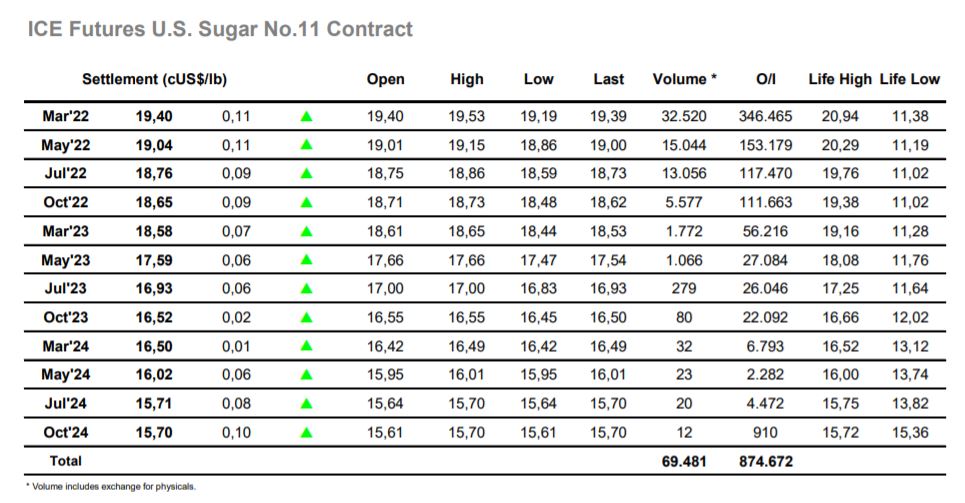

Sugar #11 Mar ’22

A macro recovery was in swing this morning and we followed the herd upward to reach 19.53 during early trading before settling back to consolidate the 19.40 area. It was only as we entered the afternoon that fresh movement came and it was a case of moving against the tide with sellers emerging to ease prices back downward and wipe out the gains, sending the price down to investigate the underlying support once again. Reaching a low at 19.19 the price was just a single point ahead of yesterday’s low mark, but it held comfortably, and this seemed to spark some renewed buying interest for the smaller specs and day traders as we resumed the macro path higher. The final couple of hours was spent consolidating the 19.40 area again as we had this morning and while uneventful on no news it served to halt yesterdays decline and cements us still within a broad range which seems likely to prevail as the holidays approach. Spreads were little changed with March/May’22 ending the day at 0.36 points while the front month ended the day calmly with settlement at 19.40.

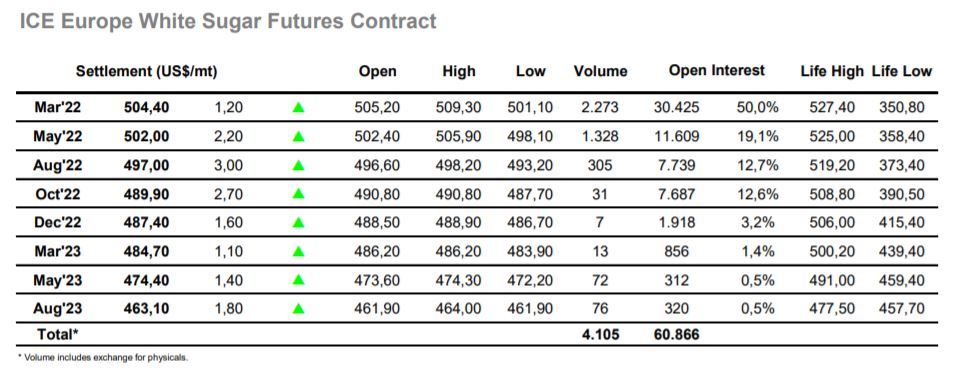

Sugar #5 Mar ’22

Moving back down towards $500 yesterday drew out a degree of physical interest and though there was not a huge volume of hedge lifting taking p[lace this morning it was still sufficient to push up through the relative vacuum and reach a high at $509.30 within the first hour. This was sufficient to fill the small gap established on the daily chart earlier in the week however with the buying concluded we soon started to slide back into the range. The slide gathered momentum despite a more positive macro environment and by early afternoon we were at new session lows and once again sitting in front of the scale buying that rests beneath $500. Starting to stabilise once more it seemed that the macro positivity drew in some more buying interest and this enable prices to remain clear of the lows for the rest of the session, though the recovery was never fully convincing while the nearby March/May’22 spread was uninspiring as it narrowed in to $2. Some end of day position squaring saw March’22 settle at $504.40 to conclude another day of slow trading as we head quietly towards the holiday period.