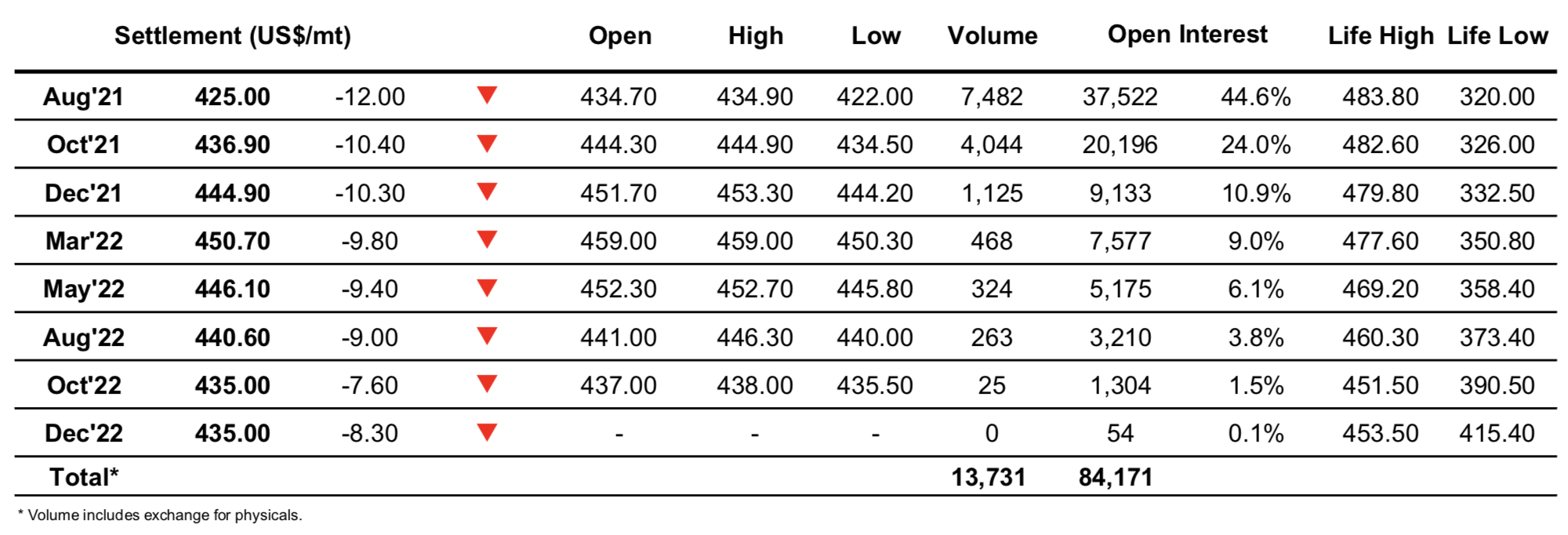

Sugar #11 Jul’21

Having fallen beneath the range which had dominated the first half of this month we find the market looking rather more vulnerable and there was selling from the start today placing pressure onto nearby prompts. Oct’21 was pushed towards 17c during the first few minutes and while there was some reasonable support in the form of scale down consumer buying it merely served to moderate the pace of decline with the remainder of the morning seeing a slow retreat into the 16.80’s. Still the buying remained robust, particularly at the round numbers however as US traders joined the fray there was a new more aggressive push downward as specs looked to explore beneath last months 16.72 low mark. In the event we matched against this level precisely with subsequent consolidation providing the basis for a short covering rally with the price returning to match the opening high at 17.10 before stalling. With specs and algo’s chopping around there was another volatile reversal to follow with long liquidation sending prices plunging back to the lower end of the range, re-joining the wider macro weakness while providing the opportunity for the bears to make hay during the final hour and re-explore the underlying support. New lows were recorded late on as Oct’21 traded to 16.69 and though scale buying continues solidly the weak technical close suggests that we will continue trying to test downward.

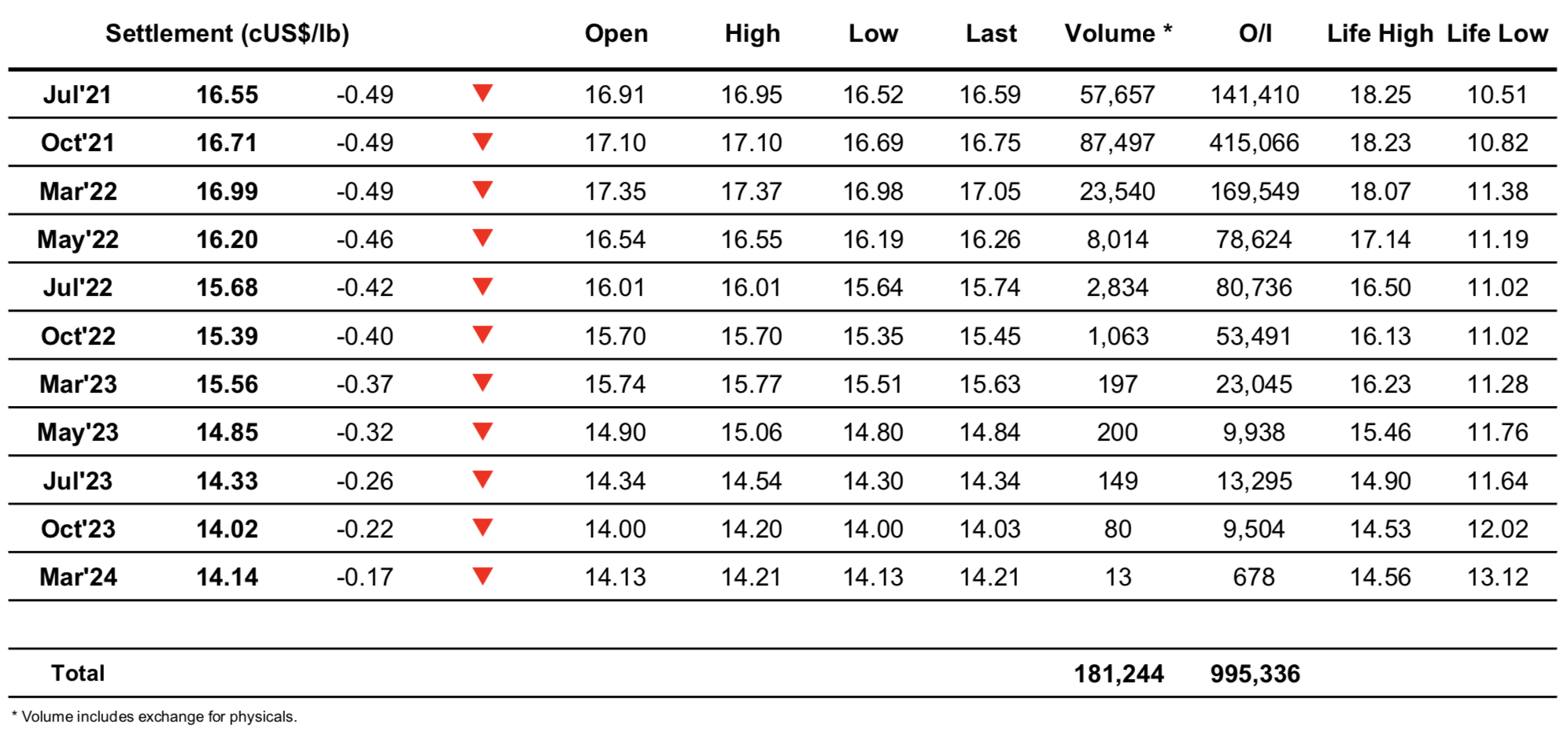

Sugar #5 Aug’21

The past week has seen whites post a series of increasingly poor performances and that trend looked set to continue as we opened beneath $435 for Aug’21 and soon gathered pace as selling came in once we broke yesterdays $433.80 low mark. Though there was continuing scale buying for both Aug’21 and Oct’21 the decline was maintained throughout the morning with pressure also being exerted upon the spread and white premium values with Aug/Oct’21 making a low at -$12.80 while the Aug/Jul WP fell towards $54. Such low levels encouraged more significant buying to appear and it was this interest which started to turn the tide as over the course of three hours Aug’21 climbed back above $433 with the premium returning to the $60 area. This recovery looked to be presenting some optimism however it quickly dissolved as the failure to pierce back above $433.80 led to some sharp liquidation in to a relative vacuum with the price returning to the mid $420’s. Though we did not revisit the morning lows late trading remained at weak levels with Aug’21 edging along to settle at $425.00 with next support not now seen until the early April low at $415.60.

White premiums clawed back a good deal of the early morning losses to end the day with Aug/Jul’21 at $60.10, Oct/Oct’21 at $68.50 and March/March’22 at $76.10.

ICE Futures U.S. Sugar No.11 Contract

ICE Europe Whites Sugar Futures Contract