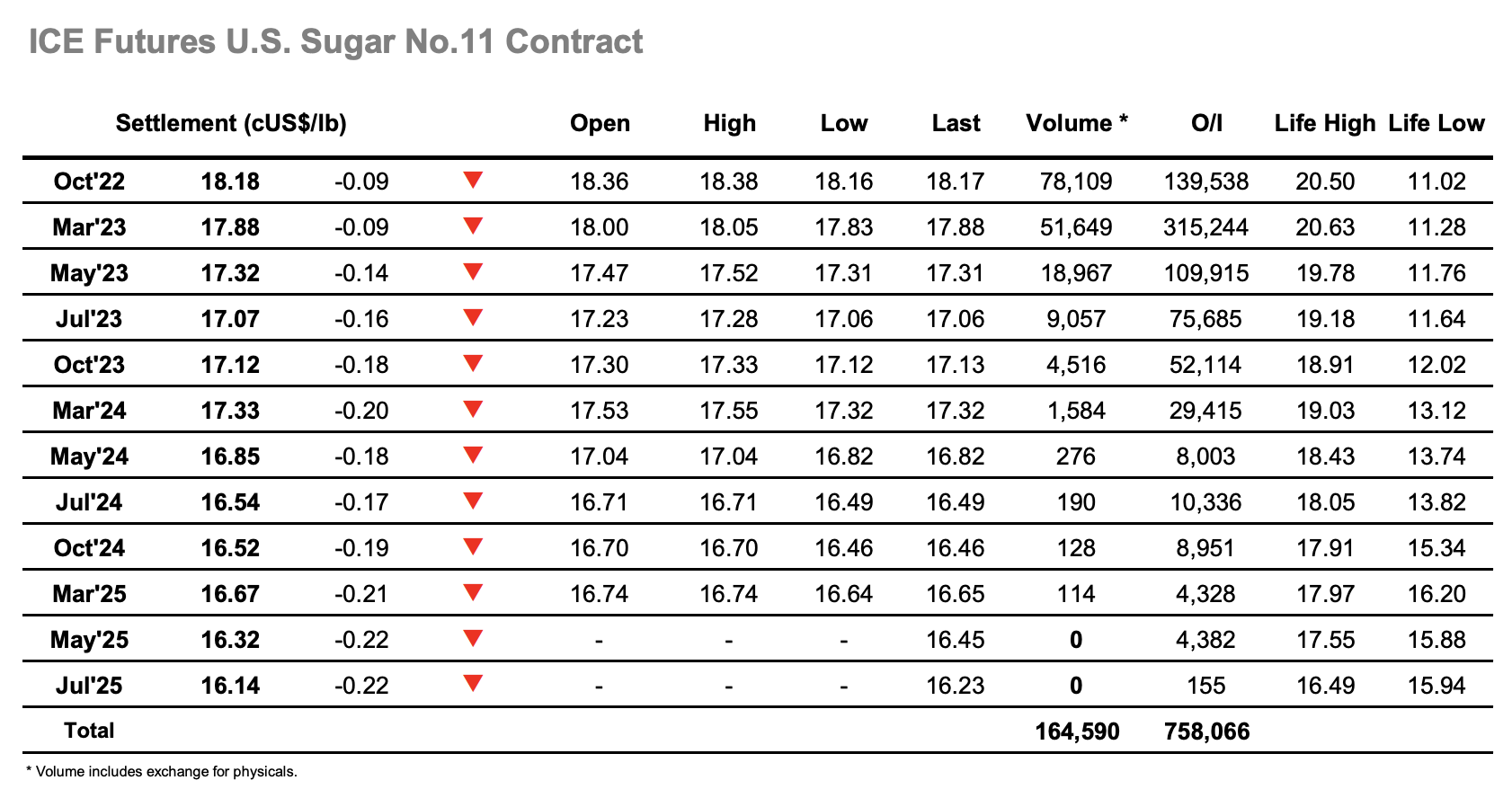

Recent exertions (albeit within the same broad range which has prevailed throughout the past couple of months) have clearly taken their toll as a very slow morning ensued for Oct’22, sitting between 18.27/18.38. Spread activity was also extremely thin on the ground and it was only as the market moved into the afternoon that a little more interest perked as selling (longs standing aside maybe) arrived to send Oct’22 slipping back down towards 18.20. Today represents the final trading day for the Oct’22 options, so that may also have played a part in keeping things calm as the price through the afternoon centred around the 18.25 strike, though such was the low volume nature of the day that any vested interests did not have to work very hard to achieve their aims of maintaining this area. In the event it seemed that there was no significant interest in ensuring settlement level near to a strike with the latter part of the day playing out ahead of the lows, leaving Oct’22 at 18.18 and toward the centre of the range again. Oct’22/March’23 gave back its early gains and also went out at the bottom of its range with a close at 0.30 points.

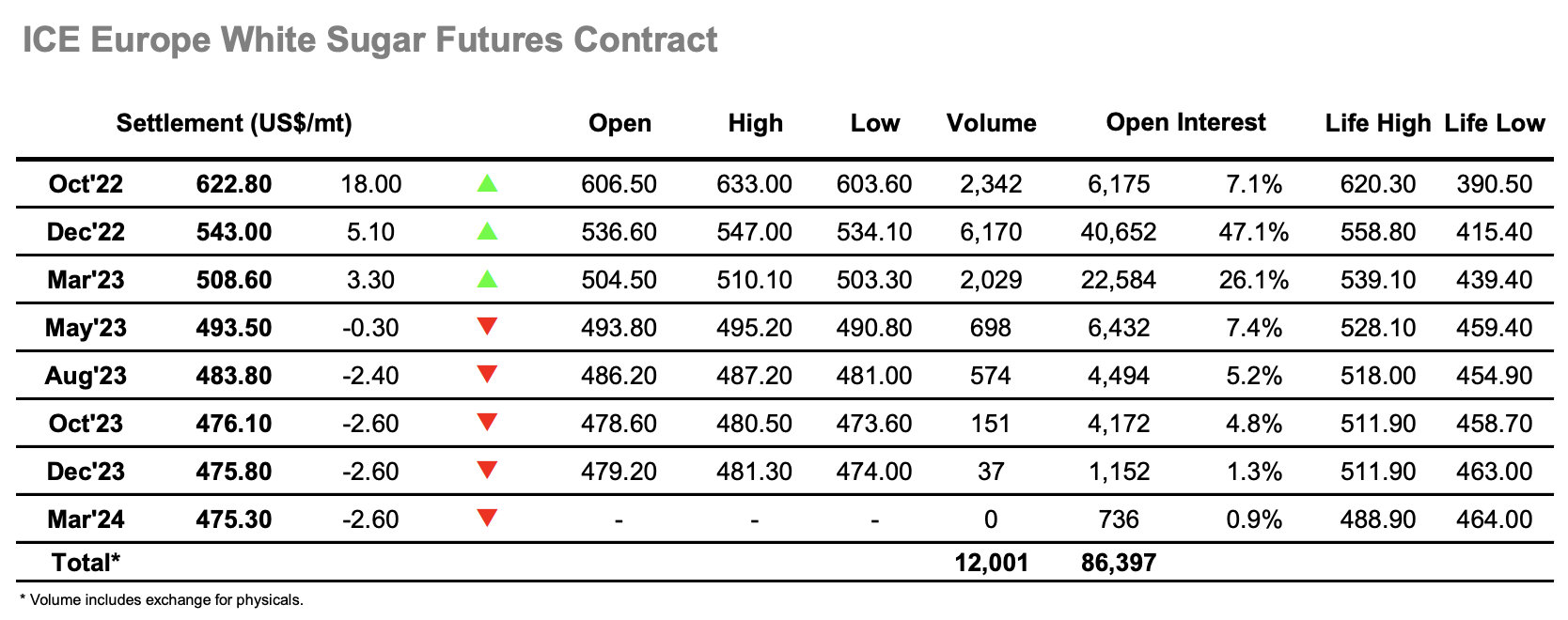

A choppy opening was merely a prelude for another slow morning during which Dec’22 nudged along quietly in the upper $530’s. There was also very low volume for the spreads with Oct’22 seeing extremely limited activity on its last day with most participants now prepared for expiry, what limited volume there was though saw the Oct/Dec’22 again widening to new contract highs. From a state of complete apathy came a sudden burst of spec aggression as we moved through the afternoon which ignited the Dec’22 contract with a surge to $547.00, however the move did not prove to be sustainable and within an hour or so liquidation had occurred to send the price back to where it started. Oct/Dec’22 meanwhile had grown ever stronger with selling seemingly limited to scale activity (possibly the receiver taking hedges back from the tape) and by mid afternoon highs had been recorded at $88.00. Dec’22 continued to the centre of the range through the final hour to ensure a positive conclusion at $543.00 while white premiums also ended positively with March/March’23 having recouped yesterdays losses to end near to $115.00. The main event remained the Oct’22 expiry with a closing period which saw the spread trade a highest $89.00 while generally having a $15-20 bid/ask spread eventually settling at a huge $79.80.

· The Oct’22 expiry is anticipated to see a tender of 4,477 lots (223,850mt) with Man the sole receiver. Details are still emerging on the other side though we believe there will be an assortment of origins tendered. Full details will be published by the exchange tomorrow.