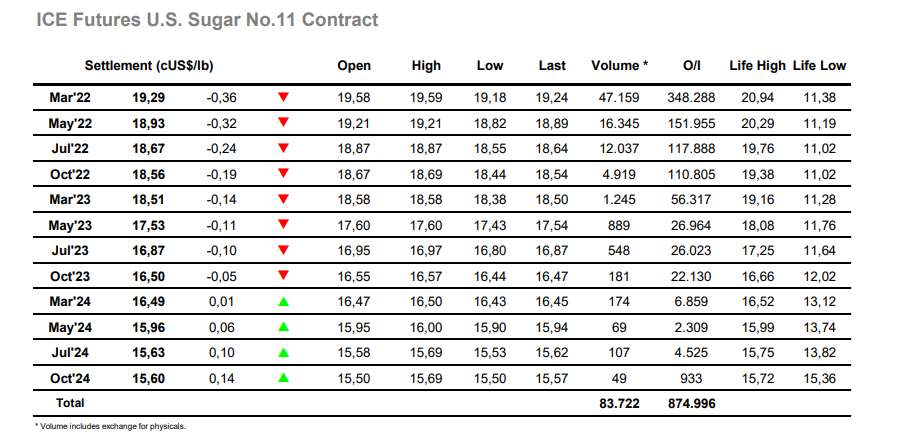

Sugar #11 Mar ’22

A slightly lower macro drew some selling for the opening and having registered a small gap lower the decline quickly gathered pace with some recent longs possibly adding to the momentum with liquidation as March’22 slipped to 19.43. Some small interest from consumer scales started to emerge at these lower levels and though there was a small extension down to 19.38 soon afterward the buying was sufficient to support prices sideways for the duration of a quiet morning. The start of the US-day initially brought no other fresh interest however as the afternoon wore on, so the market made additional losses, filling in some of the scales to record a low at 19.18. Spreads were a touch weaker as one would expect on such a front month driven move, though finding support from the mid 0.30’s the March/May’22 actually performed reasonably well in the circumstances. Despite the growing macro weakness and continuing “covid concern” which hangs over all markets right now, the move felt in many ways to be a shake out of recently added spec longs, the succession of failures around 19.80 in recent sessions likely having already flagged concerns which made it somewhat easier to close out and call things quits for the moment. Values held away from the lows as we reached the call, a calm end to the day seeing March’22 settle at 19.29.

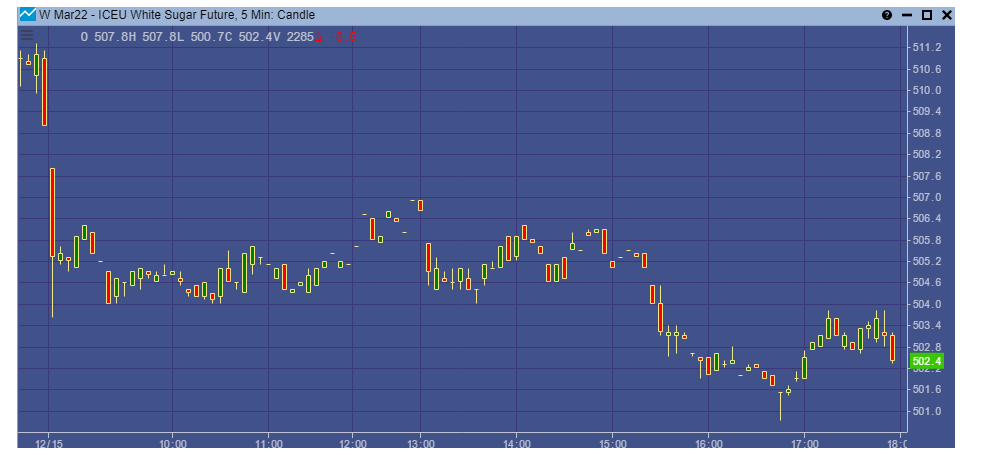

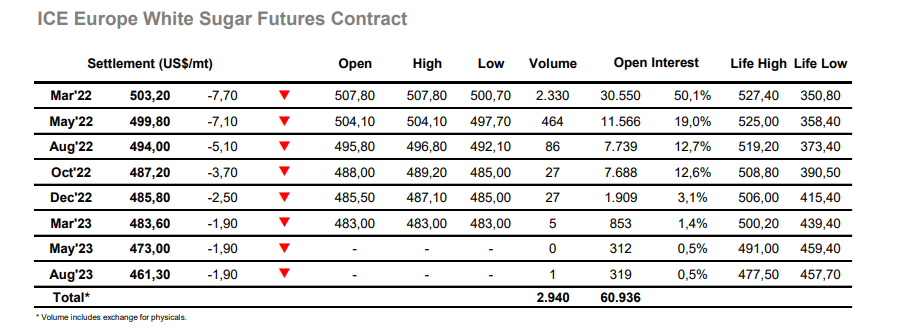

Sugar #5 Mar ’22

A weaker macro environment discouraged buyers from the market this morning and it was this which led prices to gap lower on the opening with March’22 slipping by more than $7 from overnight levels on just 300 lots. Some light buying interest did then emerge from the shadows however market orders were few and far between with the majority of the interest sat beneath on scale orders. A sideways pattern ensued for several hours and aside from a flicker upward early in the afternoon the price did not stray far from the $505 area. The whole of the macro picture was now painted red and with no sign of mounting a comeback the market extended the range lower still to $500.70 before recovering by a couple of dollars on position squaring. Volume outside of the spot month was virtually non-existent today, a mere 183 lots March/May’22 spread traded by way of example, and when a much welcomed close arrived the flat price was still holding a short way above the lows. We ended in calm fashion with March’22 settling at $503.20 while the March/March’22 white premium was touching $78 to continue its recent steady climb upward.