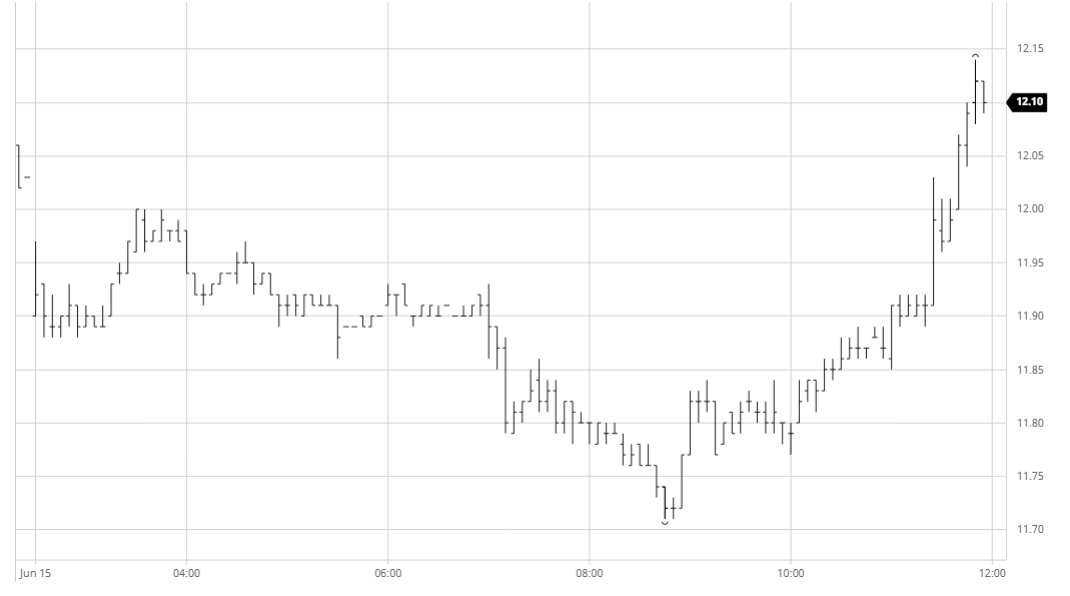

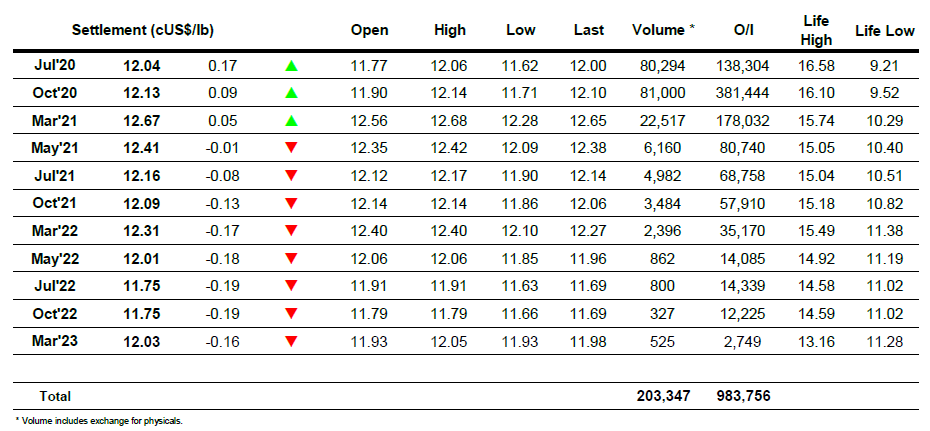

Macro weakness set the market off on a negative footing, encouraging some early selling which sent Oct’20 down to 11.88 during the early stages. Relatively speaking this still represented a reasonable start given that crude was showing the largest losses of all commodities, and the situation remained stable throughout the rest of the morning with prices tracking a narrow range. A significantly weaker USDBRL opening at around 5.14 brought some fresh selling into the market to break this stalemate and send Oct’20 on a path down to a session low of 11.71, however with both equities and the wider commodity world now showing signs of recovery some buying interest emerged to pull back into the range. Remarkably this set the tone to continue on to new session highs and we moved back above 12c during the final hour to virtually eradicate the daily losses, specs and algo’s buying against the recovery in the energy sector while also illustration that the BRL has little influence upon proceedings currently with its further weakening to 5.22 seemingly disregarded. This recovery continued into the close ensuring that nearby prompts ended the day in credit, settling at 12.04 (N20) and 12.13 (V20) with the continuing lack of any fundamental consensus likely to mean we remain driven by the macro for the near term.

no.11 Futures oct 20

ICE Futures U.S. Sugar No.11 Contract

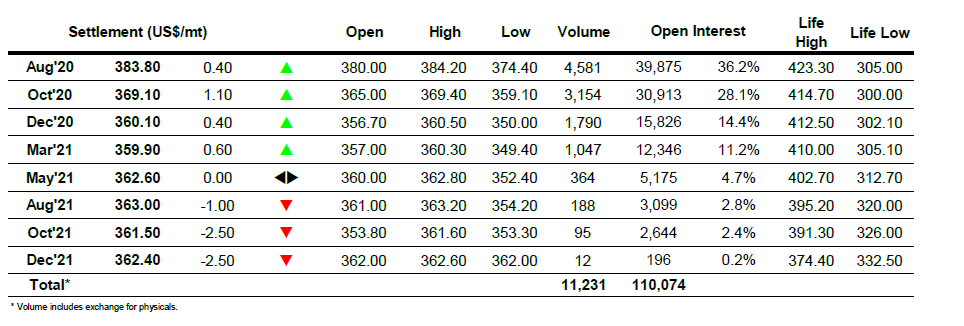

ICE Europe White Sugar Futures Contract