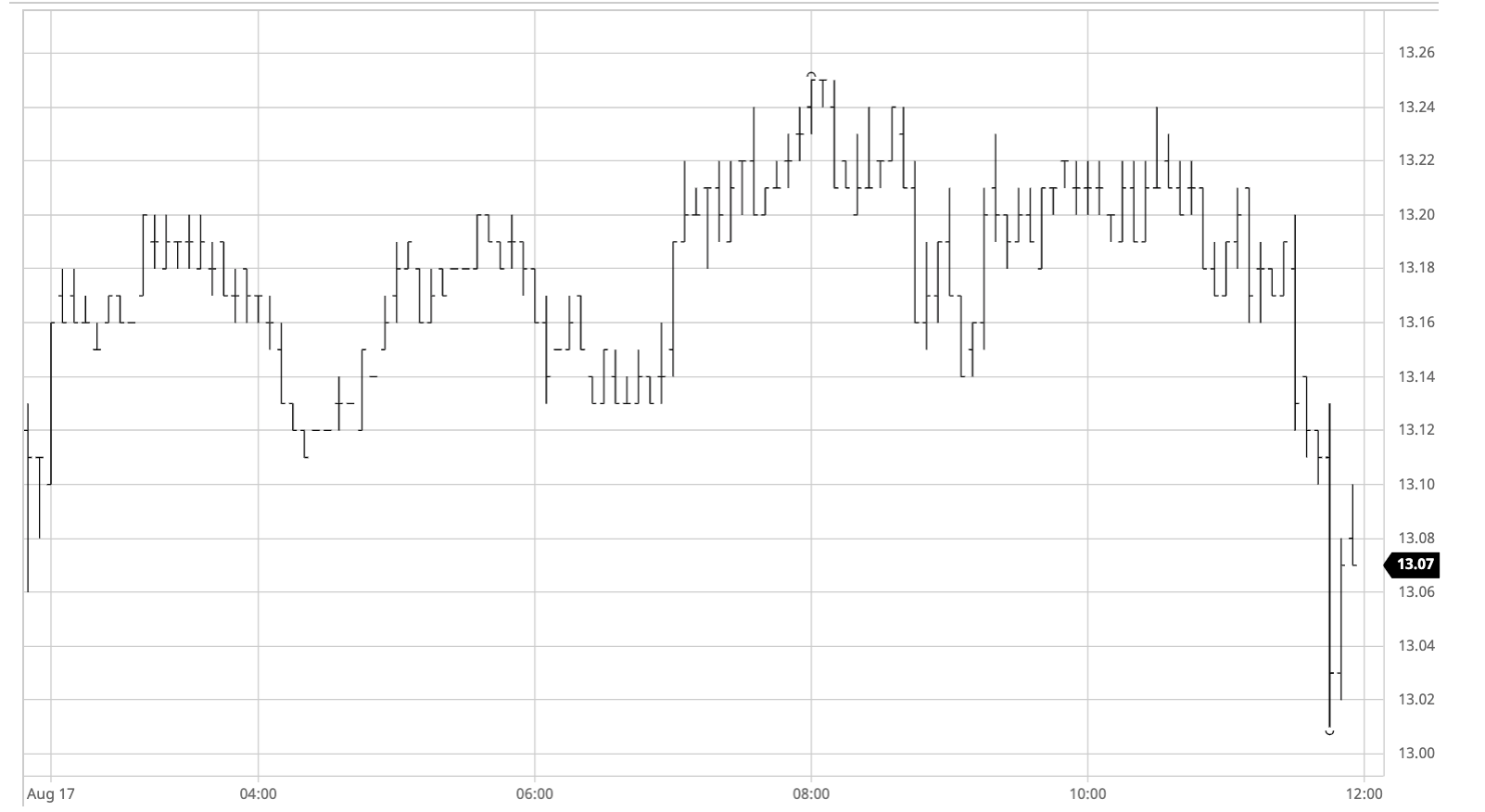

Sugar failed to follow the softs general rally today and traded on a narrower range, on a consolidation of past week’s prices. No major bullish news (and in fact, a bearish one) driving the NY#11.

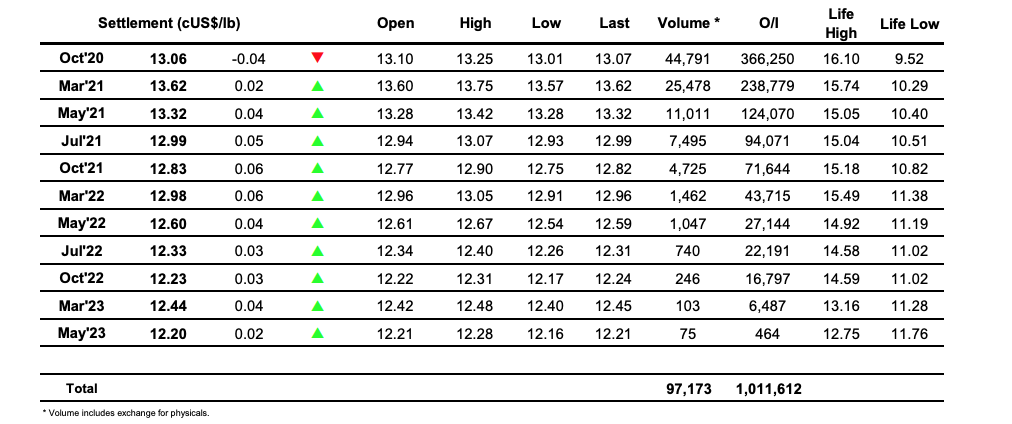

Even though there is still an upward momentum on the market, we see a little drag starting to appear. Specs have eased on the buying with the news of persistent rain reaching the states of Paraná, São Paulo and Mato Grosso do Sul over the weekend and, in fact, a foresight of these continuing through the week. V0 reached 13.18 within the first minutes of trading and remained rangebound for almost the remainder of the session. We saw NY come alive at 9 a.m. and bring good volume, with the market, however, demanding more and more energy for each point up, with the first significant resistance level appearing to be around 13.25, the highs of today. At around 13:30 (BRT) we saw rather a large selling pressure, possibly funds realizing some of their profit with the loss of momentum, which dragged the spreads down across the board in 2021. On 2022, however, spreads have strengthened, probably due to more intense producer activity on the wake of a 1.5% rise of the dollar, which coupled to the low liquidity makes it easy to deform the curve.

Oct – Sugar No.11

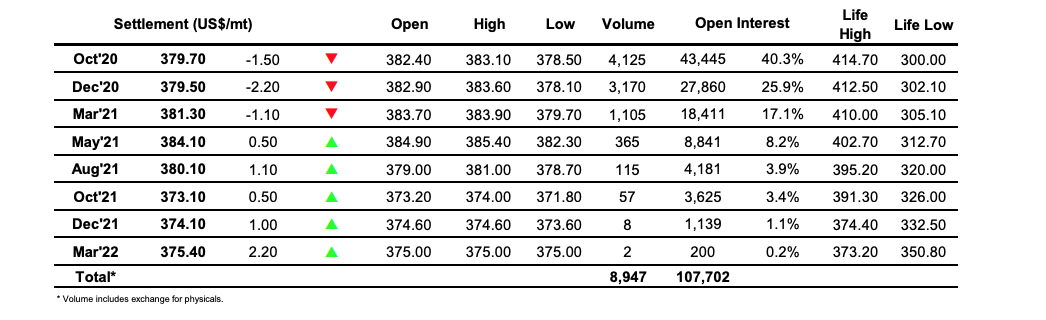

ICE Futures U.S. Sugar No.11 Contract

ICE Europe White Sugar Futures Contract