Sugar #11 Oct’21

The fall to new recent lows yesterday continues the weak technical trend, however it also attracts physical activity and we saw hedge lifting take the market immediately upward today with Oct’21 recording a morning high at 16.94. more often than not we see these movements represent nothing more than a dead cat bounce and as values started to ease back so this started to show as another such case with Oct’21 consolidating the 16.70’s as we awaited the US day and the arrival of larger volumes. Bang on cue at 1pm there was a sharp burst of selling which pushed the price lower to 16.65 but though algo activity undoubtedly followed as they sold behind the trigger there were no obvious sell stops while there subsequently proved to be sufficient scale buying that values merely edged sideways. Moving through the afternoon the one more significant area of vulnerability came from the Jul/Oct’21 spread which from a reasonably solid recent footing in the mid-teens weakened all the way to -0.26 points by the time we reached the final hour. The flat price continued to rumble along either side of 16.70 throughout this period with any attempts at recovery faltering in the 16.80 area and as we approached the close values were back within touching distance of the lows. The call proved to be rather calm as it left Oct’21 settling marginally down at 16.66 (though technically negative) and it may well have been this factor which encouraged some aggressive post close activity as more than 4,000 lots Oct’21 changed hands on the post close. A new recent low was recorded at 16.56 heading out and with us having shown a disconnect from the macro today the signs are that further weakness may well lie ahead.

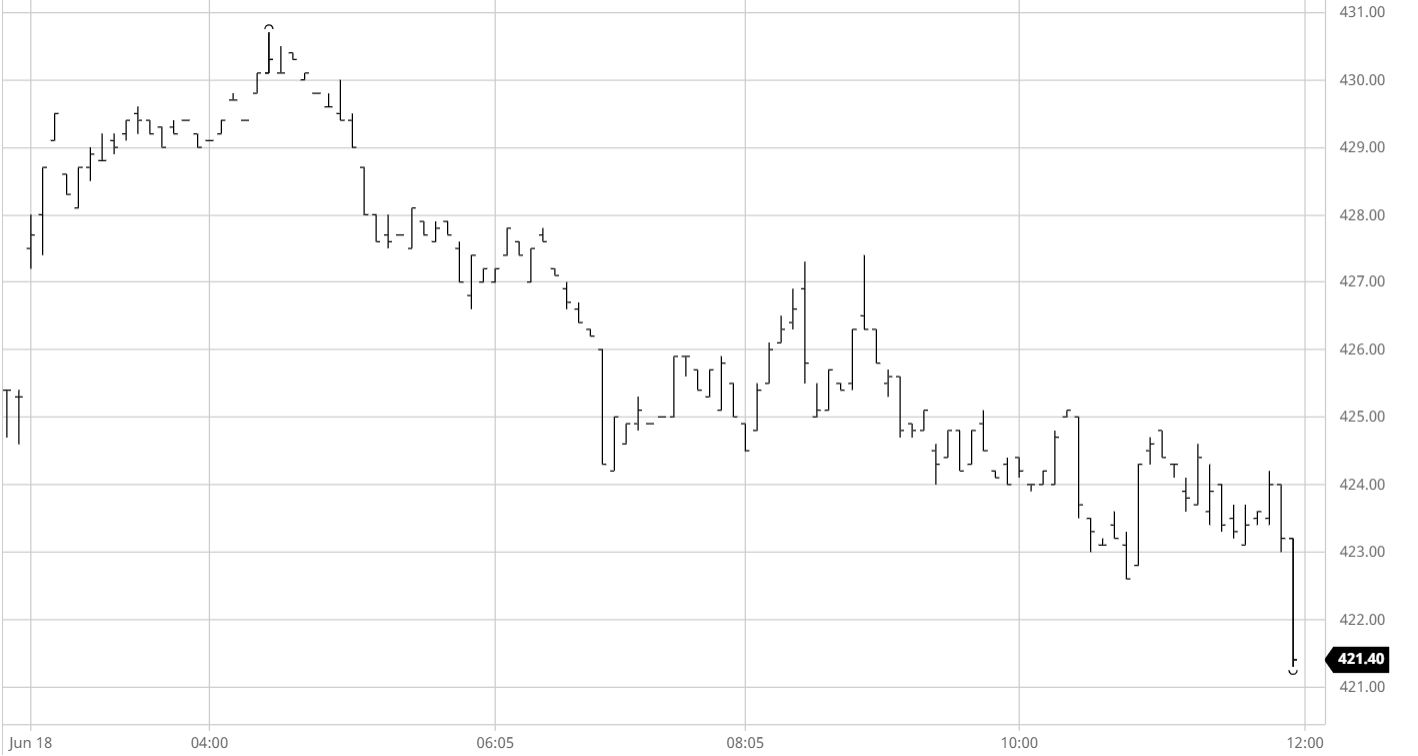

Sugar #5 Aug’21

The continuing weakness of the market leaves us looking toward downside technical targets though initially the market received some respite with the lower levels bringing some fresh physical activity and the resultant trade/consumer buying/hedge lifting talking values up by around $5 over the first couple of hours. As the buying dried up so we started to see the gains erased though it was not until the early afternoon and the arrival of some more aggressive spec led selling that prices slipped into the red. Remaining above initial $422 support the market entered something of a sideways pattern through the afternoon pivoting either side of $425.00 though with the price failing to rally back by very far it felt as though there could be another wave of pressure exerted to test support ahead of the weekend. This view was given further credence with the continuing decline in nearby spread values which saw Aug/Oct’21 trading to a -$13.50 discount with a couple of hours of the day remaining. This set the tone to work closer to $422 during the latter stages and though the close was muted which ensured a settlement level at $423.40 there was a post close push that extended the losses to $421.30 to end the prospect of an inside day and maintain the negative tone with $415.60 the next technical target.

White premiums had another steady day with a little more support having materialise at these lower levels, and we head into the weekend posting net gains with closing values for Aug/Jul’21 at $61.20, Oct/Oct’21 at $69.10 and March/March’22 at $76.90.

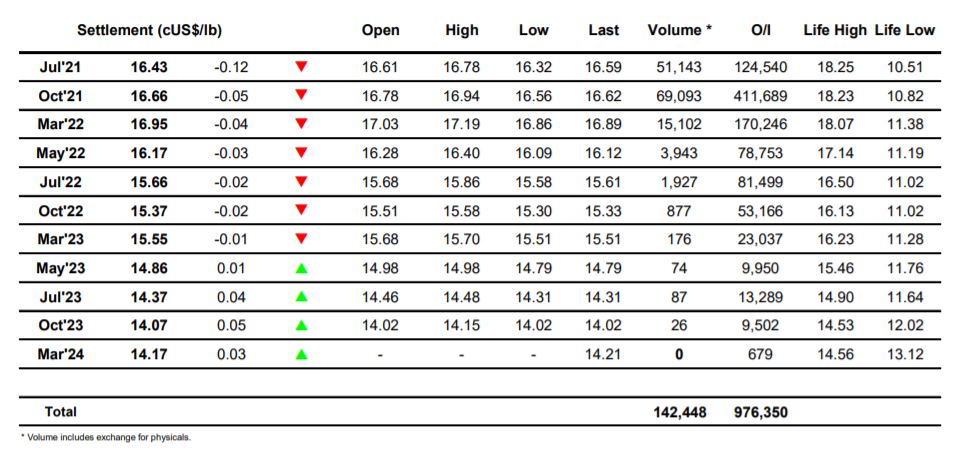

ICE Futures U.S. Sugar No.11 Contract

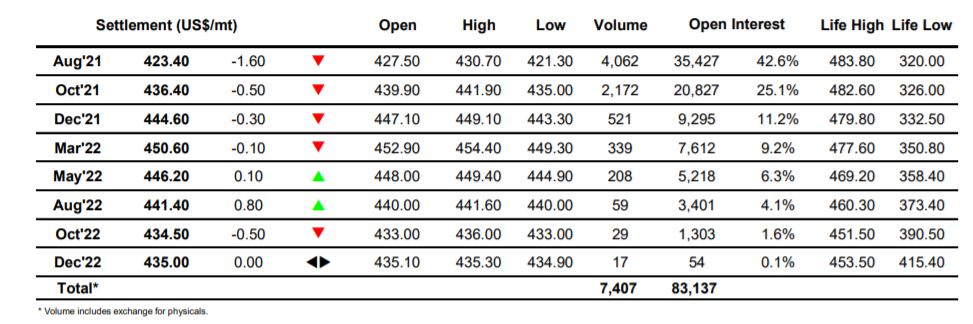

ICE Europe Whites Sugar Futures Contract