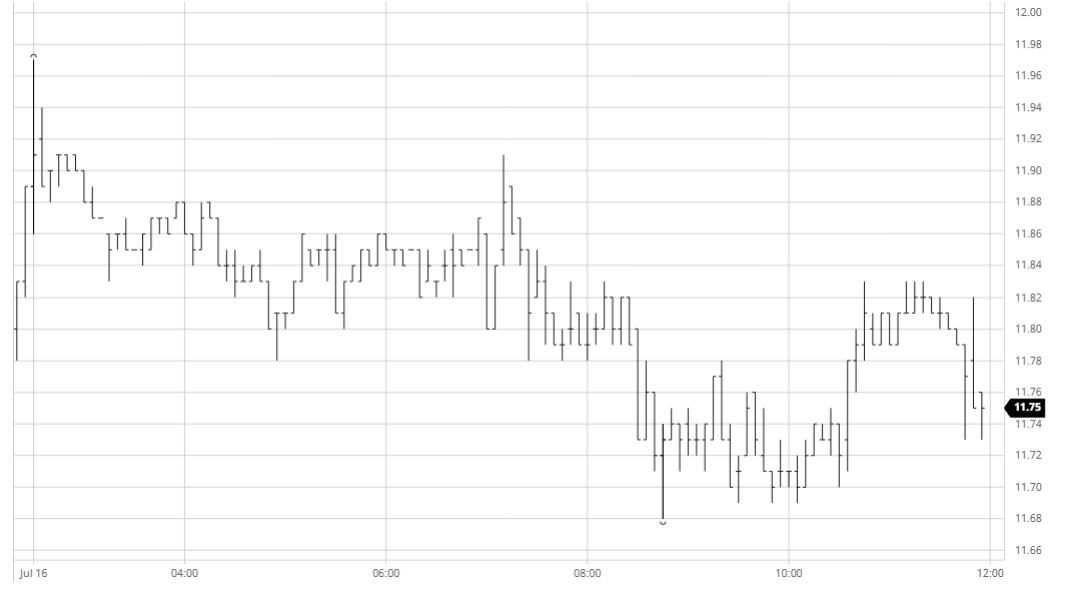

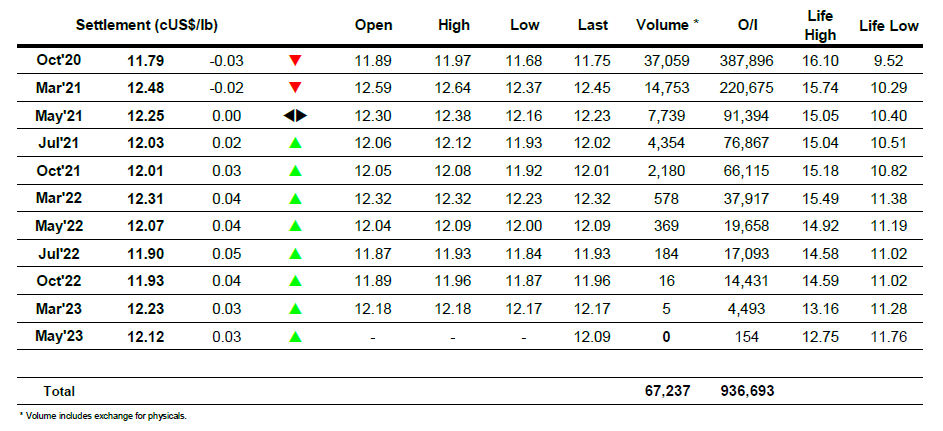

- Yesterday’s impressive turnaround encouraged buying for this morning’s opening which pushed Oct’20 quickly up to 11.97, however the push lacked substance and prices soon slipped back to consolidate near to overnight levels. In what was proving to be an anti-climactic session the market remained in a sideways pattern throughout the morning and though the “US opening” brought a little buying to the fore which pulled Oct back to 11.91 the move was brief and we returned to the range. Spreads were proving to be as inactive as the outrights as Oct/March held around -0.68 points, and though it subsequently weakened slightly to -0.70 as the front month eased down to the 11.70 area still volume remained on the low side. Flat price recovered from these lows to mid-range before ending the session marginally down at 11.79, bringing a rather non-descript day to an end with continuing range bound activity seeming inevitable.

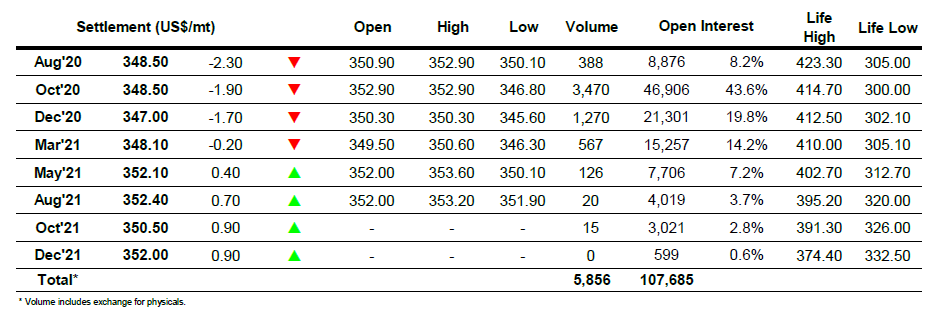

- Aug’20 whites expired today at parity to Oct’20. We are hearing that 8,650 lots (432,500 mt) will be tendered with Wilmar and Tereos tendering to Man, Sucden, Alvean and Dreyfus. Full details will be published by the exchange tomorrow.

SB Oct – Sugar No.11

ICE Futures U.S. Sugar No.11 Contract

ICE Europe White Sugar Futures Contract