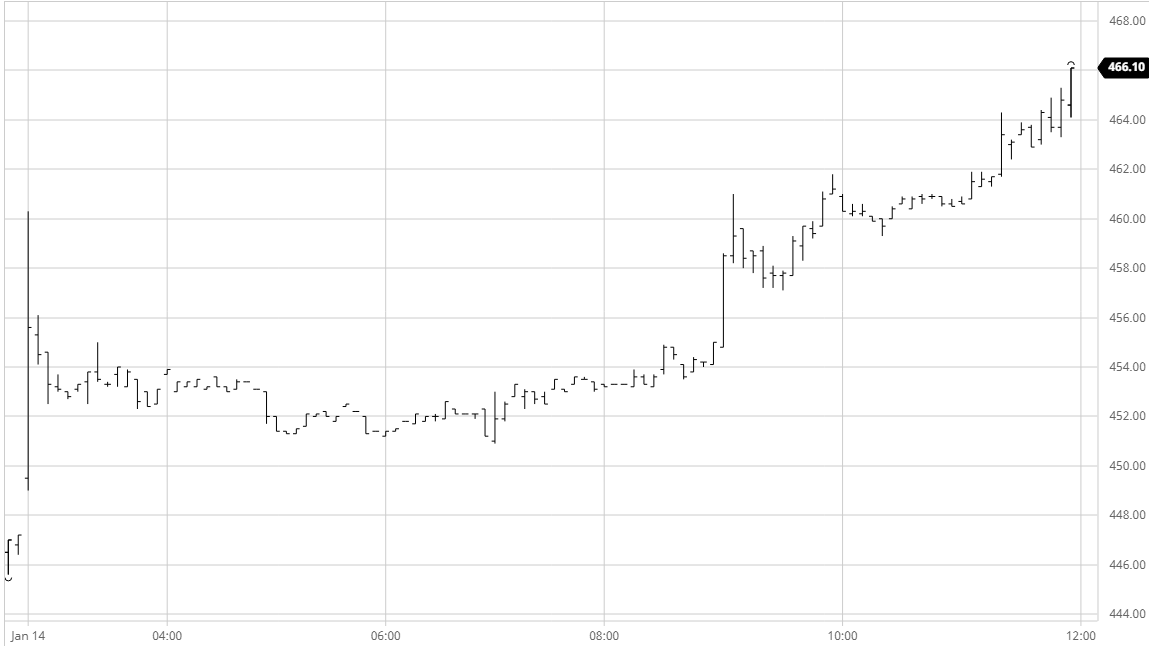

Sugar #5 Mar ’21

An unbelievably strong start to the day saw March’21 gap higher above yesterday’s contract high and run buy stops to immediately reach $460.30, a gain of $14 on settlement price. Some of these gains were given back in an instant however with the market absorbing news of whites imports being agreed by Pakistan (500,000mt) and Indonesia (600,000mt) the underlying remained firm and consolidated in the lower to mid $450’s throughout the morning. Having held so well in positive ground the market started to edge a little higher again during the early afternoon before igniting for a second time in reaction to No.11 buy stops as they also made new contract highs. Despite the wild swings in the flat price the nearby spreads were proving relatively calm as the day progressed, with March/May’21 retreating from its morning spike to $22 and now holding steadily either side of $18. Whites premium values were also now calmer following morning volatility which had seen March/March’21 spike above $102 on the opening, though now holding nearer to $97 while the middles maintained gains at $100 for May/May’21 and $98 for Aug/Jul’21. The hugely impressive technical picture encouraged more buying in and we continued to make new contract highs through the final hour with March settling strongly at $464.40.

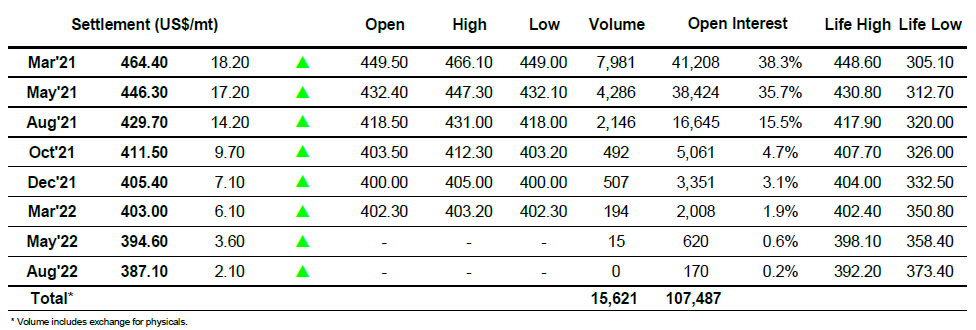

ICE Futures U.S. Sugar No.11 Contract

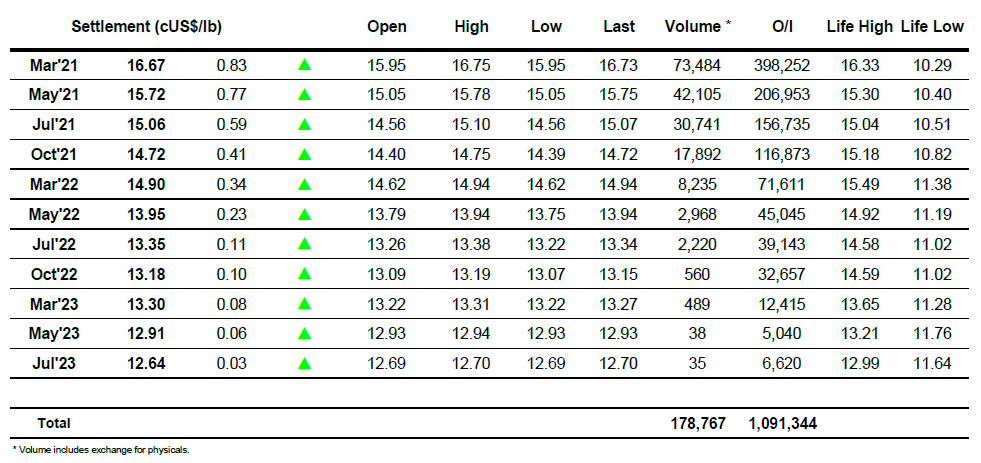

ICE Europe White Sugar Futures Contract