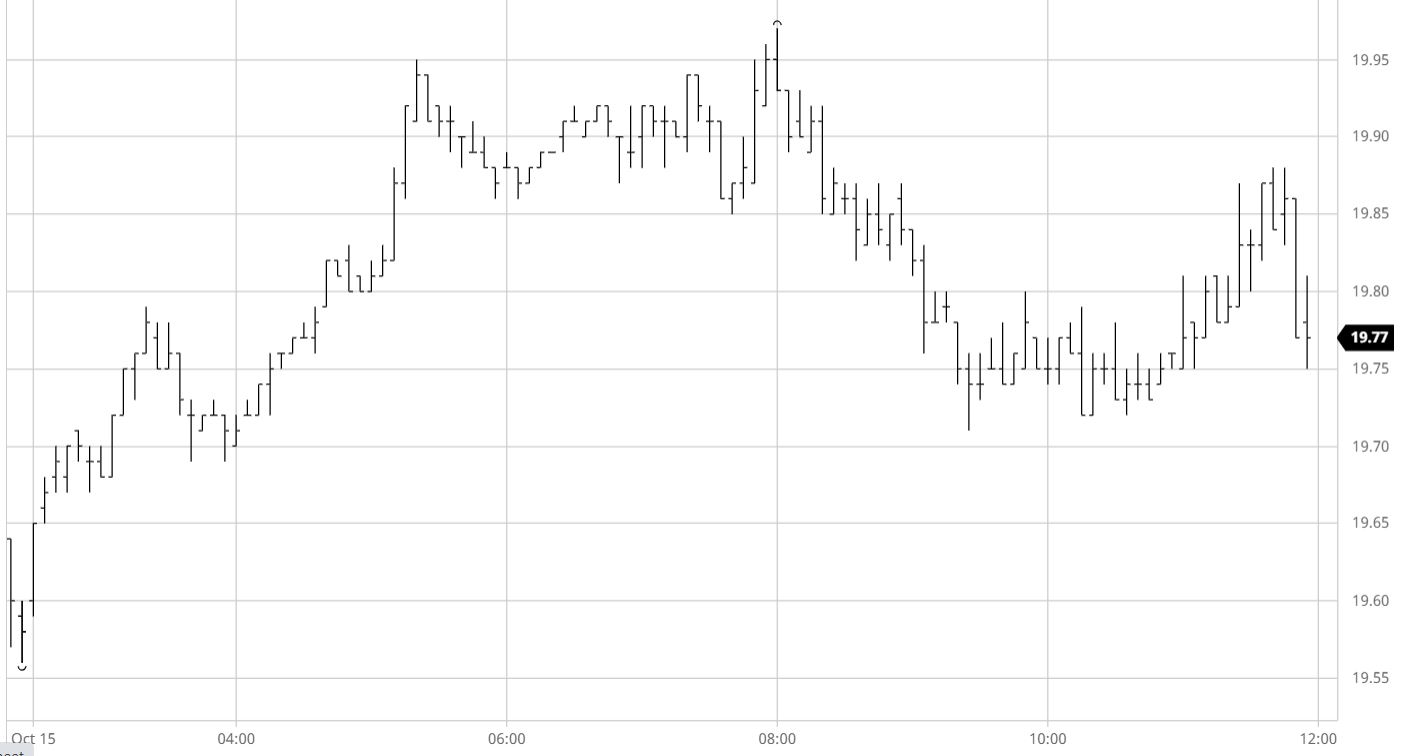

Sugar #11 Mar’22

An unchanged opening soon became a higher market as consumer buying and hedge lifting against fresh sales helped March’22 up into the 19.70’s in a continuing illiquid environment. With the initial requirements covered things calmed for a while however having shown that the previous three days of decline had been stemmed at the bottom of the range once again so some enthusiasm emerged from smaller specs to push a little further upward. The morning push sent March’22 up into the 19.90’s and a second nudge to 19.97 followed during the early afternoon though the enthusiasm then waned having failed to break above 20c and long liquidation followed. Finding prices holding back in the 19.70’s so volume fell away to a minimum, with the market giving the feeling that most participants simply wanted it to close and head into the weekend. The final hour brought a little more buying from specs/day traders however the highs were never challenged and so leaving us resigned to a technical inside day. Pre-weekend liquidation sent March’22 back downward on the call, concluding a quiet day at 19.80 and leaving us no closer to finding a way out of the range.

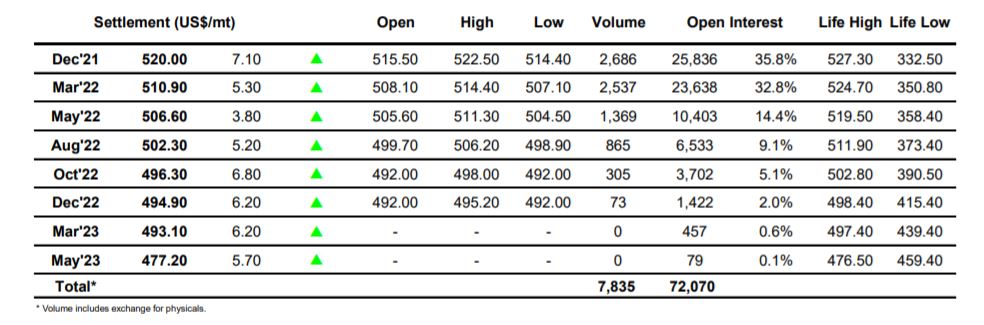

Sugar #5 Dec21

The market opened positively with some supportive buying from consumers and built upon this base to recover all of yesterday’s losses in the next couple of hours as we reached $522.50. This action is in keeping with everything we have seen over recent weeks and though some selling emerged at the higher levels we did not fall back initially with spread buying once again providing the impetus to hold firm. In quiet conditions there was a gradual slide into the range as some very light long liquidation emerged however with Dec’21/March’22 pushing up to $8.40 later in the afternoon the flat price pulled back up to leave Dec’21 in the vicinity of $520 as we approached the close. Some MOC selling appeared (long liquidation?) to send Dec’21 back into the upper teens, though this still ensured a positive settlement value of $520.00 while closing Dec’21/March’22 trades at $9.20 will provide some encouragement to bulls as we look toward next week.

ICE Futures U.S. Sugar No.11 Contract

ICE Europe Whites Sugar Futures Contract