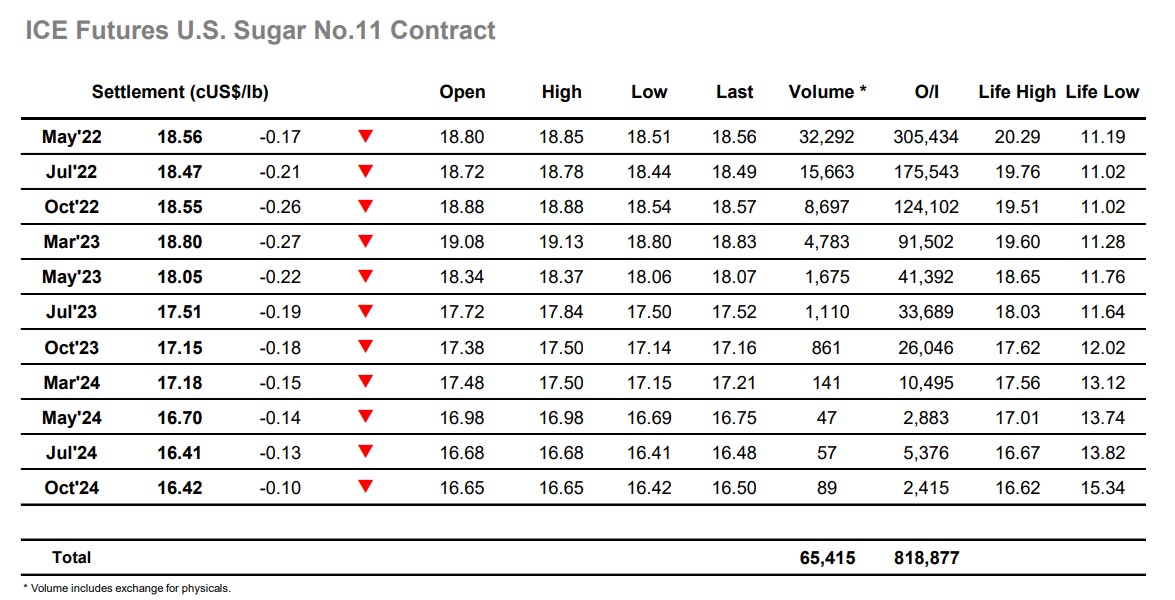

Sugar #11 May’22

The market found some early buying and traded as high as 18.85 during the opening minutes before settling down to find a range either side of last night’s closing values. The wider macro continues to struggle with prices correcting/consolidating following the sharp surge a couple of weeks ago and though consumer scales are starting to emerge they remain thin and so enabling the range to extend further south. Specs showed with some light buying as the US-day got underway to take May’22 back within a point of the opening highs however the volume was limited, and the recent pattern resumed with long liquidation that extended the lower end down towards 18.50. Nearby spreads were finding some support to rally for the first time in several days (May/Jul22 trading up to 0.09 points) but that had little influence of the flat price which remained rooted at the lower end for the remainder of the afternoon. A marginal new low was recorded at 18.51 ahead of the close and though the final stages saw short covering it had limited impact and May’22 closed at 18.56. Overall another disappointing session and no sign that we will not see a similar pattern of trading continue for the near term.