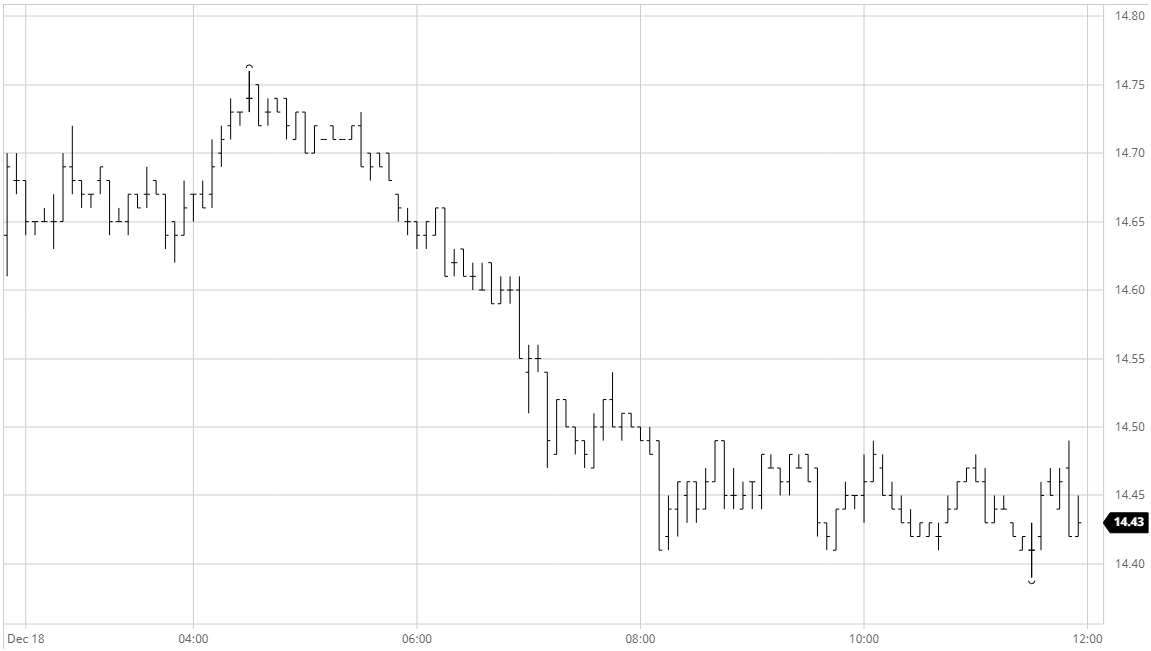

Sugar #11 Mar ’21

Whilst the market today was no more illiquid than yesterday, today we saw a clearer pricing action that eased this week’s momentum on the NY#11. Market traded within range through the earlier morning all the way until 9.00 am BRT. By then some producer pricing started to come in, seizing the recent 60 point opportunity and very little opposing buying has led the market 14.60, an 8 pt low from yesterday’s settlement. Only at 10 am we started seeing bigger lumped orders coming in, possibly an unwind from this week’s profit by specs, which in this low liquidity environment were enough to drive the market another 20 points down to the low 13.40s by 11:12 am. A very calm afternoon saw the market trading flat within the 14.40 – 14.50 range, and the closing call, as usual, saw day traders closing out their positions and SBH1 settled at 14.43, a 1.6% decline from yesterday’s highs. BRL traded down the whole day with Brazilian congressman Rodrigo Maia scheduling a vote on the Coronavirus Aid Bill, which scared investors into thinking that coronavoucher aids could be extended into next year when it was already said that they would not (Brazilian fiscal situation is indeed and edgy subject).

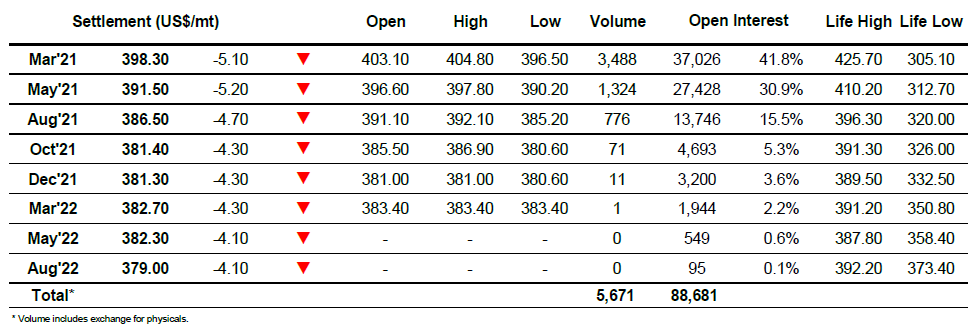

ICE Futures U.S. Sugar No.11 Contract

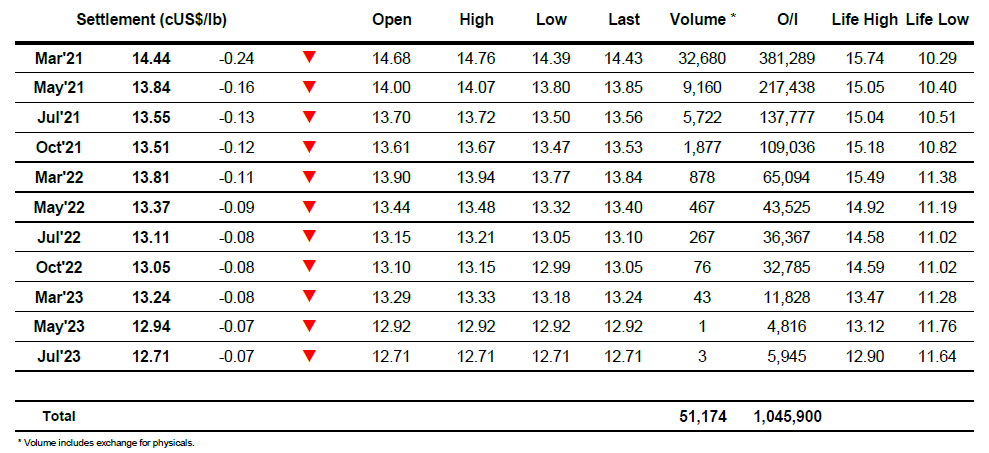

ICE Europe White Sugar Futures Contract