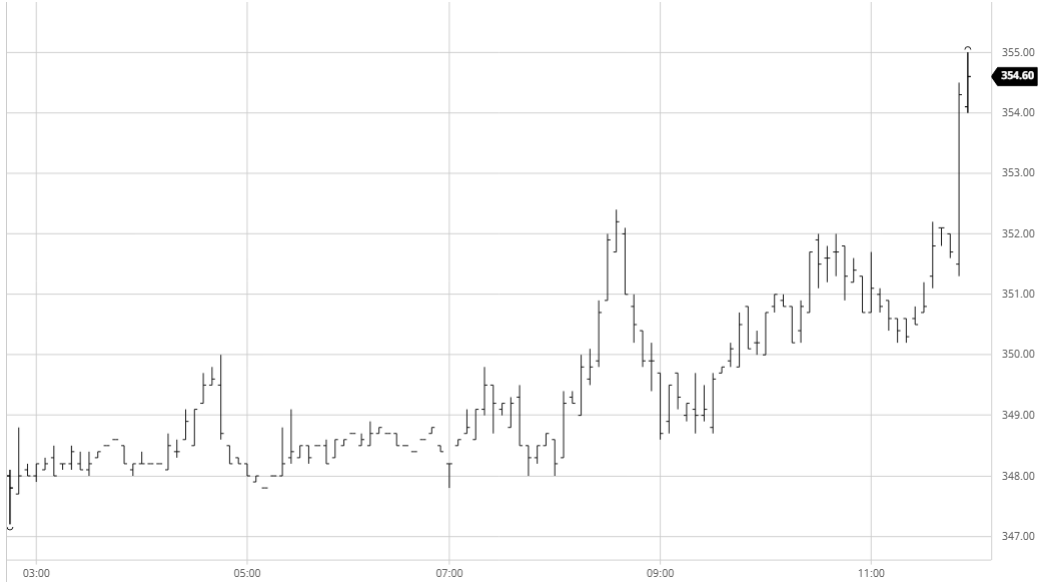

A very slow start to the session saw values trading little changed before finding some support which took Oct’20 up to 11.91 ahead of the US morning. This support appeared to be based upon tonight’s Oct’20 option expiry with a desire from some to try and pull the underlying up to the 12c strike level, however macro concerns initially limited the gains as we fell short. Renewed support arrived once US based traders entered the fray and the market moved to new session highs with a 12.01 print, though maybe of concern to those with a vested interest in defending the 12c options we then retreated back to the range once the buying eased. Despite the index roll window concluding yesterday there remained strong volume for the Oct’20/March’21 spread and all of yesterday’s losses were being reversed with the differential recovering back to -0.65 points. This served to assist the option related buyers and a fresh push upward later in the afternoon had Oct’20 reaching above 12c to a new session high mark of 12.05 with a further push for the close taking it higher still to 12.10. With settlement level established at 12.08 the recent technical negativity has been halted though whether it leads to a wider recovery is questionable with that dependent upon the specs as physical support seems unlikely to follow immediately higher and the fundamental outlook remains unchanged.

Oct – Sugar No.11

A mixed opening saw Dec’20 trading either side of unchanged levels while Oct’20 began its final day by struggling, registering losses as the Oct/Dec’20 spread was initially sold down to -$2.00. Outright values then started to climb a little with the movement being generated by the association to No.11 as they found support against their option expiry, though initially at least the pace of the rally could not match our raw sugar counterpart and WP values slipped back a little. Focus remained upon the Oct/Dec spread in an otherwise quiet environment and much of the day was spent near to parity although a widest print of -$5.00 was recorded during the afternoon as the final position management took place. Values drove to new session highs during the closing stages as we continued to be led by No.11 to ensure the most positive conclusion to a session in recent weeks, though whether it represents a short term correction to the trend or a more meaningful change of direction remains questionable at this stage.

Tonight’s Oct’20 expiration has seen 6,908 lots (345,700mt) tendered with Man (2,560 lots), Sucden (2,448 lots), Dreyfus (1,400 lots) and Tereos (500 lots) delivering to Wilmar as sold receiver. Most is thought to be of Brazilian and Indian origin with formal details published tomorrow.

Dec – White Sugar No 5

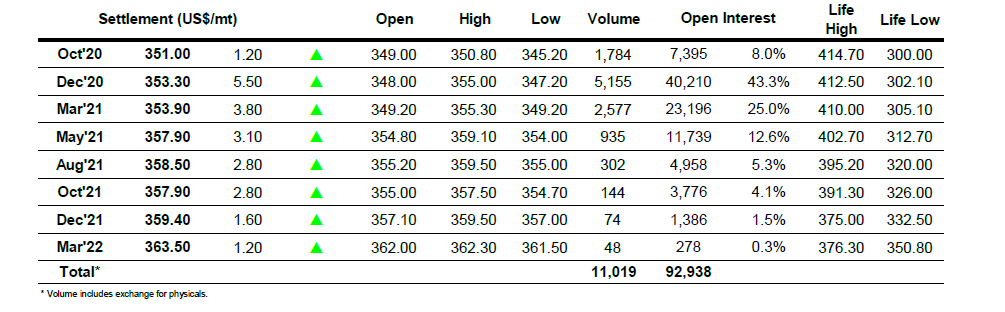

ICE Futures U.S. Sugar No.11 Contract

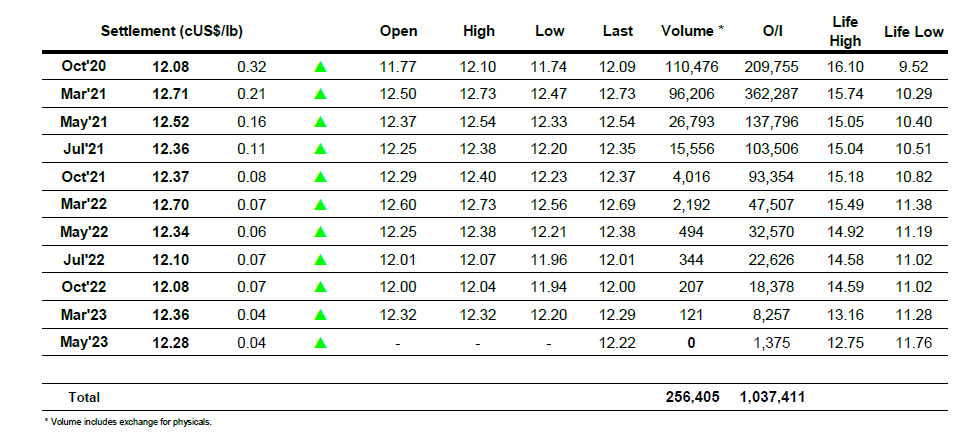

ICE Europe White Sugar Futures Contract