No.11 Market Summary

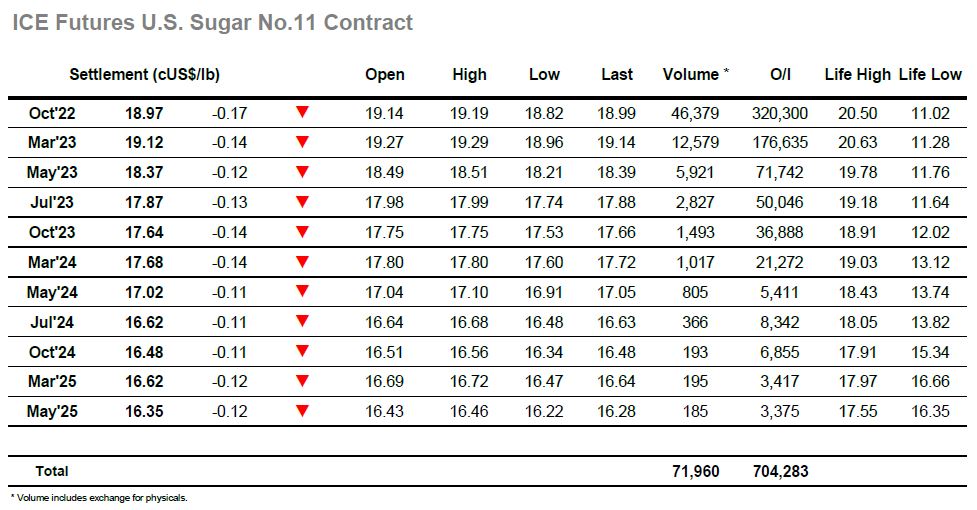

A lethargic opening saw us trading a touch lower in reaction to a weaker macro, and despite a brief pop back up into positive ground at 19.19 the sentiment remained negative to send prices back into the red. Specs appear to be increasingly disinterested with the market now having maintained the same area for a few days in a row and this led the rest of the morning to play out calmly. The arrival of US specs brought no immediate impetus, and it was only the growing losses across the wider commodity spectrum that drew in some selling to force Oct’22 down to 18.82 and expand the range. Spread volumes were low and with the range established and an inside day certain the final few hours played out tediously. Reaching the close Oct’22 made unsuccessful efforts to claw back above 19.00 but fell short to settle at 18.97, the dull environment suggesting that without significant outside influence we could see similar quiet trading ahead.

Whites Market Summary

The day began on a solid footing however progress became more difficult above $550 for the Oct’22 contract and so things settled down into a range centred around the upper $540’s. Other commodities were performing poorly and so the resilience of our own market was quite impressive, though there can be little doubt that the continuing strength of the Aug’22 contract was a major factor in this. A surge of buying during the morning took Aug/Oct’22 back up above $49 for a brief period, and on thin liquidity the Aug’22 held firm throughout. Moving into the afternoon a new high for the spread was recorded at $50.00, and though it subsequently retreated from this mark the resit of the day played out above $40 as we seem set to remain firm into the expiry. Oct’22 managed to scoop itself up from an afternoon dip to remain near to $550 while the Oct’22 white premium was trading above $132.00, and despite the macro showing a sea of red concluded the session positively at $551.10 as the positive Aug’22 expiry sentiment continues to filter down.