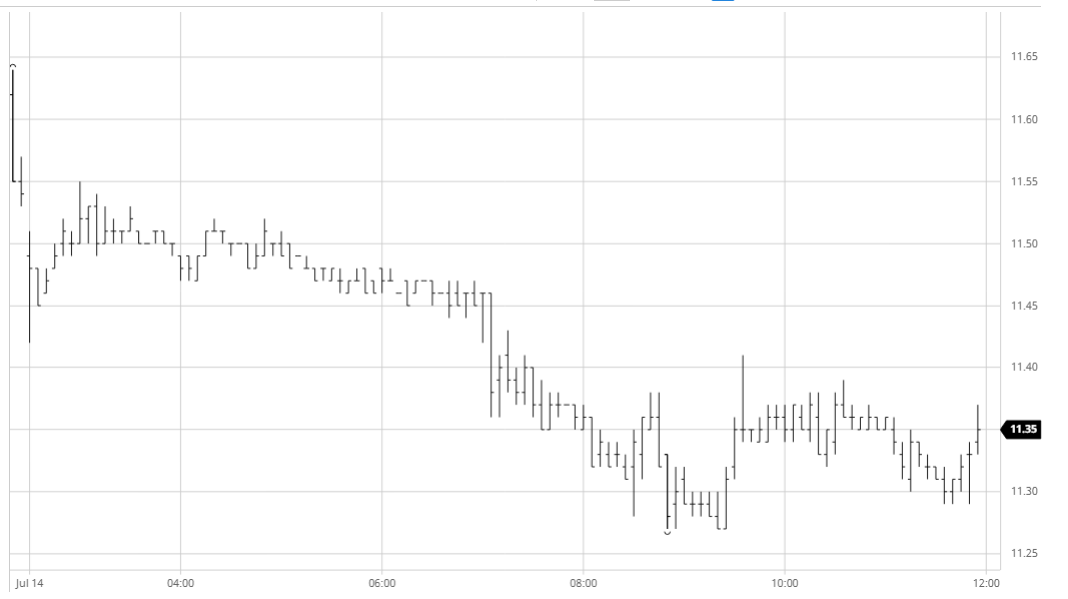

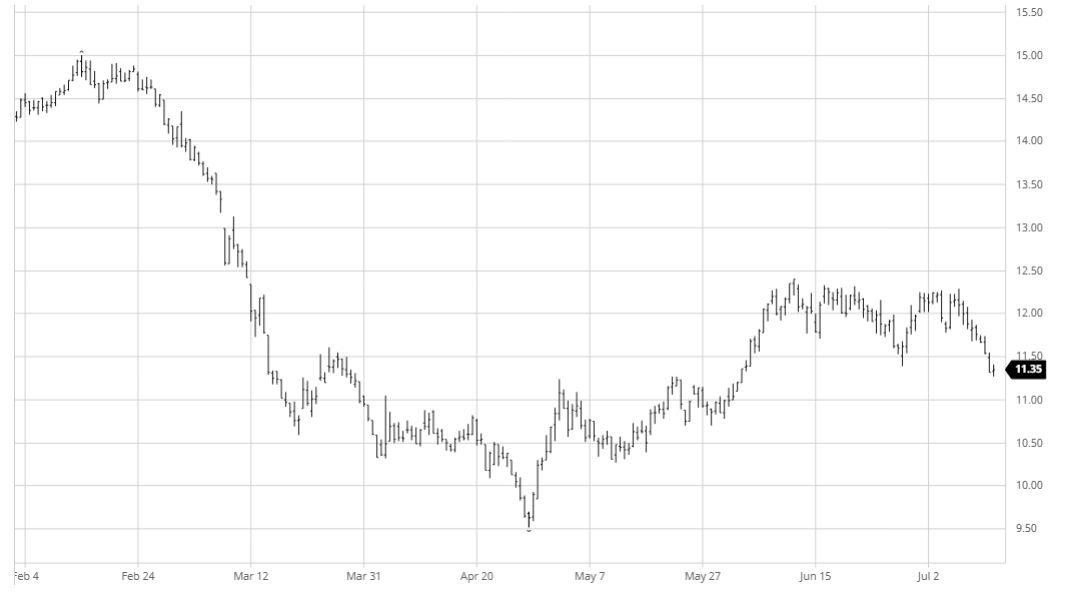

The weak performance yesterday and negative technical potential encouraged selling for the opening which caused Oct’20 to immediately gap lower to 11.42. Buying soon followed which allowed the overnight gap to be closed before the market settled into a range for the rest of the morning on light volumes. The 1pm “US opening” brought with it a burst of spec/algo selling which sent Oct through the 11.40 support level however any fund sell stops were relatively small and with some decent consumer buying starting to emerge the decline became more gradual than may have been anticipated. The following two hours did see the steady erosion take the front month down to 11.27 which matches the next technical point basis highs recorded on 21/22 May however continued scale buying provided sufficient support to prevent values from collapsing. A brief short covering rally lifted the price back to 11.41 however the weakening trend encouraged further spec selling through to the end of the day and we played out the final couple of hours at the lower end of the range. Settlement price at 11.32 is comfortably beneath the six week low of 11.40 and may well encourage more spec long liquidation, potentially pushing further into the consumer scales which reside below.

SB Oct – Sugar No.11

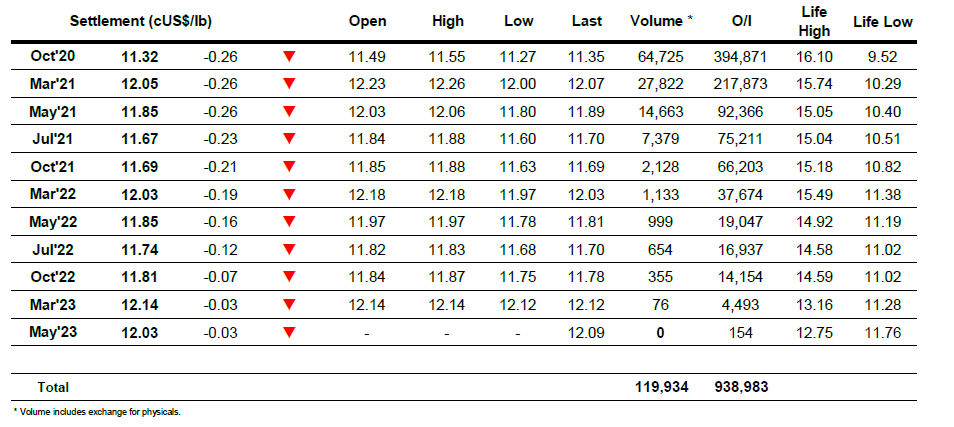

ICE Futures U.S. Sugar No.11 Contract

ICE Europe White Sugar Futures Contract