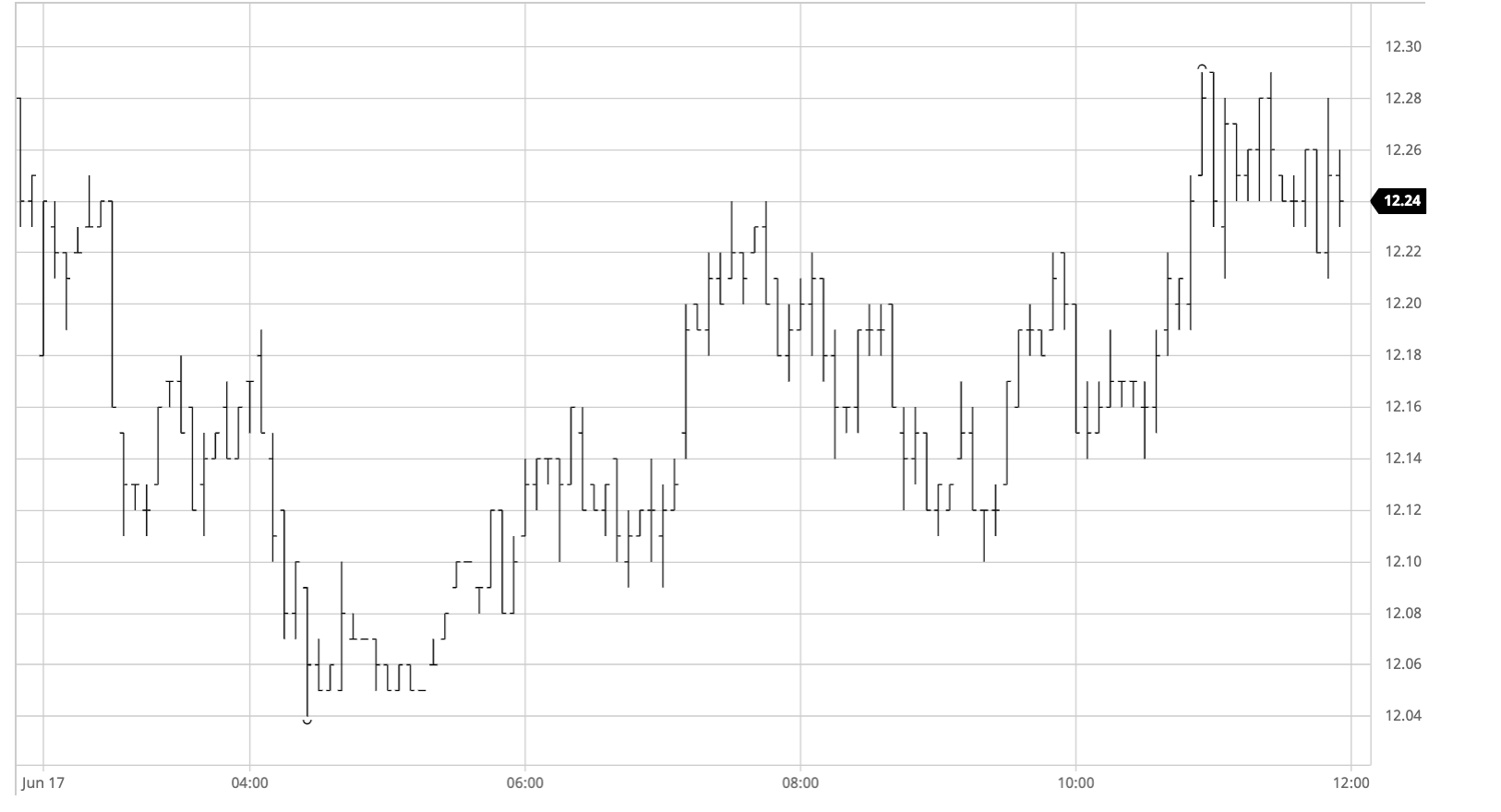

The new day began negatively with October trading down to 12.11, possibly on sentiment following that late weakening of the USDBRL to 5.24 as there was little else around to suggest why we should begin so poorly. Whatever the reason it undid much of the work done by the specs last night and a further burst of selling mid-morning pushed values lower still to 12.04 suggesting the recent range bound action will continue. There was support ahead of 12c which did provide the basis to work away from these lows and back into the range, but although some light spec buying emerged once the US day commenced it was insufficient to push back above the opening 12.24 high and we once again set back into the range. The latest period of sideways activity came to an end as spec buyers emerged to once again try higher and their aggression took Oct to 12.29 as we entered the final hour however the overhead scale selling again limited the move and capped things off through a final hour which saw prices hold the upper end of the range but still finish a rather non-descript day marginally lower at 12.26.

SB Oct- Sugar no. 11 Futures

SB Oct- Sugar no. 11 Futures

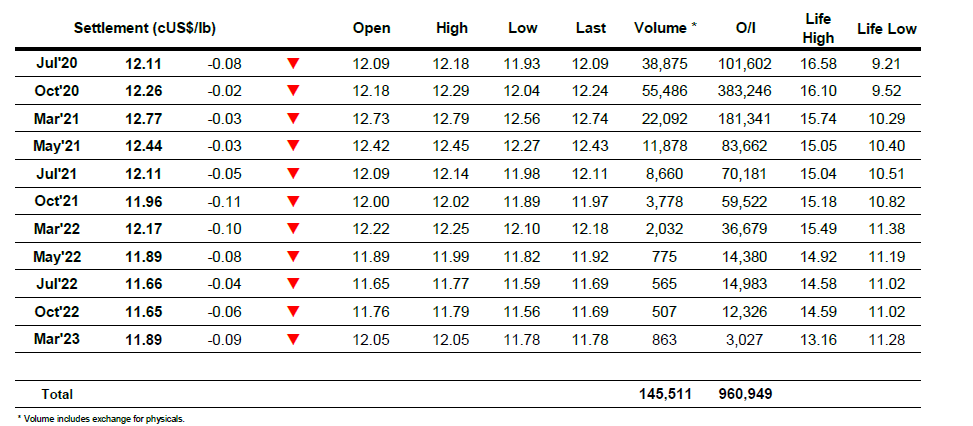

ICE Futures U.S. Sugar No.11 Contract

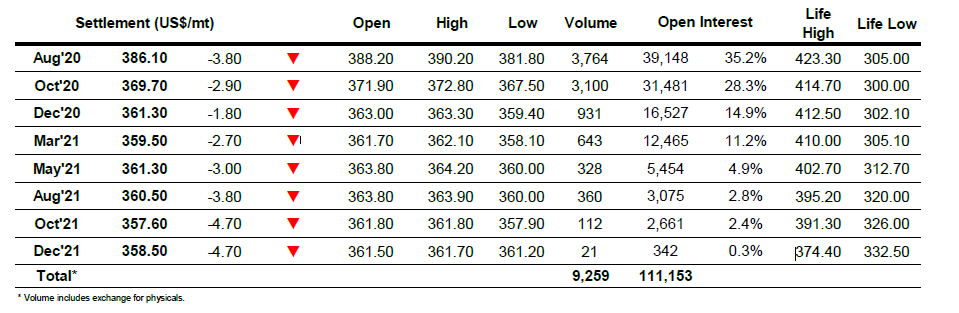

ICE Europe White Sugar Futures Contract