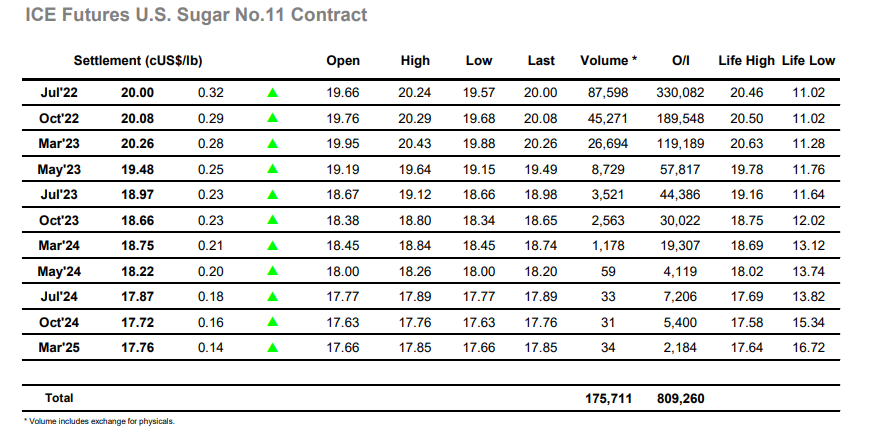

The strong pace of recent increase has left many wondering just how much furt5her the market can go without pausing for breath, and so in many ways this morning’s calm action was to be expected with Jul’22 holding quietly in the 19.60’s. The macro was also calmer with marginal gains for energy being offset by corrective losses for wheat, though the fact our price was not retreating was encouraging for the longs. Moving into the afternoon there was the usual uptick in volume, and it was not long before the specs began to show again and start pushing up towards 20c. Producer selling was still moderate (USDBRL back below 5 not helping their cause) with their sporadic heavier pockets of pricing not proving sufficient to dent the spec/fund enthusiasm, and with the grains sector recovering losses so they were encouraged to keep pushing upward. Stories were circulating that the Brazilian gasoline price is to increase by 20%, and this sparked a fresh surge of buying into the front of the board that took Jul’22 to 20.24 in quick time. This put the market a mighty 194 points above last Thursday’s low, a remarkable increase under any circumstances and particularly so given most analysts view the balance sheet in surplus currently, while also placing sugar at the upper end of the macro gains for the day. Naturally after such a rise some profit taking emerged through the latter stages to send Jul’22 back beneath 20c before a late recovery saw it settle at 20.00 on the nose. Another strong day sees the contract high at 20.46 as the first target, although after such recent exertions the overbought nature of short-term indicators leaves things open to corrective action -= seemingly the only certainty is that things will remain volatile.