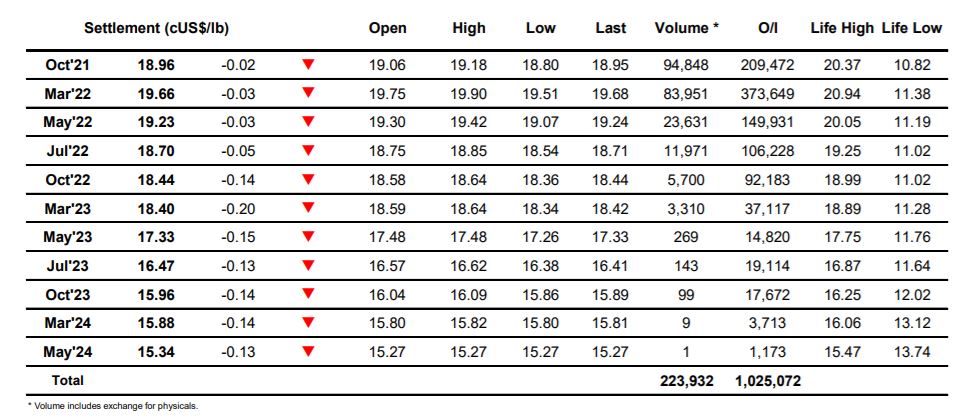

Sugar #11 Oct’21

With the market today seeing the final day of the index roll attention has turned towards the March’22 contract for many and here we started the day positively with a push upward to 19.90 during the early stages, some light spec buying finding assistance from consumers who have pricing remaining to conclude against Oct’21. Topping out ahead of 20c the market then beat a slow retreat back towards unchanged levels over the rest of the morning on low volumes, though this was briefly enlivened midway through the session as a few stops were triggered to spike down to 19.51, potentially the early spec buyers being tipped back out. This failed to yield any kind of reaction and prices soon returned back to consolidate within the range as the spread continued to take centre stage, with more than 50,000 lots again changing hands either side of -0.70 points as the flat price rumbled along quietly. There was no change to the scenario as we reached the close with just some position squaring taking place as March’22 settled marginally lower at 19.66 while the Oct’21/March’22 spread appropriately ended the day at -0.70 points. Overall it was a day which reaffirms the view of continuing broad sideways movement unless we see some news to significantly change the thinking amongst the specs.

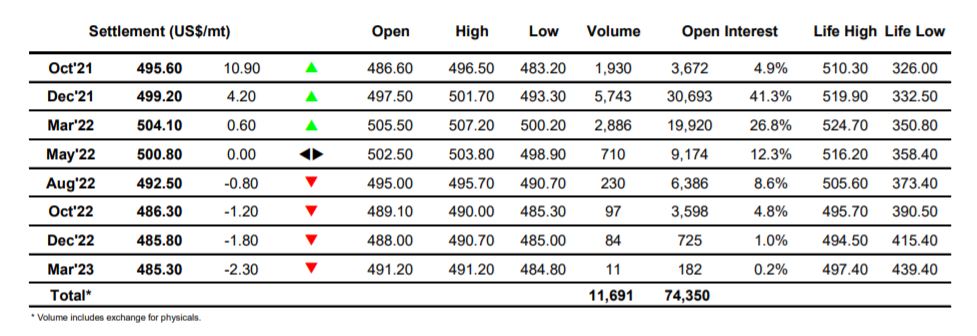

Sugar #5 Dec’21

A buoyant opening saw the whites look to continue last night’s pacy recovery with early buying surging Dec’21 upward through $500 during the first 15 minutes and then on to a high at $501.70 soon afterwards. This had the effect of widening out nearby white premium values however with the Oct/Dec’21 finding some selling as the last of the pre-expiry activity takes place the momentum became lost and we instead settled into a quiet sideways pattern, albeit one that held onto the bulk of the gains. With the US morning approaching the market lost a little of its shine and briefly dipped into negative ground however a degree of buying from consumers was uncovered on the dip and the price soon returned to positive ground where it held through the afternoon without threatening the morning high. Throughout the day we again saw Oct/Dec’21 continue its rapid ascent with those on the receiving side of the forthcoming tender seemingly intent upon ensuring a strong conclusion, picking things up following a dip to -$13.00 in the morning to trade all the way up to -$2.10 later in the afternoon. The flat price appeared set to end comfortably toward the centre of the range until some MOC buying emerged, instead providing a positive conclusion as Dec’21 settled at 499.20.

ICE Futures U.S. Sugar No.11 Contract

ICE Europe Whites Sugar Futures Contract