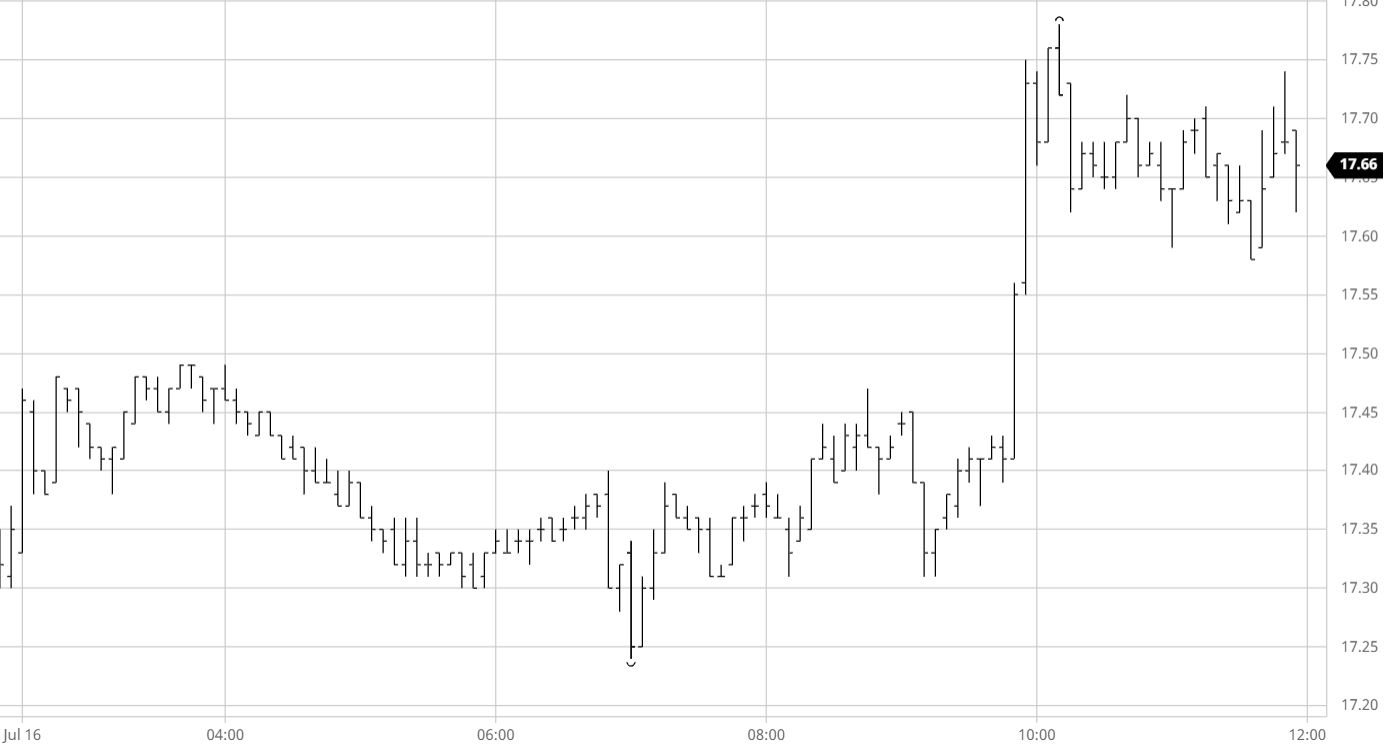

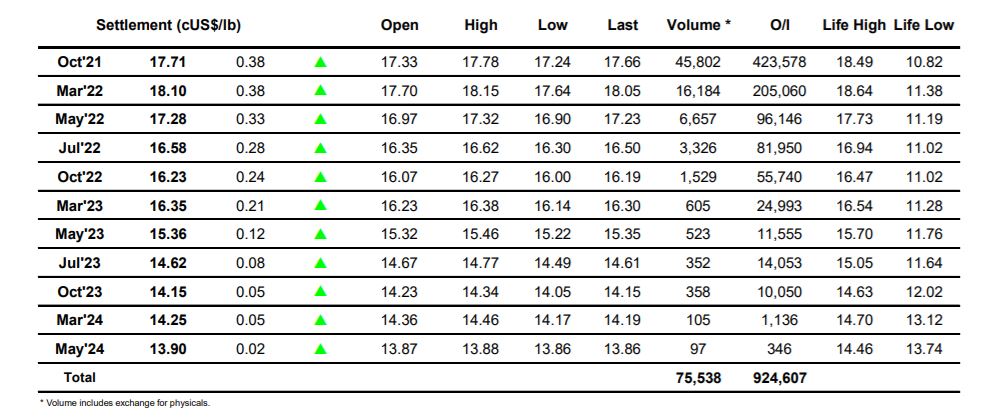

Sugar #11 Oct’21

A firmer opening maintained the positive shine of last nights close though having failed to push through 17.50 there was some liquidation from day traders which set back process towards overnight levels. A brief burst of selling then set Oct’21 back to 17.24 during the early afternoon but there was little appetite from the specs to gather behind this effort and prices simply gathered back into the morning range to further consolidate against a featureless environment. WE appeared set for a quiet end to the week but the specs had other ideas and a second consecutive “4pm rally” set prices racing higher as buyers punched beyond the morning 17.49 high and drew in additional spec/algo interest which drove the value quickly onward to 17.78. Such sharp moves only rarely maintain the pace of increase and today was no such day, instead easing back slightly to hold the 17.60’s in the hope that it would provide a base for a further closing effort to end the week on a high. When the closing push did arrive it sent Oct’21 back above 17.70 with settlement established at 17.71 prior to a further round of pre-weekend position squaring bringing values back by around 10 points on the post close.

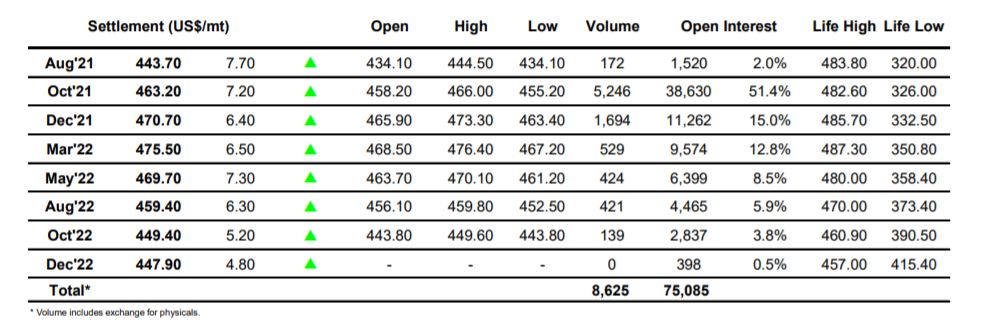

Sugar #5 Oct’21

The market gapped upwards this morning and extended the Oct’21 value above $461 on two occasions, and though volume was relatively limited once more values continued to consolidate in positive ground with sellers remaining few and far between. With no sign of significant movement in either direction a small dip to $455.20 which filled the gap was about the only highlight, while spread volume was also extremely thin on the ground. The expiring Aug’21 contract was meanwhile seeing only some very slight position tweaking on its final outing and with Open Interest already very small at just 1,520 lots it was no surprise to see only the last of the position squaring taking place. Similar to yesterdays session a dull scenario was enlivened with just a couple of hours remaining and it was once more the spec buyers in the driving seat as Oct’21 pushed sharply upward to $466.00 before pausing when the pace of buying eased. An intriguing final hour saw the price slide back down through the range to $458.00 before specs returned undeterred to bid prices back upwards and conclude the week with a positive settlement value at $463.20.

White premium values were unable to maintain earlier gains and in amongst the choppy closing action settled a little lower, with Oct/Oct’21 at $72.80, March/March’22 at $76.50 and May/May’22 at $88.70.

Tonight saw Aug’21 settle at $443.70, expiring at a -$19.50 discount to Oct’21 with a small tender of 1,469 lots (73,450 mt) being made.

ICE Futures U.S. Sugar No.11 Contract

ICE Europe Whites Sugar Futures Contract