Sugar #11 Mar ’21

Market continued this week’s upward trend on the wake of the good news regarding Indian subsidies, even though liquidity is still quite slim, especially considering its holiday season. By market open we have already seen a 15 pt increase from last settlement, with market reaching a high of 14.66 in the first few minutes of the morning, a top which was only crossed again in the last two trading hours of the day.

After the first top, volume disappeared and trading was sparse, and the lack of bulls made the market ease a bit until the first prompt reached the daily low of 14.45. After 11:00 am BRT, market traded within a 20 pt range until around 13:20 BRT. By far the most liquid hours of the day were between 13:30 and close, when finally, some volume came through and buying action resumed, leading the market to the daily high of 14.72, easing back to 14.60 shortly after. Spec buying activity on the close was evident, which again pushed prices higher and guaranteed a 14.69 settlement price, a 1.3% increase from yesterday.

On the FX side, we saw a worldwide dollar weakness driven by the Fed’s most recent guidance and the marketwide expectation that stimuluses are going to continue, and government aid worldwide is far from being over. BRL reached a peak rise of 0.8% trading at 5.047 and gave back some of its gains late in the day to close at 5.0662, a 0.38% rise from yesterday.

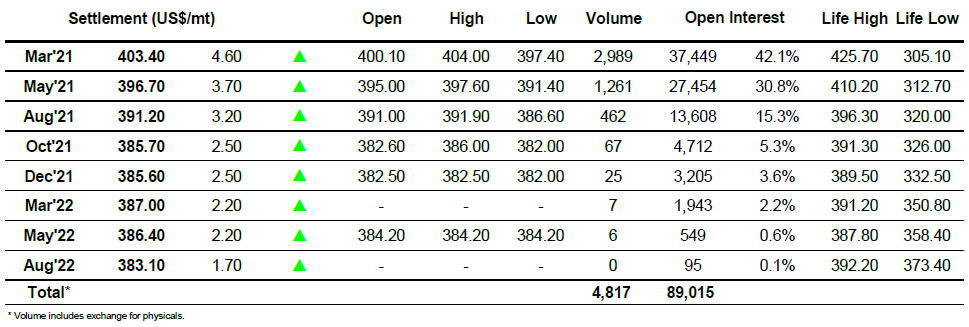

ICE Futures U.S. Sugar No.11 Contract

ICE Europe White Sugar Futures Contract