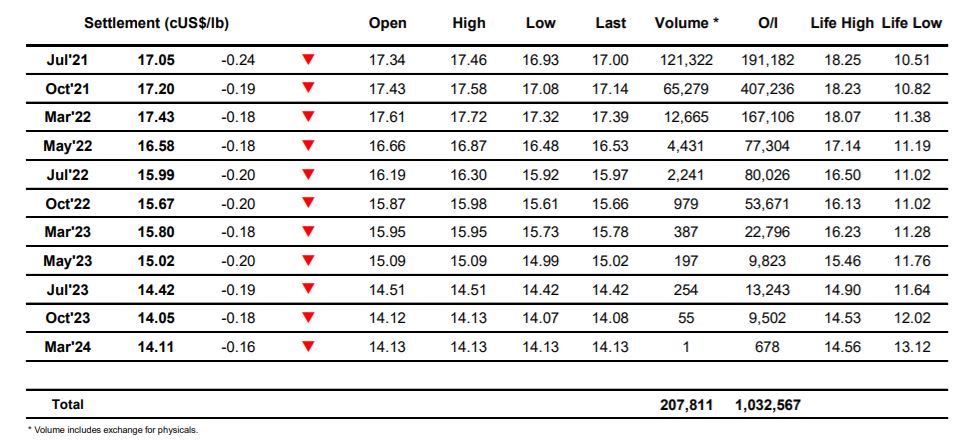

Sugar #11 Jul’21

The market has seen a good deal of intra-day volatility in recent times and today was no exception to that with initial higher values erased as sellers sent Jul’21 back down to 17.03 in quick time. These lows proved to be short-lived with trade/consumer buying in the vicinity of 17c providing a slight uplift from which others began to chase, and in so doing we drew back some spec and algo activity to send values beyond opening levels and reach 17.46 before stalling. Tonight’s Jul’21 option expiry was raising some questions as to which strike would prove the greatest draw at wish to finish and answers began to arrive as the start of the US day drew out some sharp selling to send values back through the relative vacuum and look to the morning lows once again. Scale down hedging continues to be present in this area and it softened the pace of decline though the afternoon as traders became content to allow Jul’21 to edge along near to 17c, and while there was some interest in testing yesterdays 16.93 low mark we merely matched it with the lure of the 17c options drawing the market back on each occasion. Spreads were a touch weaker as would be expected with a lower market and Jul/Oct’21 reached a low at -0.16 points and Oct’21/March’22 -0.25 points intraday. The final hour saw no real change to the outright picture and though some late buying ensured a settlement value at 17.05 the nature of the performance suggests further support testing for the near term as we begin to look toward the Oct’21 for our guidance.

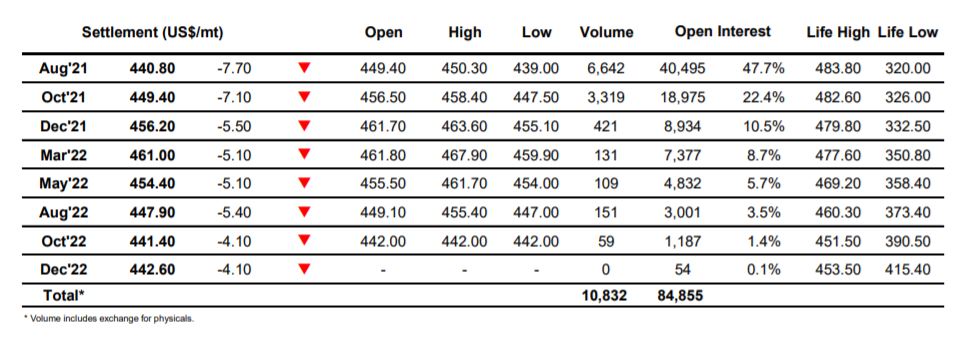

Sugar #5 Aug’21

There was early selling in the market which led to a large chunk of yesterday afternoon’s gains quickly evaporating as Aug’21 traded down to $443.00 within the first 30 minutes before finding some light support. Conditions were relatively thin through the morning and as consumer interest brought the price back away from the lows so some short covering emerged to place values back into credit before noon, action which only creates more uncertainty as to which way the market wants to head in the near term. A period of calm ahead of the US morning was broken by a second wave of selling in reaction to No.11 movement which returned prices to the morning lows at a rapid pace, and though we initially paused as we ran into the scale buy orders on this occasion it was merely a pause before continuing down at a more gentle pace. Spreads were showing no sign of reversing recent losses as Aug/Jul’21 continued in the region of -$8.50 and the slide subsequently took values to new recent lows as we broke beneath yesterday $440.60 mark. Having extended to $439.00 we remained toward the lows as we moved through the closing stages and though there was some buying seen as a few positions were squared away settlement at $440.80 remains on the weak side.

On a calmer day for the white premiums we saw values edge back off again with closing values for Aug/Jul’21 at $64.90, Oct/Oct’21 at $70.20 and March/March’22 at $76.70.

ICE Futures U.S. Sugar No.11 Contract

ICE Europe Whites Sugar Futures Contract