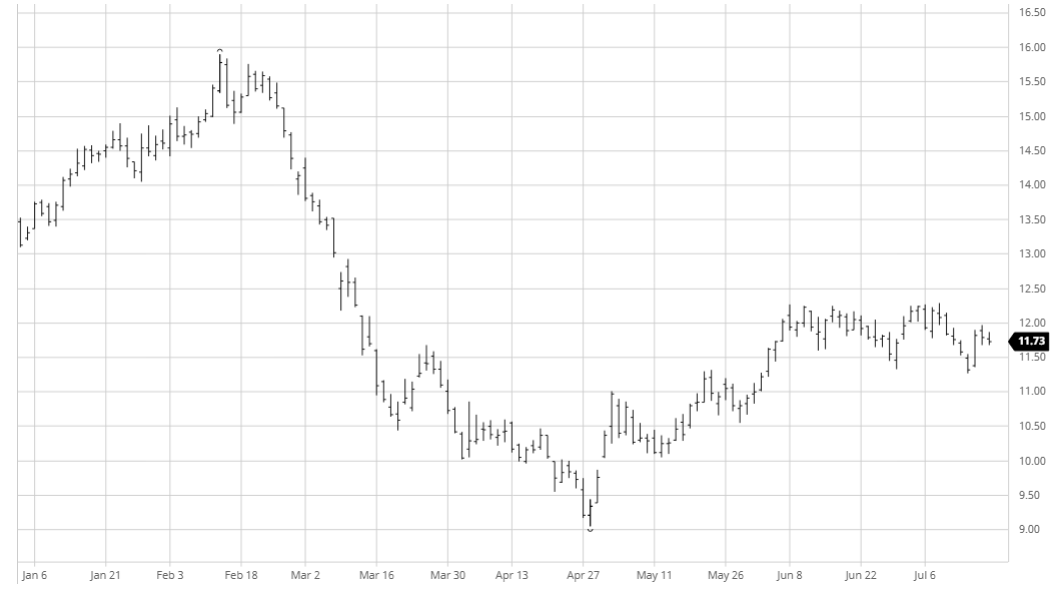

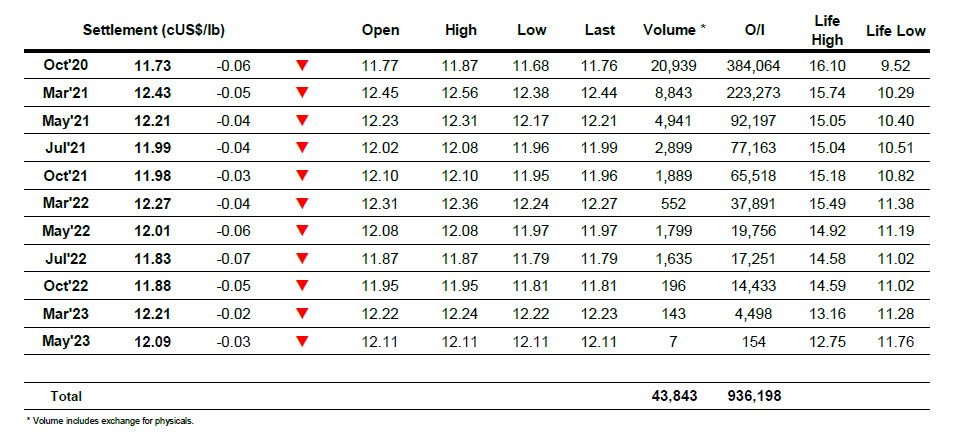

- If we thought that yesterday was a slow performance it was nothing compared to today. A marginally lower opening gave way to a dip to 11.68 during morning trade, matching yesterday’s lows on incredibly light volumes that saw only Oct’20 having traded more than 1,000 lots by the end of the morning with Oct/March volume at just 122 lots as the 1pm “NY opening” approached. The arrival of increased spec activity did bring a wave of buying that sent Oct up to a session high 11.87 over the next couple of hours though this remained on very light volume. Prices eased back into the range and remained here for the rest of the day, the low volume and lack of spec/algo activity illustrating just how much the algo’s they add to activity on a regular basis. Closing values were a little lower, Oct’20 settling at 11.73.

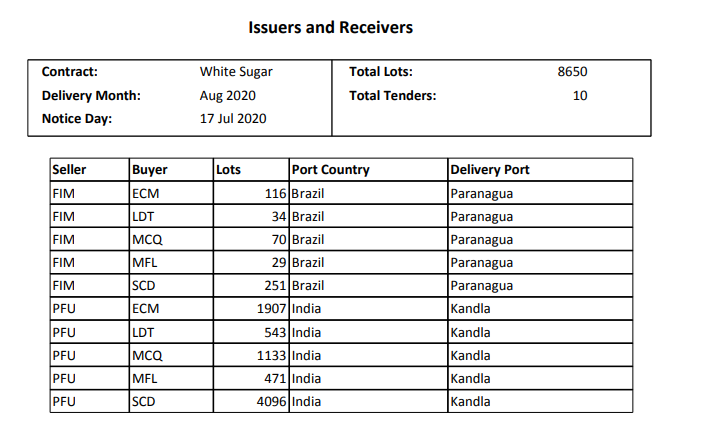

- The Aug’20 whites sugar delivery notice showed that as anticipated 8,650 lots (432,500mt) was be tendered, largely of Indian origin alongside a smaller quantity of Brazils. The formal notice is shown below:

SB Oct – Sugar No.11

ICE Futures U.S. Sugar No.11 Contract

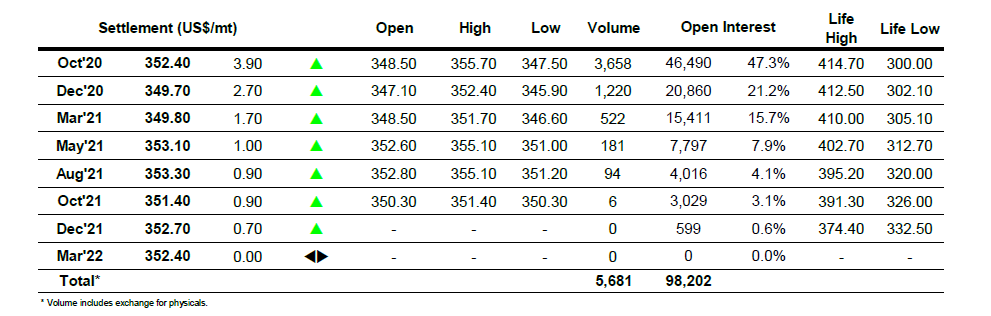

ICE Europe White Sugar Futures Contract