A bull has to be fed every single day; a bear can hibernate for months without eating anything.

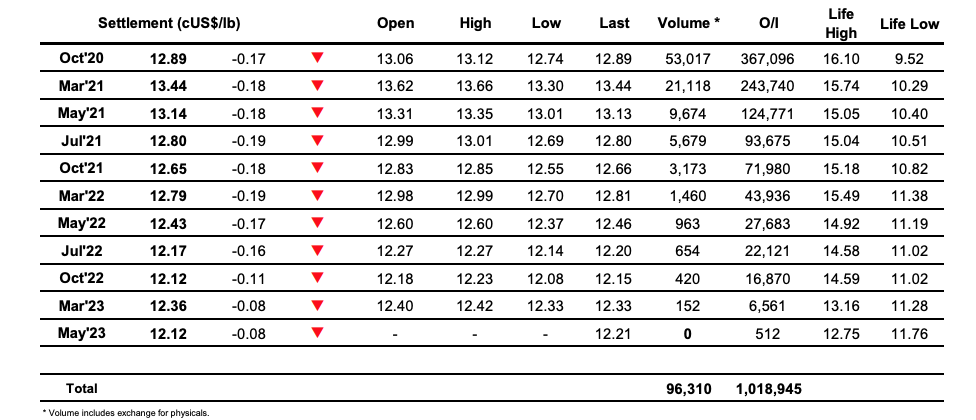

With the rains coming to CS Brazil, the rumours of export subsidies coming from India and crude oil failing to gain strength, in part due the recent production hikes from OPEC+, today was a rather bearish day for sugar. With spec buying losing momentum, the commercial buyers have no reason to rush in and lock their prices and with repeated attempts of pushing past 13.30 gone awry, it is not unexpected to see some retreat as the Fast Money people realize some profit and wait. This is not to say the rally is over: demand is still strong, and market liquidity makes it quite vulnerable to speculation, especially considering the rather low 400K OI with 5 weeks still to go until expiry. With nothing to feed the bulls, however, the bears will always lurk around.

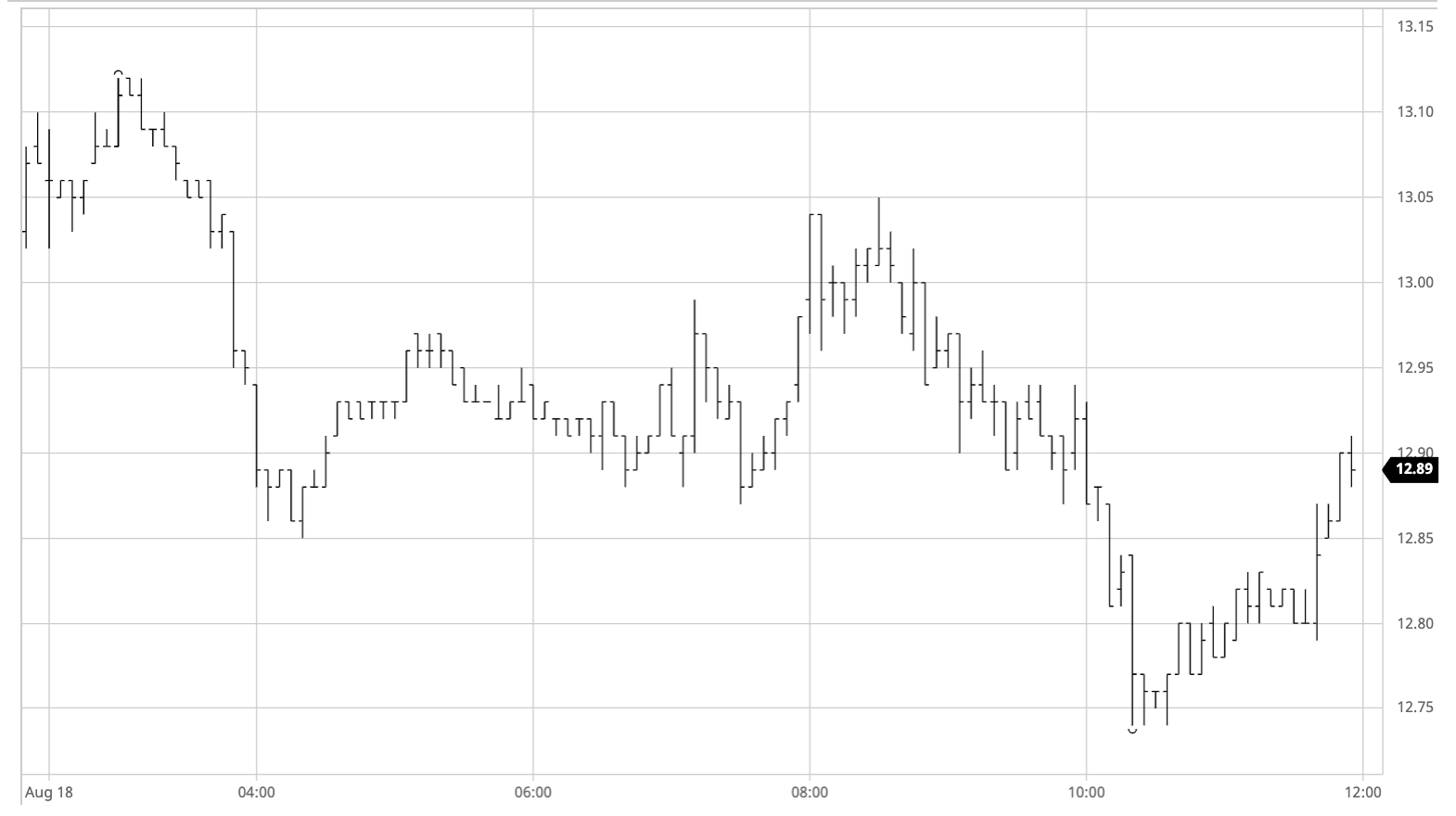

Market opened unchanged from yesterday, rapidly peaked to 13:12 during the first 30 minutes of trading, just to see an unusual early volume bring it down to 12.88, trading on a range all the way until 12:00 BRT, when a larger volume appeared and quickly drove us down to the lows of 12.74. Market recovered slightly afterwards, mostly during the end-of-day adjustment trades and closed at 12.89.

Oct – Sugar No.11

ICE Futures U.S. Sugar No.11 Contract

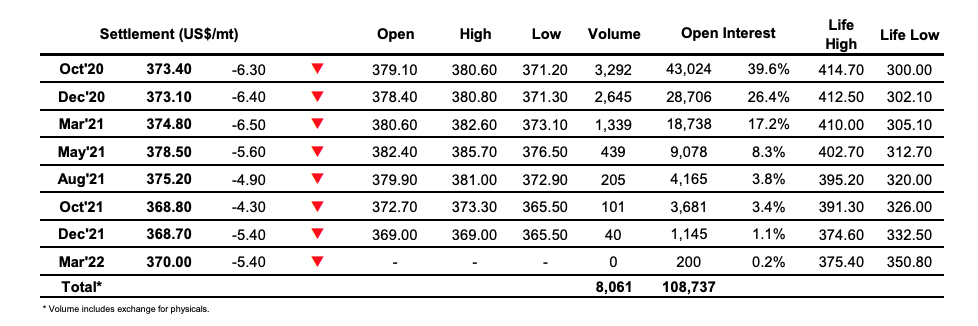

ICE Europe White Sugar Futures Contract