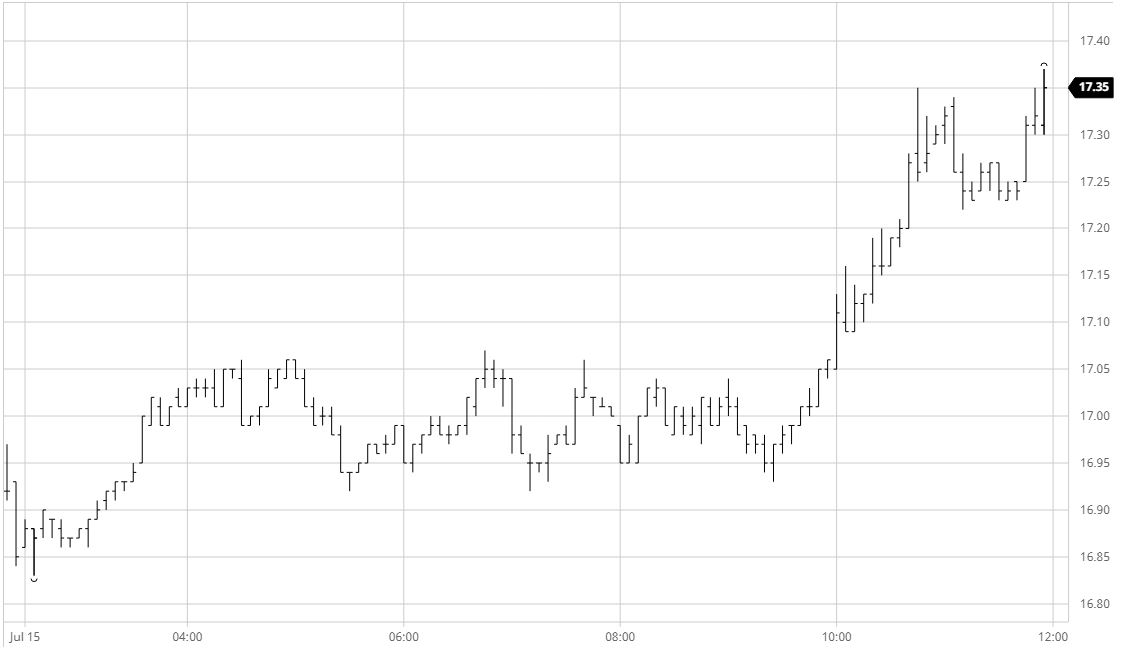

Sugar #11 Oct’21

A marginally lower start to the day was soon forgotten and with underlying scale buying encouraging day traders to look from the long side Oct’21 edged up to consolidate in the 17c area where we remained throughout a low volume morning. There was little change to this scenario during the afternoon with the US morning failing to generate any fresh interest and continuing sideways it felt as though we may as well have closed the market such was the complete lack of interest. The situation changed however during the final couple of hours as from nowhere we found prices begin to push higher with specs/day traders exploring what could be achieved given the lack of any significant overhead selling. Algo interest peaked as the move gathered momentum and in a complete shift we suddenly found Oct’21 trading above yesterday’s 17.25 high with more than an hour of trading still remaining. Naturally there was a pause as some position squaring / profit taking took place but those who had remained committed to their longs had saved some buying for the close, taking Oct’21 back up to settle at 17.33 with a new daily high 17.37 recorded on the post close. Overall a positive day which will please the bulls as we appear increasingly to be building a base from which they can in time look higher once again.

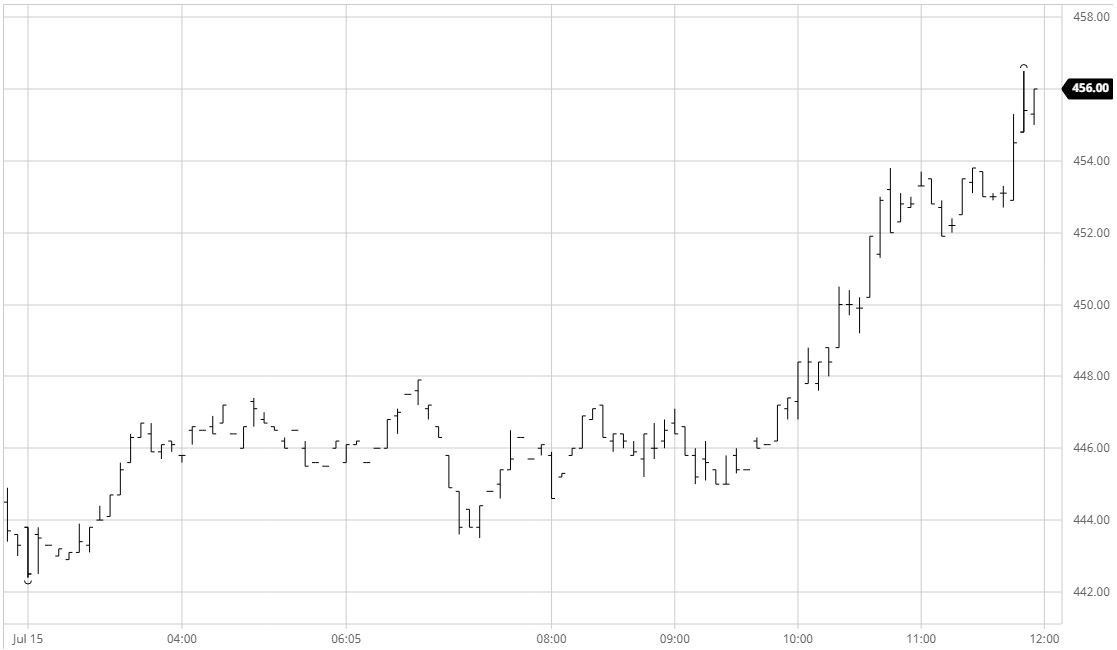

Sugar #5 Oct’21

A slightly lower opening encountered sufficient support from scale buying that the market soon began to push upwards with Oct’21 rallying to the $446 area before settling in to a period of quiet consolidation. Volume was incredibly low and with the Aug/Oct’21 spread also increasingly quiet as the Aug’21 Open Interest has reduced to just 2,147 lots with two days remaining until expiry we continued along sideways until the final couple of hours. It was at this stage we saw the situation change with the market finding some spec interest which accelerated the price through $450 to consolidate in the are of yesterdays highs. Not content to let things rest here the market found a second buying wave during the closing stages which sent us all the way to $456.50 and in the process extended the white premium back above $73 to recoup some of the ground given back yesterday. The strong conclusion left Oct’21 settling positively at $456.00 and following three consecutive daily lows between $443.00 and $442.00 it feels as though something of a bottom has been established.

White premium values ended right around session highs having recovered yesterday’s losses, settling for Oct/Oct’21 at $73.90, March/March’22 at $78.30 and May/May’22 at $88.70

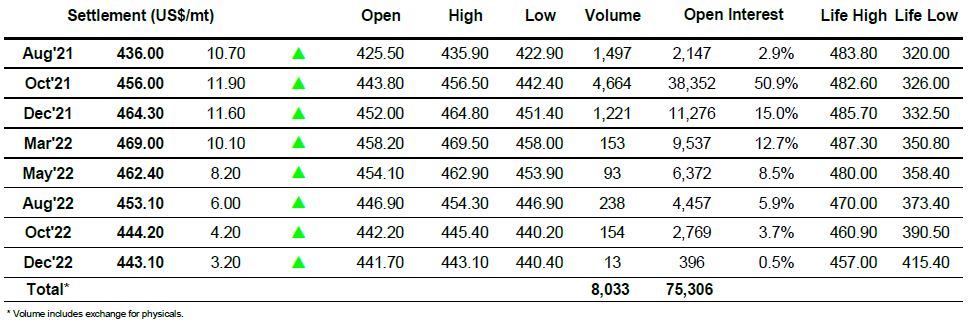

ICE Futures U.S. Sugar No.11 Contract

ICE Europe Whites Sugar Futures Contract