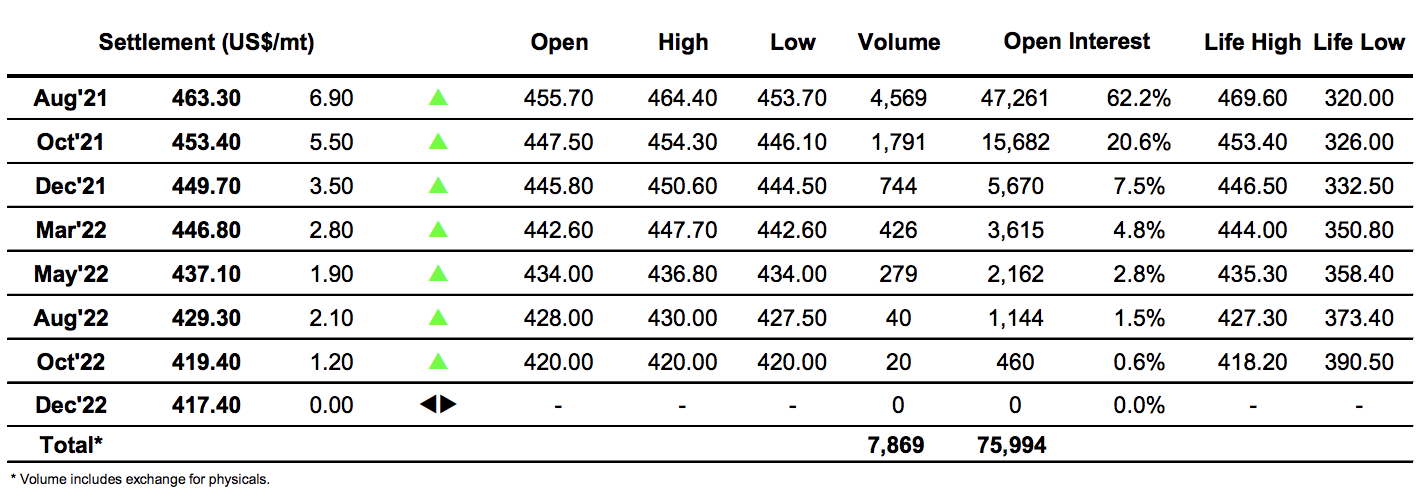

Sugar #11 Jul’21

It was a slow start to the session following on from last night’s option expiry and early trading saw nearby values ease back a touch with May’21 slipping to 16.22 while Jul’21 registered a low of 16.17. Gradually some light buying crept in to pick values up away from these lows however we still struggled to work beyond overnight levels on the thin available volume and had to await the start of the US day in order to see things pick up a little further. Despite a quiet and mostly neutral macro picture the specs looked to maintain recent progress and give the market another jolt higher, their efforts today taking us through to a new Jul’21 high mark for the current move at 16.47. The environment remains very thin with producer activity mostly limited to some light scales while consumers are understandably not keen to follow upward with the exception of any remaining May’21 pricing which needs to be concluded over the coming days ahead of the expiry at month end. Retreating from the highs we saw day traders jobbing back out of some of their longs as the price returned to hold the 16.30’s, while May’21 sat a little higher with the May/Jul’21 spread having extended out slightly to 0.11 points premium. Moving through the final hour the specs returned to the fore and eased prices back upwards through the earlier highs as they looked to ensure the positivity was maintained into the weekend, recording session highs at 16.80 (May’21) and 16.57 (Jul’21) with the spread extending far more significantly to 0.22 points. There was naturally some position squaring ahead of the weekend but we still closed impressively at 16.57 basis Jul’21 to again defy the macro and continue the strong technical outlook.

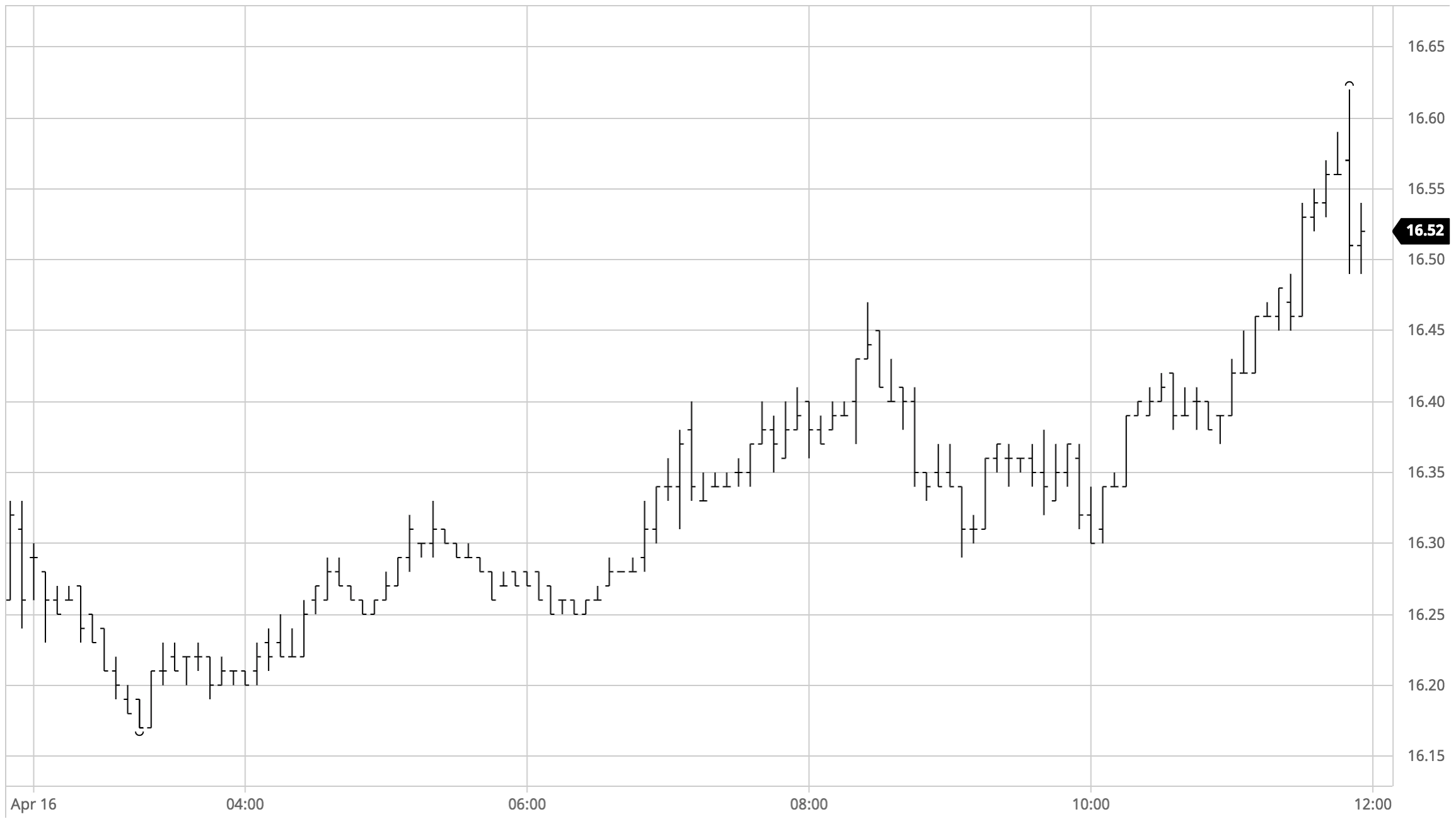

Sugar #5 Aug’21

A subdued morning saw prices trading marginally lower though given the strength of recent days some quiet consolidation does no harm at all to the technical picture. Aug’21 only broke out of its narrow $2.5 range during the early afternoon in reaction to some spec interest from across the pond reaching our No.11 counterpart, setting the wheels in motion for a look upwards towards yesterday’s $458.10 high mark. This target was soon reached and surpassed as the light buying worked through a thin environment to reach $460.10, though the highs were seen only briefly with long liquidation into the same thin environment then sending the price back down to unchanged levels once more. The environment remained somewhat featureless with sped activity at a minimum following on from the May’21 expiry – Aug/Oct’21 seeing a modest volume of lots as it extended out to $9.50. Everything changed during the final hour with an aggressive push which sent values to new recent highs, reaching $464.40 on aggressive MOC action with settlement established at $463.30. Another technically strong close leaves the Aug’21 contract high mark firmly in the sights as we look towards next week.

Nearby white premium values remained firmer today, pushing out to daily highs against the late market strength. Closing values see Aug/Jul’21 ending at $98.00, Oct/Oct’21 at $91.20 while Mar/Mar’21 was valued a little lower at $82.60.

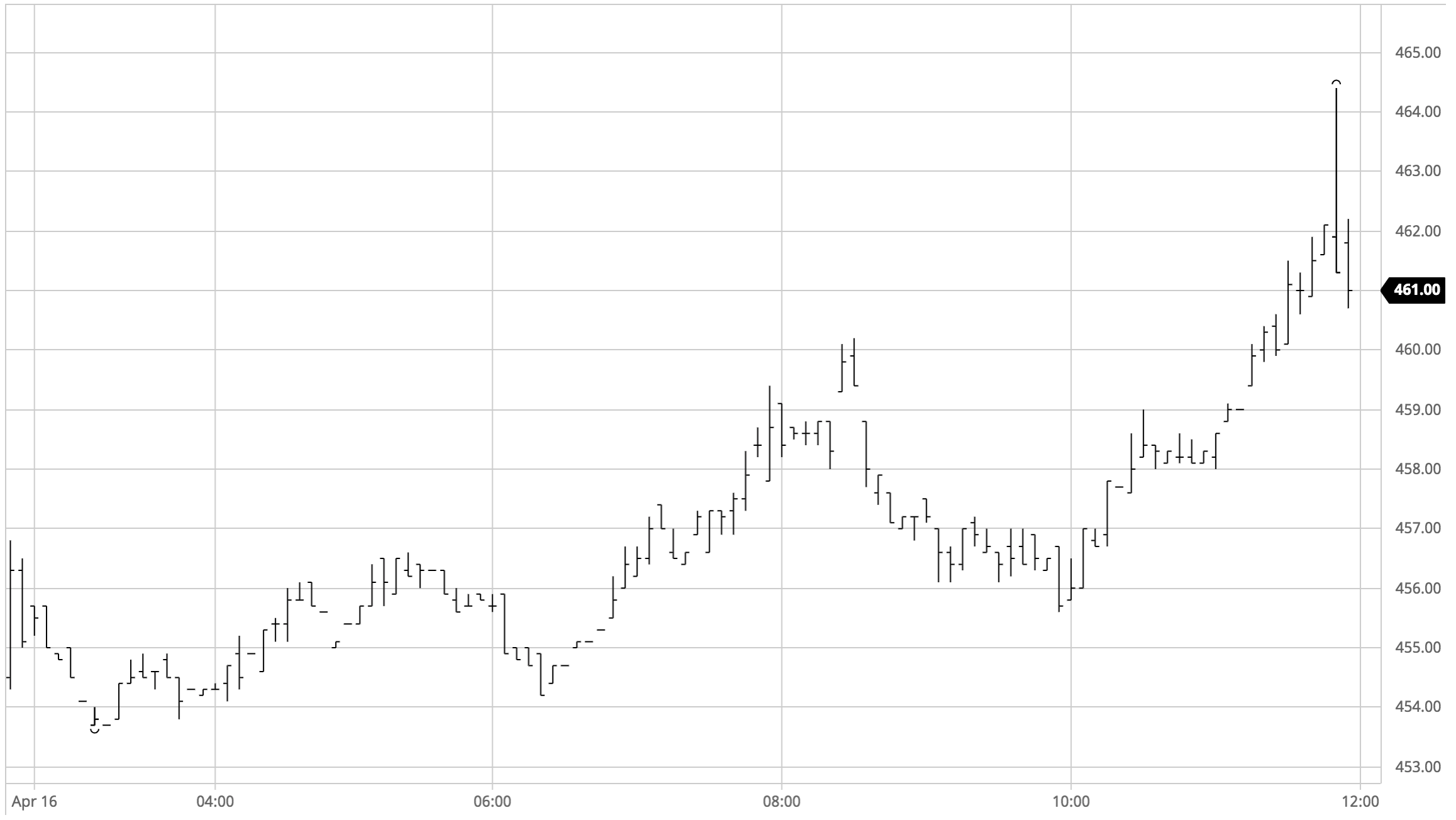

ICE Futures U.S. Sugar No.11 Contract

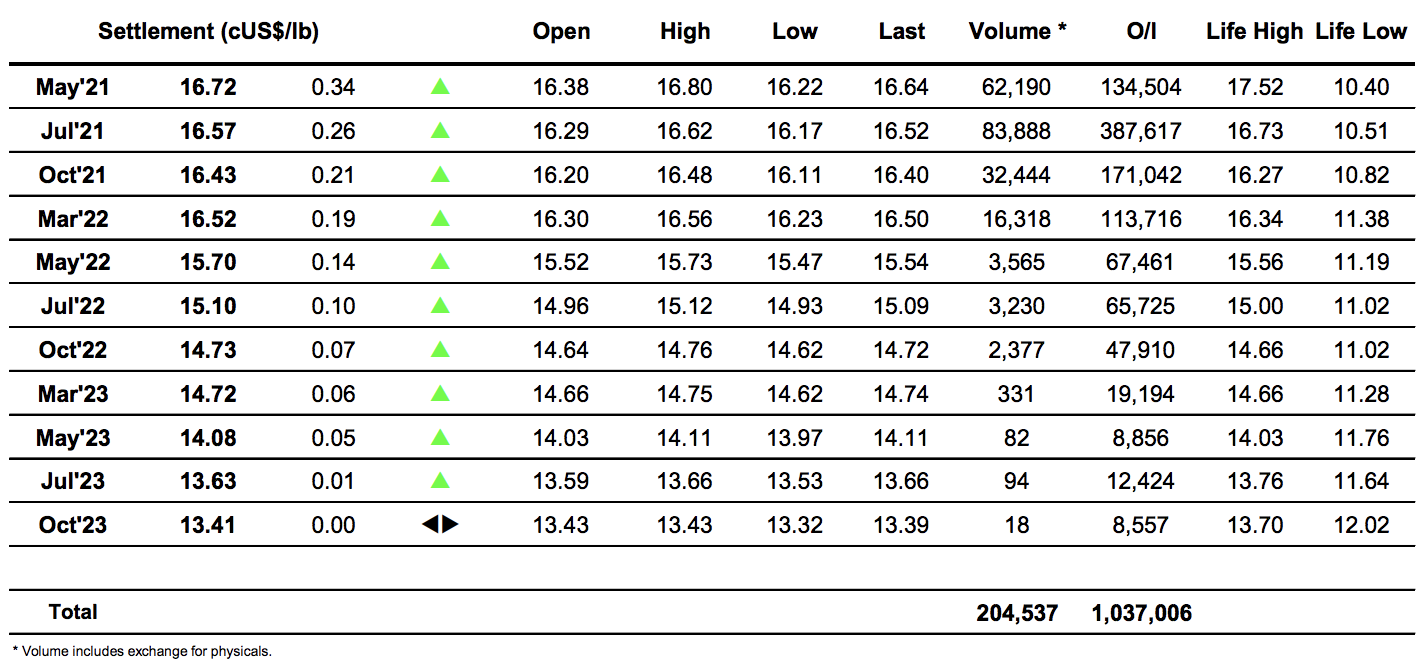

ICE Europe Whites Sugar Futures Contract