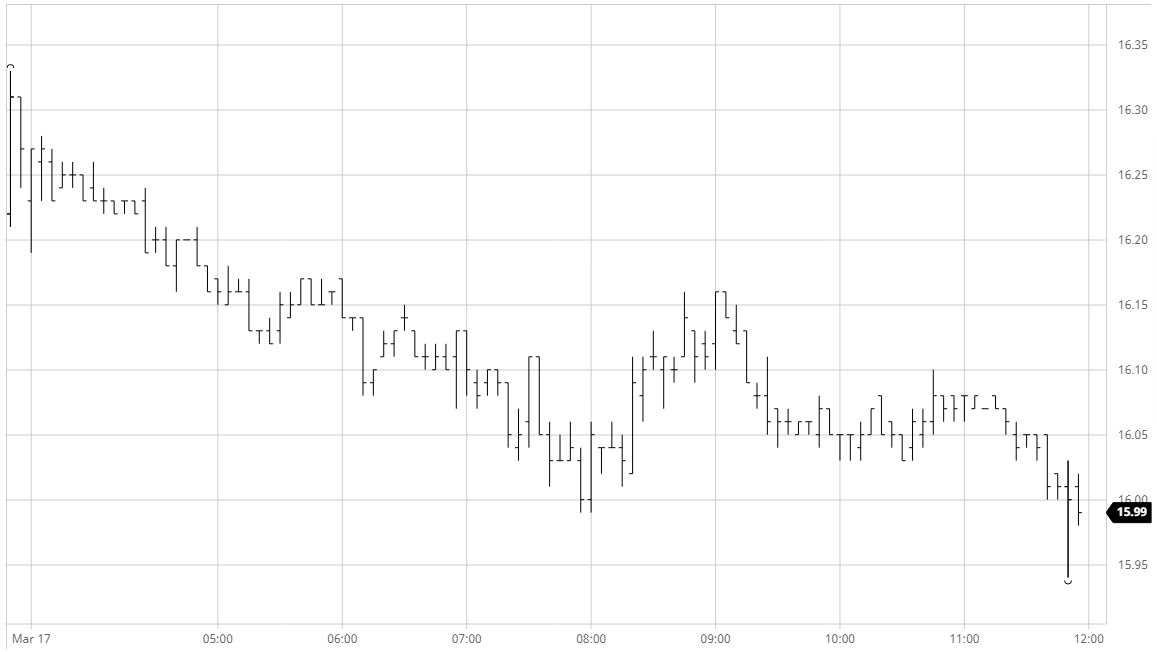

Sugar #11 May’21

The morning brought with it some selling which in a very tedious way eased the May’21 value back downward through the range towards 16c, eventually reaching this point during the early afternoon. More negative over the course of the morning had been the May/Jul’21 spread which from the word go had been under pressure with selling quickly pushing it down to 0.37 points, action which sends out worrying signals despite the reluctance of the flat price to do anything other than yo-yo within the recent range. Having encountered support in the 16c area the market nudged back upwards on some short covering, though the rally was limited and for most of the afternoon we simply edged along a small way above the highs showing no intent to move by very far. The only thing continuing to move was the May’21 spreads which worked down to record a new low for the year so far at 0.32 points, more than 0.50 points below the high recorded late in February, and though the lfat price continues to show no sign of exiting the recent band this does place more pressure upon the downside. Closing activity saw a brief spike to a session lows 15.94, and while settlement at 15.99 may have a psychological impact there remains solid buying in place ahead of 15.85 which will need to be filled if we are to extend lower.

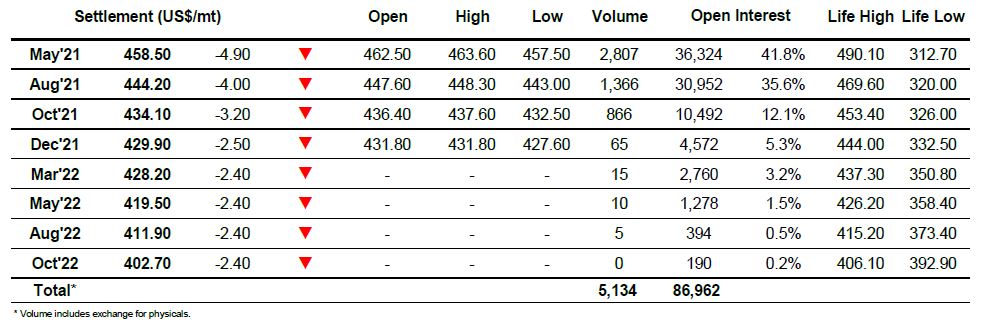

Sugar #5 May’21

Small early losses set the tone for the market to continue downward over the course of the morning and it seemed that yesterday’s failure to break upward from the range had encouraged the day traders and algos to try the lower end once more in the hope of generating a break and the increased volatility that they crave. Sliding steadily we reached $457.70 midway through the session, placing the market just 0.30c ahead of the morning low seen yesterday from where the price had jumped. Unsurprisingly given recent action we found sufficient buying in this are to again provide support as short covering followed to send the price away from the low. The afternoon saw consolidation nearer to $460 on minimal volume until the closing stages when some aggressive selling emerged to send the front month back down to $457.50 and into the support area once again. In late volatility we traded back up towards $460, and though the settlement price of is on the weaker side of things there is no indication that this could finally lead us down through the $452.20 recent low and on to fresh ground.

ICE Futures U.S. Sugar No.11 Contract

ICE Europe Whites Sugar Futures Contract